CME: Hog Slaughter Higher Than 2014

US - Cattle futures were lower on Friday, and hog slaughter is down on the year in the last week, write Steve Meyer and Len Steiner.Fed cattle futures were lower on Friday, reflecting the decline in cutout values as well as ongoing concern among market participants about the sustainability of cattle prices in the cash market in June and July.

But futures have been playing catchup with the cash market for many months now. The basis for June fed cattle now stands at $8/cwt.

In the past we have seen futures move higher to match the cash market. Fed cattle supplies in the ground are expected to be a bit more plentiful, however, thanks to very limited slaughter in April.

Based on the daily USDA steer/ heifer slaughter, April slaughter was likely down about 8.5 per cent from a year ago (actual monthly statistics will be released today).

Fed slaughter was down even as on feed supplies were at par with last year’s levels. As a result, the cattle on feed numbers that will be released at the end of the week (we will cover this tomorrow) will likely show an increase in total inventory as of May 1 compared to last year.

Beef prices remain very high both at the wholesale and retail level. We think packers have been able to manage their order flow and inventories much better this year forcing end users to pay up in order to secure product.

Some of the data reported showed packers in recent weeks had a more limited position of forward orders than last year, which in turn may have allowed them to be less aggressive in trying to source cattle.

They had to pay up to get cattle for much of April and May but the overall volume was down sharply as evidenced in the weekly slaughter numbers.

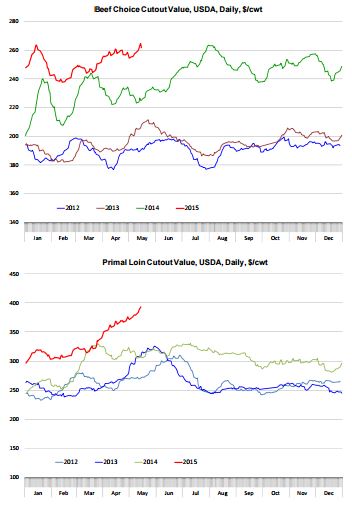

The choice and select cutout have been trending higher in recent weeks. Despite the lower close on Friday from the previous day, the choice beef cutout at $261.93/cwt was still some $35 higher (+15 per cent) compared to a year ago while the select cutout at $251.1/ cwt was $27 (+15 per cent) higher than last year.

The gains in the cutout have come from all four main primals but middle meats has certainly played a key role. Of the $35 gain in the cutout, $17 have come from higher loin prices.

The loin primal accounts for just 20 per cent of the carcass but has contributed half of the increase in value. Rounds have also performed quite well, adding about $9 to the carcass.

We think retail promotions certainly have been key going into Memorial Day. Retailers understand that consumers are willing to pay for high priced, high quality beef during special times of year.

The start of the summer grilling season is one of those times. Steak promos during this time help foot traffic which helps sales overall.

So far, the run-up in loin primal values has followed almost the exact path (albeit at a much higher price point) as in 2013. But, once the retail promotions disappear, the loin primal could come back to earth and this may pose some problems for the overall cutout.

It is a key factor that bears watching in June.

Hog slaughter for the week was 2.128 million head, 6.5 per cent higher than a year ago.

Since March 1, hog slaughter has totaled 24.107 million head, 8.5 per cent higher than the same period a year ago and in line with the projections based on the USDA Hogs and Pigs report.

USDA used an average carcass weight of 214 pounds in its weekly sheet but it is likely that number will be revised lower as the MPR report currently pegs average carcass weights for all hogs at around 213 pounds.

Hog carcass weights have been drifting lower since the beginning of the year. Since mid April, weights are down about 2 pounds and this has helped limit the supply increases.

Seasonally hog weights are lower in June, July and August. Weather will be a key factor for those months as summer heat takes its toll on hogs.

Pork demand in the short term certainly has benefited from the start of grilling seasona, with prices up for loins, butts and ribs. As with beef, post Memorial day sales will be key.

Pork belly prices normally move higher in June and July and this should also help underpin the hog carcass. Bellies jumped 10 per cent this week alone and the trend in belly prices may set the tone for the overall complex in June.