CME: Are Current Gains in the Pig Market Sustainable?

US - Lean hog futures posted fresh gains on the 13 November and the nearby December contract has climbed by more than 400 points in the last seven days, writes Steve Meyer and Len Steiner.The question is how sustainable are current gains given the steady decline in the value of the cutout since early October. And, if pork prices are indeed poised to move up, what will/should lead the charge.

The pork cutout was quoted at $96.24/cwt, gaining about $2.5/cwt so far this week and giving rise to hopes that maybe, just maybe, the rapid rise in cattle futures will help sustain pork price going into winter.

The gains in the pork cutout this week have been driven by higher prices for hams, picnics and bellies.

In the case of hams, the price increase was expected as normally we see a rally in ham values between mid November and early December on fill in Christmas ham business.

Picnics also tend to rally into Christmas on improving seasonal demand.

It is important to note the seasonality impact in the case of both hams and picnics, however, especially as one considers whether the current rally in cutout values will be sustained after the holidays.

In three weeks, those holiday purchases will be done and then the pork cutout will need to receive support from loins, bellies and trimmings that is far from certain.

One could argue that pork loin prices could once again be the driver behind higher pork (and thus hog) prices in Q1 but historically the seasonal increase in loin prices in winter has been much smaller than one would expect.

This could be in part due to the fact that the retail market is fairly saturated in terms of loin supplies and exports play a relatively small role.

When supplies are tight, as was the case this past year, then retailers have to raise their bids to fill the meat case.

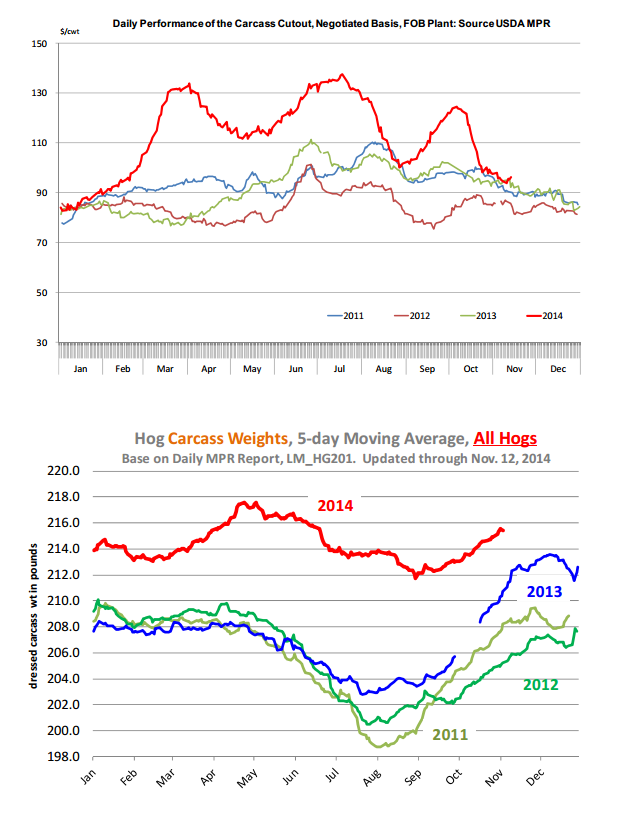

Most of the time, however, loin supplies are fairly adequate. Slaughter numbers are up and with heavy carcass weights, pork production is only slightly behind year ago levels.

Current loin cutout values are now three per cent above year ago levels and in line with prices in each of the past three years.

A more interesting item to watch, in our view, is bellies. Belly values have been hit quite hard this year and vastly under performed relative to expectations.

We think regular users, be this food service operators that like to put bacon on everything or retailers running bacon specials, were scared off by the sharp rally in hog futures and curtailed their bacon buys.

The pork belly cutout last night was quoted at $99.69/cwt, 25.5 per cent lower than a year ago and also lower than both 2011 and 2012 values.

Normally belly prices bottom out in Q4 and then are higher in the spring as food service demand picks up.

There is no question that current belly prices are undervalued and it is likely many end users are planning on more bacon features next year.

Higher belly prices should help underpin the cutout but it is unlikely they can all by themselves carry the cutout.

After all, bellies are just 16 per cent of the cutout.

Exports and PEDv are big wild cards going forward.

Weekly export data has shown a notable increase in pork sales to China. If that is sustained, it could certainly help support pork values in 2015.

As for PEDv, we continue to see reports of PEDv cases but the number of positive accessions is smaller than earlier this year.

It remains to be seen how the disease progresses now that winter is knocking at the door.