Pork Commentary: Quarterly Hogs and Pigs Report - Hope or Disaster?

US - The USDA has released its March 2015 Quarterly Hogs and Pigs Report, but is it hope or disaster? writes Jim Long President – CEO Genesus Inc.Disaster?

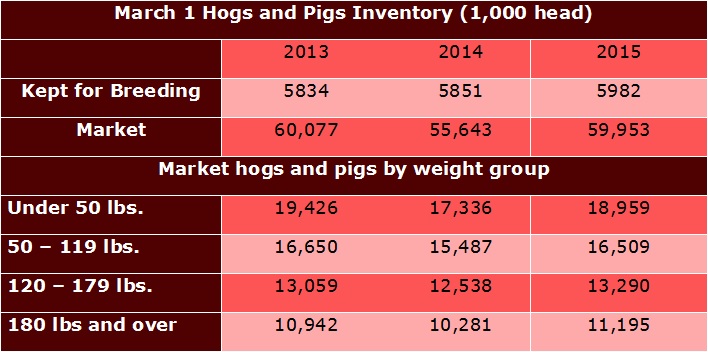

- March 01, 2015 Market Hog Inventory up 8% over a year ago – plus 4.3 million head!

- Breeding Herd up 2% year over year – plus 131,000

- Pig Crop December – February 28.758 million – up 432,000 compared to December – February last year.

Hope?

- March 01, 2015 Market Hog Inventory down -124,000 compared to March 01, 2013. Inventories 2015 – 59,953; 2013 – 60,077.

- Breeding Herd 2015 up 2% compared to March 01, 2013 – plus 148,000.

- Pig Crop December – February 28,758; 2013 December – February 28,099 up 659,000.

?Obviously, we have a massive increase of more market hogs compared to 2014 when PED knocked production lower. There is no doubt our industry has mostly knocked down PED and that record profits last year has stimulated increased production. At face value, the increased numbers seem daunting when compared to last March. That is why we thought the 2013 inventory numbers are a better blueprint where we will be price wise in the coming months.

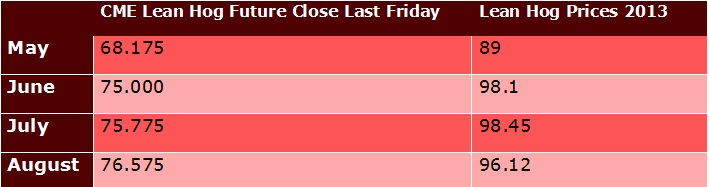

As you can see the Market Hog Price between May – August 2013 was significantly higher than current lean hog futures indicate. We believe the 2013 prices are a good barometer on where prices in 2015 will be. Why?

Market hog inventory on March 01 this year was essentially the same as 2013 (minus 124,000),

- With lower beef supplies and higher beef prices in the US this year compared to 2013 we see this supportive of lean hog prices. I.e. no more hogs 2015 but certainly less beef.

- 2013 May – August actual lean hog prices were about $45- 50 per head higher than what 2015 May – August futures reflect currently. No more market hogs in inventory than 2013! How can 2015 prices not get significantly stronger?

- We still expect China’s massive liquidation of their breeding herd (over 6 million sows) will lead to huge pork imports in the future. We expect summertime exports 2015 will jump unless liquidation in China continues unabated and if that is the case, China imports will be even greater at a later date. Do the arithmetic. China liquidates 6 million sows – USA adds 131,000. In the USA we think 131,000 is big expansion! China liquidates one million sows in January. A flea on an elephant.

Bottom line:

There are no more market hogs in inventory in 2015 on March 1 2015 than 2013. Lean hog prices ranged from 89 – 98.45 in May – August 2013. We see no reason why this year will not reach or surpass this range.