CME: Hog Slaughter on the Rise

US - Hog slaughter has grown since early August, write Steve Meyer and Len Steiner.An update on the lack of reported trades in the negotiated (spot) cattle markets for Texas and Oklahoma.

The lack of the noted prices in USDA’s weekly report for 24 September had nothing to do with confdentiality criteria. There were no negotiation cattle trades in that market during that week.

Recall that we had speculated that the lack of a published number was due to too few trades or too few buyers reporting trades. We guess that is true since there were zero trades and zero buyers.

Also note in our Production and Price Summary table that the time period for no year on year price comparisons has arrived. It was once year ago that the government shutdown forced USDA’s Livestock Market News to close up shop for three weeks.

The agency was able to backfill some of those missed data but could not parse out daily or weekly data for most cattle and hogs from the lumps of data submitted when LMN’s operations resumed the week that ended 25 October, 2013. Note that there is a price for OKC feeders in our table because that auction occurred early in the week that ended 4 October, 2013.

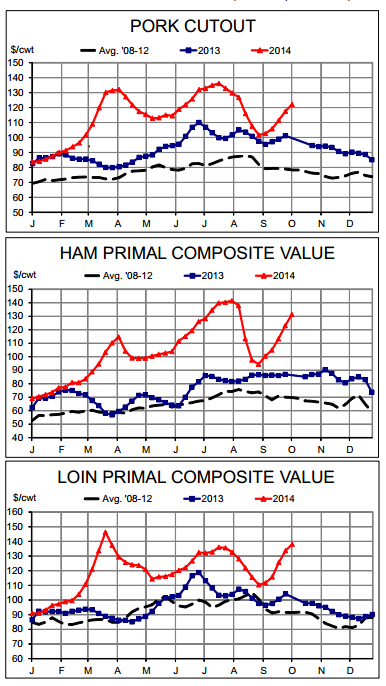

Even that price will be missing from our tables the next two week. Last week saw the remarkable counter seasonal move of pork prices continue with USDA’s estimated cutout value gaining $4.65 to reach $122.13, its highest level since early August.

The cutout value has gained over $20/cwt. in just five weeks. What is more remarkable is that the five weeks from late August to early October is normally a period in which the cutout value slides on seasonally larger slaughter.

Hog slaughter has grown since early August but a) started that increase at a very low PEDv induced level and b) has increased less than normal (11.8 per cent vs. 13.3 per cent) over the time period.

Perhaps more important this year, though, is the fact that average slaughter weights have not increase nearly as quickly as normal or as they did one year ago. Over the period 2009 - 2013, the average dressed weight for all hogs increased from 200.4 lbs. the first week of August to 204.4 the first week of October.

This year, that weight has declined one pound (213 to 212). Producer sold barrows and gilts normally go from 200.9 to 204.0 pounds during that period. This year 214.0 to 213.0. Weights had made up for 5 per cent?plus of the PEDv slaughter reductions since May.

They made up for only 2.4 per cent of the 5.8 per cent year on year slaughter reduction last week.

And while supply is one driver of the >rally, we must remember that last week’s cutout ($122.13) was 12.8 per cent higher than the last pre shut down value we had for last year. A price increase of that magnitude on 3.2 per cent less product, year in year, suggests a resurgence of demand as well.

Virtually every pork cut — even bellies — has played some part in this rally but none to the degree of hams, whose primal composite value has surged by 39 per cent since the end of August.

Just as with the cutout value, we are normally on the back side of seasonal strength for hams at this point. And loins have played an unusually large, and also counteseasonal, role in this surge.

The loin primal composite posted its second highest value of the year last week at $138.06, up $27.70 in five weeks.