Pork, Big Winners in Meat Demand

US - The people have spoken: The Ds lost ground and the Rs gained, writes Steve Meyer for The National Hog Farmer.The implications of that decision will be debated and watched closely for some time. We in Iowa get about a four-month respite from political campaigning before the whole thing starts over and every well-healed special interest this side of London starts interrupting our basketball games, prime-time soaps and so-called reality shows. The caucuses bring a lot of money and notoriety but ...

The people continue to speak on another subject as well: Meat demand. And pork and beef remain even bigger winners than Republicans!

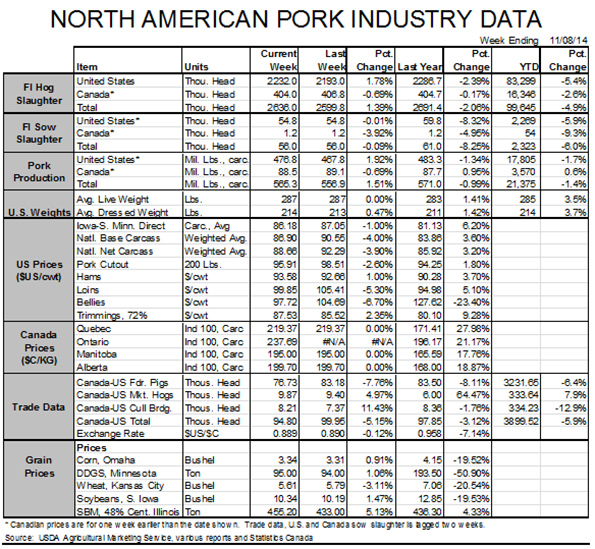

Last week’s monthly exports completed the data needed to compute per capita consumption for September. The export data were not terribly positive but their implications for consumption and, when combined with retail prices, pork demand were good indeed. Figure 1 shows monthly real per capita expenditures (RPCE) for pork. September’s $12.56 is the second highest (to last November’s $12.60) since late-2003. It was up 11.4 per cent from one year earlier and 15.2 per cent higher than the 2009-13 average RPCE for pork in September. Note that all RPCE figures are in year-2000 dollars.

Pork RPCE normally peaks in November. If the normal September-to-November increase ($0.64) prevails again this year, that November figure will be $13.20, the highest monthly total since late 1991. There are obviously no guarantees that the normal increase will happen again this year but continued high beef prices will make pork an attractive feature during the holidays.

Year-to-date pork RPCE now stands at $100.42 in year-2000 dollars, 7.1 per cent higher than last year and 11.3 per cent higher than the five-year average.

Domestic per capita consumption was, for just the second month this year, slightly (1.9 per cent) higher than one year ago in September. Production was 1.6 per cent higher in September. Adding in lower exports and a relatively large year-on-drawdown of frozen inventories and adjusting for one more slaughter day this year, made that increase in output stick in terms of availability-disappearance- consumption.

The increase in domestic availability/usage per person, though, had no impact on retail prices which were record-high for the seventh straight month. The nominal (i.e. current dollars) average price of pork was $4.215 per pound, up 1.5 cents from August and 11.2 per cent higher than last year. After adjusting for inflation the real price of pork was $1.77 in year-2000 dollars, 9.3 per cent higher than one year earlier.

Higher consumption (in supply-demand parlance, quantity demanded) and higher real price can mean only one thing: Higher demand.

High retail prices represent both a “need to charge” on the part of pork sellers and a “willingness to pay” by pork buyers. Our foray into prices above $4 per pound has caused many to question just how long either of those will last. Retailers certainly will ask for higher prices when the cost of items increases but would really prefer to offer better value. It generates more traffic and makes customers a lot easier to get along with. Many (including me) have wondered just how long consumers will pay these kinds of prices for pork and the other species. We are fixing to find out, I think.

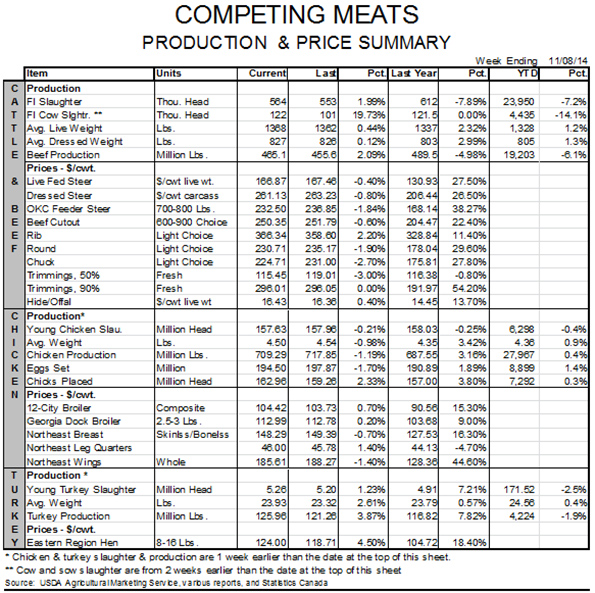

Figure 2 shows retail prices of pork, chicken and turkey as a percentage of beef. Pork is cheap relative to beef but not significantly so. Note that the beef-pork relationship is near the bottom of a range in which it has been since 2003. At 71 per cent, pork is a good value relative to pre-2004 and to the peak 83 per cent in 2010, but a bargain? Some items may be, but I would not characterise pork as a whole in that manner.

Chicken, on the other hand, is a huge bargain relative to beef and, by extension, pork. The average retail price of chicken has fallen to just 33 per cent than of beef. The retail chicken price is 47 per cent that of pork – also a record low. What’s more, chicken is getting ready to be even less expensive relative to beef as broiler output grows in 2015. Whether chicken prices fall relative to pork remains to be seen. Lower hog prices next year will allow pork prices to fall but history tells us that retailers frequently use chicken features to drive traffic while holding the line on pork price reductions to keep margins for the entire meat case acceptable. I – and probably you – don’t necessarily like that but it is true.

Note that the turkey price used here is for whole birds. It’s the only one available from the US Department of Agriculture and not likely very representative of the state of demand for turkey sold as parts or in processed items. The prices of many of those items have been significantly higher at the wholesale level this year while whole bird prices have languished. I apologise, but it’s the best – and only – retail price available.