CME: How is Russia Affecting the US Markets?

US - One of the top stories in business news today (16, December) is the implosion of the Russian rouble, making this a good time to review some of the macro factors impacting livestock markets at the moment.The Russian Ruble has been losing value since the summer amid tightening economic sanctions, a worsening economic outlook and accelerating capital flight from Russian assets.

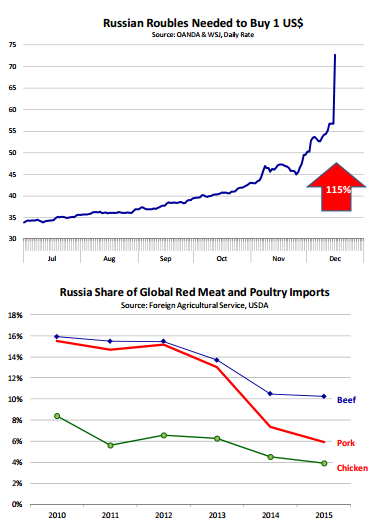

In early July, it took about 34 Rubles to purchase one US$. Last week, the exchange rate had gone to 57 Rubles per one US$ and today, as we write this report, the rate jumped to 73 Rubles per one US$.

The most recent spike in the exchange rate followed a shock announcement from the Russian Central Bank, pushing rates up by 6.5 points to 17 per cent. You can read all the details and the reasons for the spike in major papers, our primary interest is the implications this may have on meat markets.

First, consider that Russia is a major buyer of red meat and poultry in the world market. During the period 2010-2013, Russia accounted for about 14-16 per cent of the red meat purchases of major meat importers.

This year, that share is expected to drop to about 10 per cent for beef and seven per cent for pork. In the case of chicken, Russian purchases in 2010 accounted for a little over eight per cent of global imports but are expected to account for around five per cent this year.

Furthermore, USDA projected these shares to fall even further in 2015, a forecast that was made well before the implosion in value of the Russian currency.

If anything, their imports will be even smaller next year. Russia stopped buying US meat products in the summer and some may see these recent events as having no impact on US products. That is not a correct view, in our opinion.

We operate in a global marketplace and a precipitous decline in the purchasing power of a large importer will affect the overall market. Those pounds of beef, pork and chicken that Russian consumers no longer can afford now will have to be absorbed by other markets, likely at lower prices.

Lower crude oil prices have hammered the Russian currency. They also have battered currencies of other countries that rely on energy exports for a considerable portion of their revenue.

Lower oil prices may help consumers in developed countries but they have a detrimental impact on the economy, and thus purchasing power, of consumers in emerging and developing countries.

The meat industry has relied on growing demand from these emerging/developing markets to sustain its expansion. As the economy of those countries struggles, and the value of their currency drops relative to the dollar, this makes it more difficult to export US meat products.

Some US exports will have to be absorbed in the domestic market. The US chicken and pork industry were poised for growth in 2015 and a worsening export outlook certainly is seen as a bearish factor.

Even cattle prices, which not long ago seemed impervious to such macro shocks, have declined in recent weeks. Cattle numbers are tight and will remain tight but market participants remain concerned about demand, both in domestic and export markets.

The drop in equity values and a worsening global outlook appear to have caused some market paricipants to reduce bullish bets on fat and feeder cattle. The latter has been hit particularly hard, in part because prices were seen as overly inflated and longs have found it particularly difficult to unwind their positions.

In all, the recent news about Russia, downward spiraling oil prices and the real possibility of an economic crisis brewing in emerging markets, all have clouded the demand picture for meat proteins in 2015.

US beef, pork and poultry producers have relied on global markets to absorb and increasing share of US production. But customers in those other markets now are finding out that their currency buys a lot less US beef, pork and chicken and a larger share of production will have to be used up here at home, with lower prices likely needed to clear the market.