Much Hangs in the Balance of Hog Markets

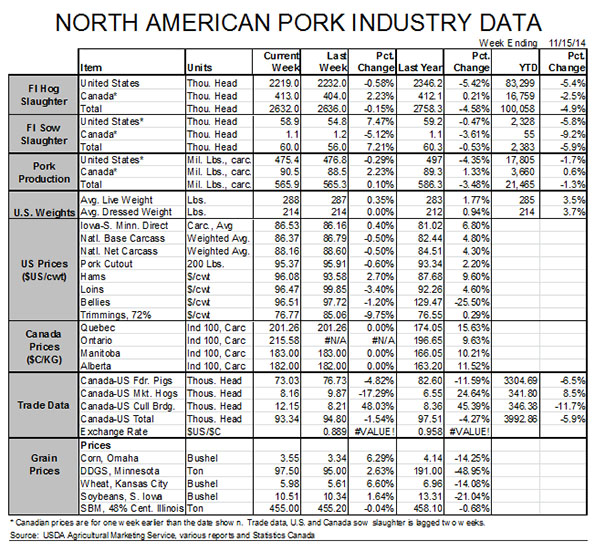

US - So how are the latest hog and pork supply forecasts and predictions panning out? That’s a reasonable question after a year of substantial uncertainty on the subject and the answer is “pretty well,“ writes Steve Meyer for the National Hog Farmer.Figure 1 shows weekly slaughter totals and includes a line representing my forecasts of FI slaughter based on the US Department of Agriculture’s (USDA) September Hogs and Pigs report.

Those forecasts, for the first time in 2014, are based completely on the USDA’s inventory estimates and include not “porcine epidemic diarrhea virus (PEDV) adjustments” on my part.

Why? Because I finally felt like the USDA estimates accurately reflected what was going on in countryside. It appears that my confidence was well-founded.

.jpg)

As can be seen in the chart, actual slaughter has been close to the predicted levels since 1 September.

Total slaughter over that time period has trailed the 2013 level by 5.4 per cent. But that figure is only 1.1 per cent lower than the September report predicted and nearly 43 per cent of that total shortfall occurred last week when only 2.219 million head, 5.4 per cent fewer than last year, moved through federally inspected plants.

A big reason for the shortfall relative to predicted levels, though, is the prediction itself. Note the big jump in the chart that corresponds to moving – at least in theory – from pigs in the USDA’s 120-to-179 pound inventory to its 60-to-119 pound inventory.

The transition is never that abrupt in reality so the forecast for this week could well be high. Weather may have played a slight role in last week’s total as well. I still expect weekly slaughter totals to grow over the next few weeks but to stay below year-ago levels.

Note the “five per cent” notation on the chart. That number represents the difference between maximum predicted slaughter levels this year and my estimate of packer capacity for a 5.4 day work week.

The five per cent underscores my concern about slaughter capacity over the next couple of years.

That amount of “slack” will be filled quickly if the sow herd increases by three per cent to four per cent over the next year (my expectation) and if litter sizes begin to grow again following the impact of PEDV.

Packers can push daily slaughter beyond the 2.438 million per week level for limited numbers of weeks. Hog numbers that exceed that level by very much for very long, though, would put significant pressure on hog prices. I don’t expect that pressure to be exerted until the fall of 2016.

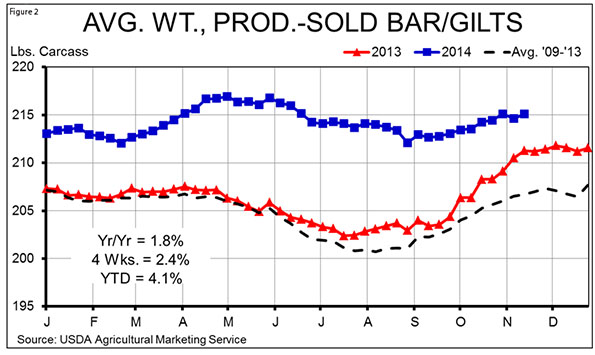

The other important supply variable is, of course, hog weights. Producers and packers have made up for much of the PEDV-driven decline in hog numbers simply by making the remaining pigs heavier.

Lower feed costs and the space vacated by PEDV-killed pigs were important factors in dramatically higher weights (see Figure 2). After a huge counter-seasonal surge last spring and summer, weights fell slightly in early fall.

The seasonal uptrend since 1 September has been about half as large as normal and has likely about run its course. I do not expect this fall’s high to eclipse the year-to-date high of 216.9 set the week ended 2 May.

While fresh corn from this year’s bumper crop is now available, the low number of sow herd PEDV breaks this summer suggest that the grow-finish slack will be getting smaller as we go through the winter and into next spring.

I think weights will get back close to year-ago levels in the first quarter before dropping below 2013 levels during the summer. That is all predicated on lower pre-weaning death losses December forward. Only time will tell whether that might be the case.

The next few weeks will be critical for next summer’s supply situation. The number of total case accessions has been rising and I heard anecdotal reports last week of a growing number of breaks in nursery and finishing sites.

Those, of course, do not imply death losses but they increase the amount of virus “available” at the same time that temperatures have plummeted and snowfall has provided some of the road grime that many suspect of playing a big role in last winter’s PEDV spread.

How will biosecurity, transport management, immunities and vaccines work in the fact of the first PEDV-friendly conditions of the year? Much hangs in the balance.