CME: Hog Prices Gaining Ground

US - Hog and pork prices are recovering from the effects of larger-than-expected supplies in the first quarter of the year, write Steve Meyer and Len Steiner.Cash hog and pork prices have gained ground in recent weeks and this has underpinned the rally in hog futures since late March.

The pork cutout last night was higher once again. USDA quoted the overall cutout at $71.02/cwt, 16 cents higher than the previous day and $2.4/cwt higher than a week ago.

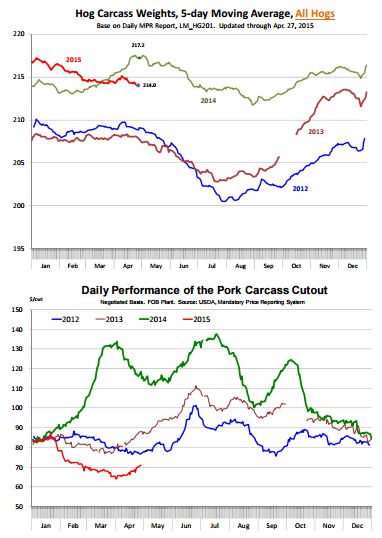

The pork cutout still is about 38 per cent lower than a year ago but year over year comparisons will provide a distorted picture for the next few months given the unusual situation created by PEDv last year.

It is more instructive, both in terms of understanding trends and market expectations, to put current cutout values relative to 2012 and 2013 price performance.

Cash hog prices were also higher last night, providing further support for the rally in hog futures. The IA/MN Lean Hog carcass price was quoted at $68.51/cwt, $1.8/cwt higher than the previous close and the highest hog carcass value since January.

IA/MN hog carcass price has increased 21 per cent so far this month, far surpassing the normal seasonal increase that we see at this time of year.

Hog prices came under significant pressure in February and March as markets adjusted from the inflationary price environment in the second half of 2014. Pork supplies were larger than expected in Q1 and when combined with high priced inventories and sticky retail prices this pressured hog values well below earlier targets.

It appears that finally hog markets are normalising and trading closer to historical price/supply relationships. To be sure, hog supplies remain large and this will contain price inflation in the pork market.

Hog slaughter in the first two days of this week has averaged 429,000 head/day and for the week we currently project hog slaughter to be 2.179 million head, 8.1 per cent higher than a year ago.

If this slaughter number is correct, it would represent a 4.2 per cent increase compared to the same week in 2013 and 4.9 per cent increase compared to the same week in 2012. More hogs coming to market has only been part of the problem for pork, however.

Hog carcass weights increased dramatically last year as producers held hogs back to offset the losses caused by PEDv.

Hog carcass weights are now below year ago levels. But we would argue that current weights are only slightly higher than what trend growth would be had it not been for PEDv.

According to the data from Mandatory Price Reporting, the average weight of all hogs (not just producer hogs) coming to market is running at around 214 pounds per carcass, 1.5 per cent lower than a year ago.

In 2013, hog carcass weights at this time of year were around 208 pounds. Using a trend growth of around 1 per cent, current weights should have been around 212 pounds.

Going forward, hog weights are expected to drift lower and summer weather remains a significant wild card.

Hog supplies are plentiful, as evidenced by the increase in slaughter numbers and the data from the USDA Hogs and Pigs survey. This will make for more timely marketings and weights should follow the pre-2014 trend, especially in late June, July and August.

Hot weather takes a toll on hog weights and above average temps could see hog carcass weights drop in the 207-08 range, about 2 per cent under year ago levels. More likely we will see hog carcass weights for summer months in 208-209 range.

This will tend to limit some of the supply increase implied by the latest pig crop numbers.

It is not a surprise at this point that futures have rallied for the summer months considering the improvement in cash prices and the normal seasonal for prices in June and July.

Prices for the last quarter of the year have also benefited from the recent rally but fall prices are somewhat more problematic.

Hog slaughter for Q4 is expected to be around 30.6 million head, compared to 30.4 million in 2012. At this point we do not expect slaughter capacity to be an issue but it remains a concern and something the market will have to grapple with as we go forward.