Survey Confirms Most Expect Growth in US Hog Numbers

US - The US Department of Agriculture’s (USDA) quarterly Hogs and Pigs report is due to be released today - the first time in memory that the report has been released before Christmas, writes Steve Meyer.The December report has hardly ever been released on a Friday as customarily are the other three quarterly reports. The USDA has normally timed the December report to leave at least one full trading day before the end of the year so market participants can adjust positions per the report before the end of the calendar year.

This year’s early release does not seem to me to harm that goal and it certainly leaves the USDA personnel free to enjoy the holiday knowing they do not have to return and finish the report next week.

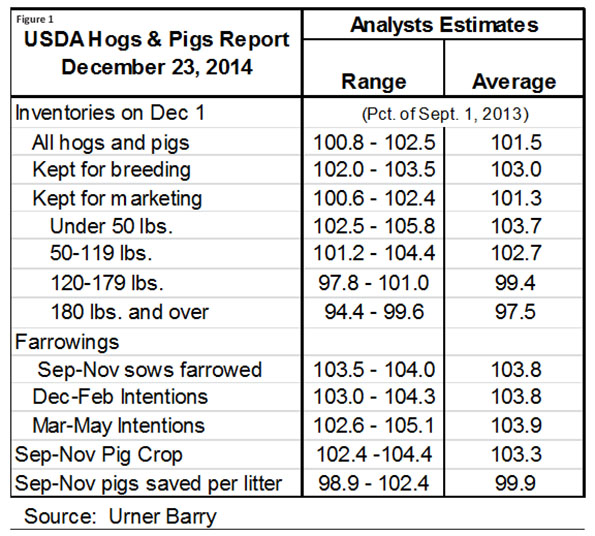

Urner Barry’s pre-report survey of market analysts confirms that most are expecting growth in hog numbers in this report. The results of the survey appear in Figure 1.

Some highlights and implications of the numbers are:

The breeding herd is expected to grow by three per cent relative to last year. If accurate, that would be the largest year-on-year growth for this key number since March 1998. Does that send a chill down your spine?

That growth rate would fit sow slaughter prior to 1 December pretty well, but would not fit the University of Missouri’s gilt slaughter percentage data which has run higher than one year ago so far this year and was a full two per cent of slaughter higher in October.

These three data series have been difficult to reconcile all year as producers saw extra value in immune sows and gilt supplies were impacted by porcine epidemic diarrhoea virus (PEDV) losses.

Farrowing intentions for the September-to-November quarter are expected to come in 3.8 per cent higher than last year. That is in line with the numbers we saw in September and with the historical productivity levels of the 1 September breeding herd.

Intentions for December-to-February are +3.8 per cent from one year ago and would imply the highest farrowing rate on record for the 1 December breeding herd. The +3.8 per cent for the March-to-May intentions would imply litters per 1 December breeding animal slightly higher than the past two years but still below the levels of 2009 through 2012.

Sow productivity is a lingering concern from the PEDV epidemic as a number of farms are reporting disappointing farrowing rates post-PEDV.

The September-to-November pig crop is pegged at 3.3 per cent higher than one year ago which would imply 29.185 million pigs save during the quarter. That number is still slightly smaller than the September-to-November 2013 pig crop of 29.319 million.

It would imply March-to-May farrowings over three per cent larger than last year. We had pegged that quarter at +4.2 per cent after the September report so this might represent a slight reduction in our supply forecasts if the average estimate turns out to be accurate. We expect weights to be reducing pork supplies relative to one year earlier by that time as stocking rates increase and thus push pigs to market faster.

The 99.9 per cent average estimate for litter size would put the September-to-November figure at 10.15, down 0.01 pigs per litter from one year ago and even with the figure for September-to-November 2013. In other words, a return to "normal" litter sizes.

Those, of course, were growing at a rate of roughly two per cent per year prior to that time, of course, so even steady litter sizes represent a significant slowing of productivity growth. This number would be back to familiar levels after being severely impacted by PEDV.

Mr Meyer still thinks the USDA has over-estimated litter sizes this past year due to its practice of revising past pig crops to match slaughter and revising past farrowings by the same percentage. Those might be OK under normal circumstances but in the face of a disease that kills pre-weaned pigs, it strikes him as overestimating litter sizes. It was not farrowings that dropped; it was pigs weaned per litter.