Pork Commentary: Reaction to 1 December USDA Report

US - The USDA December 1st Hogs and Pigs Report that was released a week ago was not negative for lean hog futures, writes Jim Long President – CEO Genesus Inc.Last Friday’s close indicates most if not all months steady to higher compared to the lean hog futures close ahead of the report’s release. It appears from the reaction of the lean hog traders, they had expected expansion and larger inventories in line with the USDA report. They were right.

Now that lean hog futures have steadied, it’s time for cash lean hogs to get some push upwards. Friday 53 – 54 per cent National Lean Hogs were $78.49 with USDA Pork Cuts $83.32. The spread for Packers at $5.00 is not profitable. We need to get a push and maybe it will come from beef.

With choice Beef cut – outs closing Friday at $247.83 and Pork cut–outs $83.32. Our Farmer arithmetic tells us Beef is three times higher than the price of Pork. In our opinion that spread will not last. Either beef will come down or pork will go up. We expect the American consumer and foreign importers will see a price advantage to pork and increase demand pulling pork prices higher.

The American consumer now is seeing the day to day benefit of $55 a barrel oil. We have read estimates that the American consumer is saving $3 billion a week in energy costs compared to last July. Lower income consumers will really see the benefit of more money and we expect that this creation of cash wealth and perception of more wealth will enhance meat protein consumption over the coming months. More cash money slopping around will only benefit the pork industry.

The Other White Meat

Not to beat a dead horse, but … when we see the price of beef three times the price of pork and chicken it rekindles the dumb marketing of the pork industry when we tried through the "Other White Meat Programme" to brand pork as chicken.

How really dumb, pork is red meat, beef is currently three times the value of pork. As an industry over the twenty years of the Other White Meat Programme we gave $1 billion to Pork Checkoff.

In the twenty years we saw per capita consumption of pork flat line and market share declined. It was a dumb programme and it did not work. Trying to build your brand by equating to a cheaper product (chicken) when the natural fit is to push to a higher value product (beef) red meat was an example of too much money ($1 billion), bad leadership, bad advertising agency, and twenty year stubbornness of sticking to something that obviously was not working, as no corporation would have spent $1 billion and saw flat lined consumption levels with market share decline and stayed on the same losing message for twenty years.

Missed opportunity in our opinion. Thank God the Other White Meat Programme has been jettisoned by the new Pork Board Leadership. Finally, leadership that gets it after twenty years in the wilderness!

China - China: it is the pork powerhouse of the world with over 51 per cent of the world’s population of pigs raised within China.

We have written constantly over the last few months of the massive sow herd liquidation. In China around six million sows (US total breeding herd size).

Over the last year it is estimated China’s hog producers lost about 158 RMB ($26) per head. Give or take 650 million market hogs the industry lost $16 billion US dollars. In the April – May period when over 1.5 million sows went to market, Chinas industry was losing 400 RMB ($65) per head.

In a tough market like China’s, to get more competitive you have to search out the best methods and technology to survive and prosper when times get better. One of these technologies is genetics. Genesus China has been selling, providing technical and genetic support over the last four years.

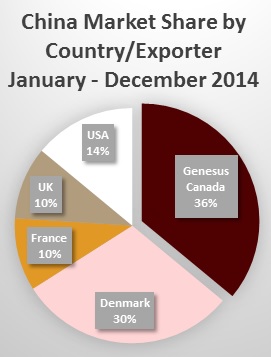

In that time, our Chinese customers have had good success. Customers are always the best salesmen. Last week we received the data of all global breeding stock exports to China in 2014.

Genesus is number one with 36 per cent market share, followed by Denmark at 30 per cent , USA at 14 per cent , United Kingdom at 10 per cent , and France at 10 per cent . The Netherlands (re: Topigs – Norsvin - Hypor) 0 per cent .

Having more pigs that grow, have tasty meat, and do not die is a recipe for Genesus’ success in China especially combined with strong technical support.

In the coming months we expect the massive herd liquidation in China and their consumers benefit from lower energy costs lead to a huge bump in China’s hog prices which are currently 13.21 rmb/kg liveweight (96.51? US liveweight a pound). When that happens, Chinese hog producers will make real money and US – Canada pork exports give a jolt to higher hog prices.