CME: High Meat Demand Despite High Prices

US - Whatever may be ailing US meat and poultry markets, it is still our conclusion that domestic demand is strong, at least through March, write Steve Meyer and Len Steiner.Last week’s March trade data allowed us to complete our monthly computations of real pre capita expenditures for beef, pork and chicken and all three remain well above last year’s levels that were, at that time, already near record high levels.

A few highlights are:

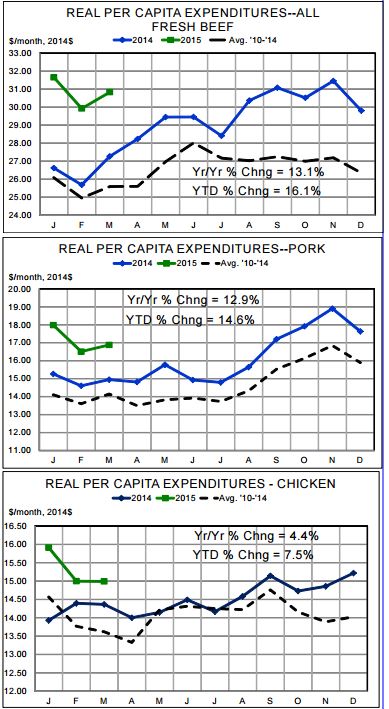

- Beef RPCE continues to be the year-on-year leader among the three major species with RPCE of $30.83 in 2014 dollars in March. That figure is 13.1 per cent higher than last year and actually reduces the year-to-date percentage gain from February’s 17.7 per cent to 16.1 per cent for March.

- Per capita beef consumption was 0.6 per cent lower than one year ago but the real (ie. deflated) price of All-Fresh beef was 13.8 per cent higher than last year, continuing the pattern of the past couple of years. Strong consumer demand is revealed by consumers’ continued willingness to pay very high prices for beef products. [Note that we now use the All-Fresh beef price from USDA in order to capture price impacts of Select and store-grade beef. We believe those products have become more important in this most recent episode of record-high beef prices as some consumers ”traded down” from Choice grade items due to price.]

- Pork RPCE for March was 12.9 per cent higher than last year. March’s $16.88 in 2014 dollars brought the year-to-date total to $51.37, 14.6 per cent higher than one year ago and 22.7 per cent higher than the average RPCE over the past 5 years.

- Unlike most of the past three years, per capita pork consumption was the big driver of RPCE gains in March. Americans consumed, on average, 11 per cent more pork in March than they did one year ago. Real (ie. deflated) pork prices were still 1.7 per cent higher, year-on-year, in March. Higher price and higher quantity can mean only one thing: higher demand. The gain in March per capita consumption was driven by three key factors: much higher than expected pork production, the lingering impacts of the port labour slowdown and comparison to March 2014 when pork production was falling rapidly due to the impacts of PEDv .

- As has been the case for much of the past 15 months, chicken demand was stronger but not by nearly as much as were the “red meat” demands. RPCE for chicken in March amounted to $14.99 in 2014 dollars. That figure is 4.4 per cent higher than one year ago and brings year-to-date RPCE to $45.90, 7.5 per cent higher than last year.

- Gains in the RPCE factors for chicken were MUCH more balanced than were those for the other species with per cap consumption increasing by 2.2 per cent versus 2015 and real price gaining 2.1 per cent. Again, increases in both factors can mean only one thing: higher demand.

- Total RPCE for these three species (we no longer include turkey due to having only a whole-bird retail turkey price) was $63.73 in March, 9 per cent higher than last year. March marks the 29th time in the past 30 months in which 3-species RPCE has exceeded one year earlier.