China: Hog Markets

CHINA - China is the pork powerhouse of the world with over 51 per cent of the world’s population of pigs raised within China, writes Ron Lane, Senior Consultant for Genesus China.Looking at the size of the breakdown of the inventory for September 2014, the information from MOA is indicating 436.50 million on farm inventory and a 44.81 million sow herd (August 2014, there was 432.04 million on farm inventory and a 45.03 million sow herd.

The 436.5 million on farm inventory is up 0.8 per cent from last month and down 5.8 per cent from September 2013.The sow herd is down 0.50 per cent from last month and is down 10.4 per cent from one year ago.

Again, in September, another 225,000 sows were sold, culled and/or eliminated from the total national herd. Along with the 360,000 sow in August, the 550,000 sows in July, the 464,000 sows in June plus another 470,000 sows in May and with the 1.05 million sows from April, the past six months has seen more than 3.12 million sows eliminated.

The current sow inventory is the lowest level in four years. It is expected that there will be more sows lost in the next few months as rumours of Foot and Mouth Disease in Henan may make farmers sell off inventory.

The 10.4 per cent loss in sow numbers is about 4.7 million sows-more than 75 per cent (3/4s) of the total number of sows in the USA-number two in the world for sow numbers.

Hog production capacity has significantly been adjusted with the main cause being the loss of farm households. Despite the recent recovery of the market price for live pigs, several farm households are still in financial difficulty.

Factors such as disease, cold weather and/or home consumption (mainly backyard farms) for Holidays, have all affected the total on farm inventory. Recently, the low prices have been sending sows to market as small farmers are lowering the sow herd size or are totally quitting the business.

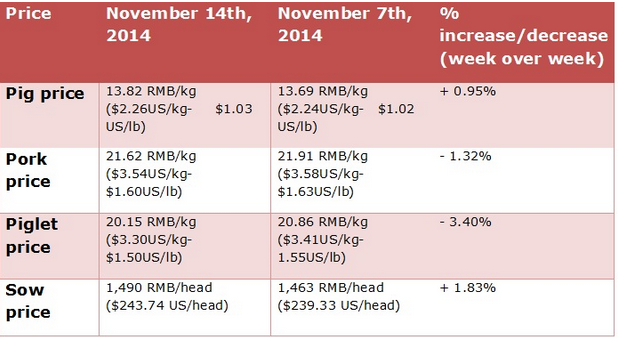

Piglet prices continue to fall as rumours of Foot and Mouth Disease in Henan area have small farmers selling off sows and pigs of all ages. Pork prices continue to fall. The fall making of bacon has been slow to start this year. In addition, the warm weather is keeping pork consumption lower than usual. With winter coming, the farmers will see more fluctuation in daytime/nighttime temperatures, which can lead to more swine flu and piglet diarrhea and slower growth. Pig to grain ratio last Friday was 5.66:1 which is still below the traditional breakeven point of 6.00:1.

The average loss of profit was estimated at 67 RMB per market pig ($ 10.96 USD/market pig). A new benchmark for cost of production in China is about 1,300 RMB/pig ($ 212.66 USD/pig). If we look at last Fridays’ market price, then the average price for a 100 kg market pig would be 1,382 RMB/market pig—with a stated loss of 67 RMB—or close to the current breakeven point benchmark ( 1382-67 =1315 RMB).

