Pork Prices to Struggle in Competition for the Consumer

US - One of the first questions I get when hog prices fall is “What are pork prices doing?The concern is understandable. First, lower hog prices are usually driven by higher production and that means more product on the market. Everyone wants to make sure the market is cleared and that takes lower prices. The question of course is one of degree: Just how much lower is needed?

The second reason for the question is understandable, too, but a bit more self-serving: We don’t like others making money when we aren’t. Or at least when we aren’t making as much. If this is your motivation, you are going to be constantly frustrated because downstream parties almost always make more money when hog prices fall. At least until competition causes the downstream prices to fall as well and that usually takes a while. In the meantime, hog producers frequently do a slow burn.

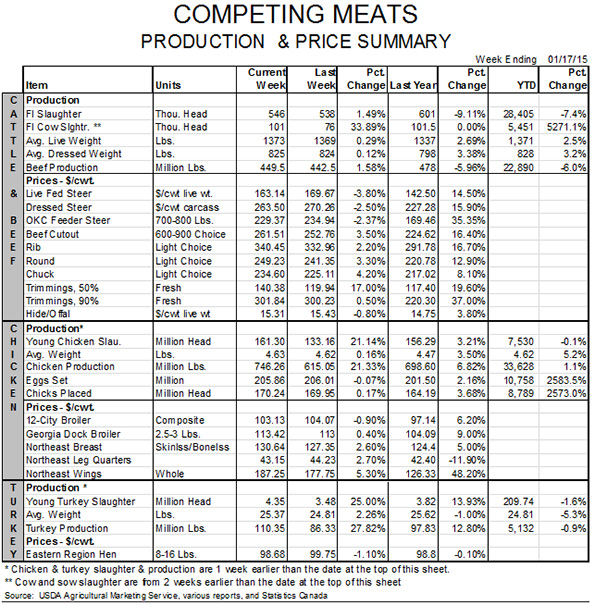

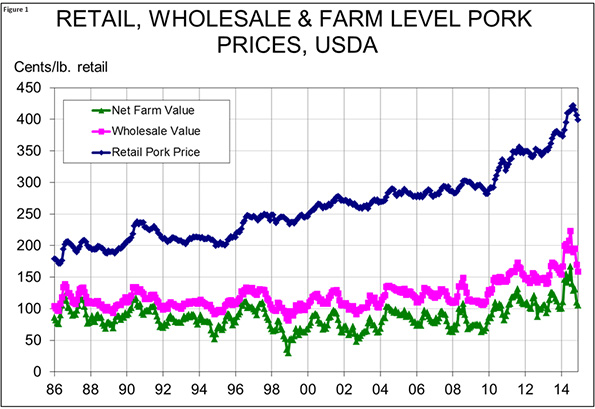

As can be seen in Figure 1, retail prices have been on a remarkable run over the past two years. The U.S. Department of Agriculture’s (USDA) average retail pork price hit $3.617 per pound in June 2013 – well before the breadth of our porcine epidemic diarrhea virus (PEDV) situation was known. That record broke the existing one ($3.562 per pound) which was set in September 2011 and launched retail pork prices on a climb that saw 11 new record highs in the next 15 months. That run ended with September’s current record of $4.215 per pound. The average retail price dropped to $3.991 in December, 1.8% lower than in November but still 6.1% higher than one year ago.

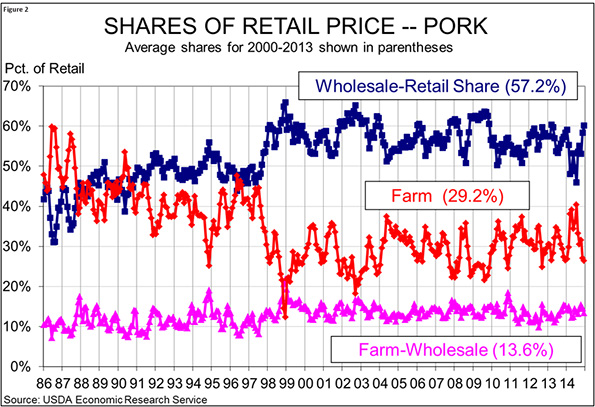

This, though, is a pretty unusual case where farm and wholesale prices rose at about the same clip as retail prices. In fact, farm prices rose much more quickly in 2014 in spite of rapid increases in wholesale and retail prices. The result was the highest farm shares of retail pork dollars since 1997. (See Figure 3.) Farm shares touched 40% in July while the wholesale-retail share hit its lowest figure (45.9%) since 1997 in that same month. Note the relative stability of the farm to wholesale (i.e. packer’s) share. That’s the mark of a true margin player.

“But retailers get a bigger share than the farmer and that’s just not fair!” Maybe, not but it is what it is and there are good reasons. Remember that the product that the consumer buys doesn’t look much like a pig. Someone makes that change after the animal leaves the barn and must be paid for doing it. Further, pork generally involves more processing than other meat proteins due to curing, smoking, sausage-making, etc. Those functions cost money. I have said on many occasions that we can guarantee that the farmer gets 100% of the consumer’s pork dollar if we just pass a law saying people can only buy live pigs and process them at home. Do you think we will sell very many of those 100% farmer benefit pigs? I think not.

The swap of retailer margin for farmer margin in the first half of 2014 has been reversed dramatically in recent months, however. Farm and wholesale values have fallen sharply, and even though retail prices have declined the share accruing to retailers has returned to a more normal level. Will it go higher? Perhaps. But you can see that retail shares over 60% are pretty rare in recent history and I suspect that any rally above that level will be short-lived as grocery stores and restaurants begin to pass the lower pork values along to their customers in an effort to gain market share.

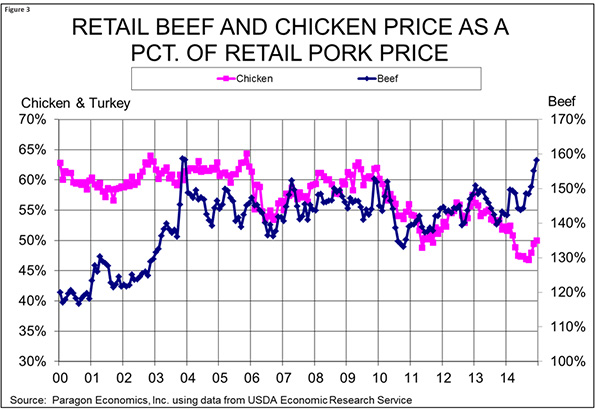

Perhaps the most important question in all of this is the relative value of the various proteins. Figure 3 shows the beef and chicken prices as a percentage of the pork price. When these lines go down, it’s bad for pork. When they rise, our product becomes more competitive. We are in about the best shape ever versus beef and that will not likely change any time soon. We were in one of the worst spots ever versus chicken this past summer. The decline of pork prices since September has helped but pork is by no means “cheap” relative to chicken. I don’t expect it to gain much in 2015 as chicken output grows.

Note that I removed turkey from these comparisons simply because the only retail price published by the USDA is for whole birds and is thus not representative of the true market position of turkey parts and products.