CME: Market Uncertainty Causes Hog, Cattle Futures Decline

US - Lean hog futures declined last week due to hog supply uncertainties, but the decline was not as steep as cattle futures, which remain jittery, write Steve Meyer and Len Steiner.Lean hog futures were lower on Friday but the decline was much smaller when compared to cattle.

June hog futures mounted a modest rally in late March and the first half of April but they pulled back last week.

Lean hog slaughter was 2.243 million head, 12 per cent higher than a year ago, higher than implied by the USDA Hogs and Pigs report.

While prices are expected to move higher in the spring and summer, at this point market participants are still guessing as to how large the hog supply will be.

Each week is bringing more hogs than anticipated and this has certainly added to the uncertainty about summer supplies.

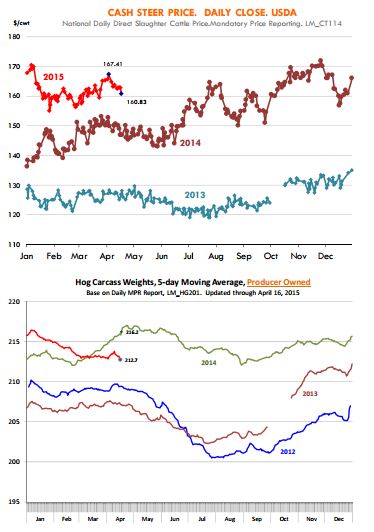

Hog carcass weigts are also a major wild card. Weights of producer hogs are down 3.4 pounds (-1.6 per cent) but weights of packer owned hogs have not declined as much.

One positive for the pork market this past week was the recovery in ham prices but stronger prices for bellies and trimmings are needed for the seasonal pork rally to gain traction.

Spring and summer fed cattle futures declined the daily permissible limit on Friday (300 points) as market participants were once again disappointed by prices paid in the cash market.

In the last two weeks cash fed steer prices have declined by $7/cwt, a larger than expected drop, fuelling fears of significant value erosion going into May and June.

For the week, fed steer prices averaged around $163/cwt but on Friday afternoon, the national live fed steer price report contained a lot of sales in the 160- 161 range.

Fed cattle slaughter for the week were 423,000 head, 6.3 per cent lower than a year ago.

Packers have kept the lid on slaughter in recent weeks as margins are much tighter than they anticipated going into the spring. There are two short term concerns for the fed market at this point.

First, how current are feedlots at this point and what pressure will this market come under in May and June? Steer weights are telling us that feedlots are indeed holding cattle on feed for a longer period of time, as evidenced by fed weights that are currently at all time records for this time of year.

Steer weight data is published with a two week lag. For week ending April 4, steer weights were 869 pounds, 2.1 per cent higher than a year ago. Overall cattle carcass weights for last week were pegged at 815 pounds, 3.2 per cent higher than a year ago.

So far, feedlots have been able to hold the line although action in the cash market in the last two weeks has certainly raised some questions about their resiliency.

Their main challenge remains availability of feeder cattle. With limited supply of replacement inventory, they have had little choice but to hold on to the cattle they have and try and get as many pounds on them as they can.

Normally cattle prices in the spring and summer are lower as supplies seasonally increase. Last year, however, the break in cattle prices was particularly shallow and fed prices were counter seasonally higher in July, both due to the effect of high prices for competing meats but also limited fed and non fed availability.

The second concern is beef demand. Export sales, in our view, have been much better than many anticipated. Based on the weekly export data, shipments to some key Asian markets are up despite the strong dollar.

Foodservice business remains critical, however. Poor weather in heavily populated areas dented foodservice sales in Q1 but, as we saw last year, better than expected spring and summer business has the potential to bolster demand.

Middle meat (steak) prices have been better than anticipated so far but we saw some reasons for concern last week as key loin and rib items took a step back. It remains to be seen if this was just a blip or if weakness persists, especially as slaughter starts to pick up.

For now, cattle futures remain very jittery, trying to assess the short term potential for a market correction relative to the string very firm fundamentals in a cattle market looking to recover the dramatic liquidation of the past decade.