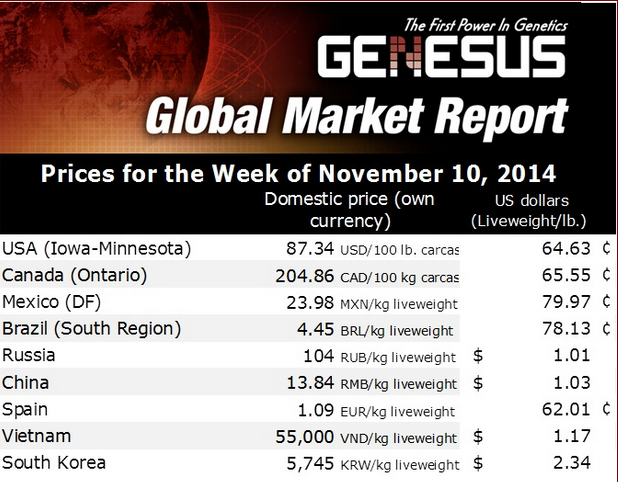

Ranking for pork production by Country: China (50 per cent ); USA (10 per cent ); Germany (5.3 per cent ); Spain (3.4 per cent ); Brazil (3.1 per cent ); Russia (2.0 per cent ); Viet Nam (2.0 per cent ) and Canada (1.7 per cent ).

Corn prices fell last week from 2.47 RMB/kg-$ 0.404 USD/kg-$1.83 USD/lb to 2.44 RMB/kg-$0.399 USD/kg-$ 0.181USD/lb.

During 2014, the China central government has allocated 1.2 billion RMB ($ 196.3 million USD) to support livestock breeding subsidies of which about 611 RMB (about $ 100 million USD was for pig breeding stock). Since 2006, 7.75 billion RMB ($ 1.268 billion USD has been provided as a subsidy to all livestock breeding purchases).

The latest USDA report projects that world production of pork will be 111.85 million tonnes (an increase of 1.1 per cent as compared to the total production estimated for 2014). The China market will produce close to 57.35 million tonnes (51.3 per cent of the worlds’ total and up 1.5 per cent from 2014 predictions).

During the 2015 year, the report also predicted that 6.32 million tonnes of pork would be imported. Japan will remain the chief pork importer with 1.28 million tonnes, a 3.4 per cent decrease from 2014. China’s pork imports will soar by 23.5 per cent over last year and will approach close to one million tonnes of imported meat.

During the first nine months of 2014, the production of all meat-pork, poultry, beef and mutton/lamb, reached 59.75 million tonnes-an increase of 2.0 per cent. Pork was 39.72 million tonnes (66.48 per cent of the total meat production and up 3.3 per cent over last year).

The projections for the 4th quarter of 2014 and the 1st quarter of 2015 have pork prices rising with the approach of Spring Festival. The Rabobank, in its report on the world pig industry, expects with lower feed costs and rising pork prices, farmers will finally start to earn profits. The report talks about the quitting of many small and mid-size farms, the consolidation of large commercial farms, the higher consumer demands that will increase meat imports and that the sow and pig farm inventory will start to be rebuilt.

Currently, pork in China is sold: 68 per cent as fresh meat, 17 per cent as chilled meat and 15 per cent as further processed products. The consumers are now looking for further processed products. The WH Group with its purchase of Smithfield will be in a strong position to introduce the US brands (with several brand names of processed pork). The opportunities for the WH Group and the introduction of their brands from the USA into China will be immense.

Historically, there has been low industrialisation in the China swine industry. In 2001, the number of intensive ( large-scale commercial farms was two per cent now it is 13 per cent; the number of mid-size ( or Specialised Pig Households-SPH) was seven per cent-now it is 35 per cent and the Backyard Farms were about 91 per cent now close to 52 per cent.

The Consumer Price Index (CPI) continues to be quite interesting for the national government. The CPI is made up of about 31.8 per cent food found in the consumers’ basket. Pork is estimated to be about 1/3 of the food portion of the basket or in other words, about 10 per cent of CPI as a whole. CPI increased to 101.60 Index points for October (year on year- lowest reading since January 2010) down from August (102.00 points) but the same as for September.

Currently, the pork prices are keeping the CPI lower, but a substantial increase, likely towards the end of this year, will cause national government concern. As a measure, when pig prices increase, CPI should increase. National inflation target for 2014 is 3.5 per cent. It is estimated that inflation will hover around 2.0 per cent for the balance of this year.