CME: Exports a Key Driver of Summer Livestock Markets

US - Exports are an important part of US beef and pork markets, but they are currently not performing as well as in 2014.Exports remain a key driver for livestock markets going into the summer but, as you know well, by the time we get the monthly export statistics the information is quite dated.

The latest official export numbers we have are for March and we will not get the April trade data until June 3. USDA does release a weekly report on beef and export sales but one needs to understand its limitations.

In the past, the report has not matched very well with the official data. Still, it is the only timely information we have and when analysing it, one needs to constantly review the relationship of the weekly data to the official numbers.

Having said that, what did the latest weekly exports tell us and what does that imply about the level of beef and pork exports in April and May.

Beef: Exports of fresh/frozen beef cuts for week ending May 7 were 11,900 MT, 17 per cent lower than the comparable week a year ago. In the last four reported weeks, US beef exports have averaged 10 per cent under last year. We now have all the weekly export numbers for April.

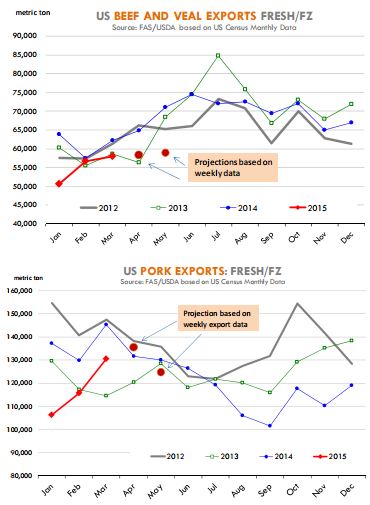

Based on the relationship of the weekly numbers to the official USDA data, we currently project exports of fresh/frozen beef in April at around 58,300 MT, 10 per cent under the previous year.

With one week of exports for May and based on the seasonal trend, we also project beef exports in May at around 62,000 MT, 13 per cent under the previous year.

The lower beef exports reflect the impact of record high prices in the US, an unfavorable exchange rate with key markets and shifts (hopefully not long term) in demand from some growing regions.

Last year, booming exports to Hong Kong helped support overall US beef trade. Strong demand from Hong Kong in 2014 particularly benefited items such as short plates and briskets.

In April 2015, weekly exports to Hong Kong averaged 41 per cent under the previous year and the first week of May exports were down 18 per cent.

Shipments to our NAFTA partners also have been problematic so far this year. Weekly exports to Canada in April averaged 8 per cent under the already quite low levels we saw last year while shipments to Mexico declined 28 per cent from last year.

Exports to Japan so far this year have continued to grow, despite lower slaughter levels and a strong US dollar. In April, weekly beef exports to Japan averaged 12 per cent over a year ago. Last week, shipments were uncharacteristically low and at just 3,173 MT they were 17 per cent lower than last year.

Cattle futures have rallied in recent weeks, with summer futures posting strong gains yesterday. Packers have had little choice but to pay up for cattle as we go into Memorial Day and they need to fill orders.

However, beef sales slow down in July and August and exports have traditionally helped clean up the market. At this point, the trend on exports is not that great.

We will update these charts regularly as we move forward and also point out how well the weekly projections match the official statistics when they are eventually released.

Pork: The volume of pork exports reported weekly has improved considerably since last year and the weekly numbers account for 65-70 per cent of the total volume of fresh/frozen export sales reported in the monthly statistics.

April data is now complete and it implies a monthly volume of 135,500 MT. If this number is correct (official numbers will be released June 3), it would imply pork exports in April were up 3 per cent from the previous year, a significant increase considering how weak pork exports were in the first three months of the year.

With only one week in May and using a seasonal factor, our current May pork export projection is at around 125,000 MT, 4 per cent under last year’s levels.

One major positive for the pork export market is that exports to China have finally started to show some life. In the last four weeks, weekly shipments to China averaged a little over 1900 MT compared to an average of about 550 M in February and 540 MT in March.