CME: Decline in US Exports of Fresh/Frozen and Processed Pork

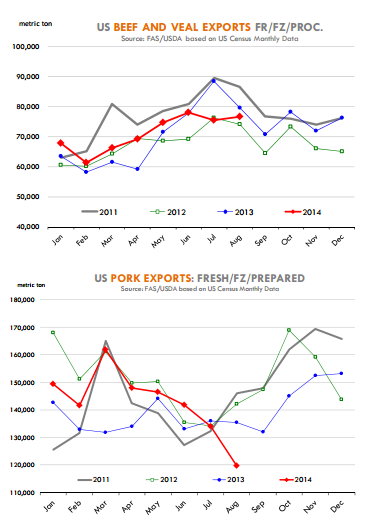

US - Exports of fresh/frozen and processed pork in August were 119,726 metric tons (MT), 11.6 per cent lower than a year ago.Beef exports in August were down 3.7 per cent compared to the previous year. The decline in beef exports in August was largely driven by lower exports to Canada and Mexico.

On the other hand, export to Asia remain in good shape and based on initial data for September we are expecting shipments to Hong Kong and Japan to show increases.

Beef exports to Mexico, which remains one of the top markets for US beef, were 10,999MT in August, down 12 per cent from a year ago.

Exports to Canada at 11,067MT were also down 24 per cent from a year ago. CME thinks the sharp increase in the value of the US currency further contributed to the decline in exports to NAFTA countries.

In early July, it required 1.066 Canadian dollars (C$) to purchase US$1 worth of US beef. By the end of August, it took C$1.10 to purchase the same amount and today it is closer to C$1.12.

The decline in the purchasing power of other currencies vs the US dollar has further amplified the impact of higher beef prices in the US and negatively impact Beef exports in August were down 3.7 per cent compared to the previous year.

It is interesting, however, that despite the strong US dollar, exports to South Korea in August were up almost 3,000MT or 43 per cent while exports to Japan, the top market for US beef at 21,528 MT, were also 1 per cent higher.

Demand for US beef in Asian markets has been exceptionally strong and this has supported prices for cuts such as chuck rolls, briskets and short plates, which traditionally go to Asian markets.

Currency rates will be especially important in 2015, especially in a tight supply environment. Asian buyers have shown they are willing to pay to secure product.

If the US dollar weakens, it could make competition for some of these products even tougher than what we have seen so far. Exports of fresh/frozen and processed pork in August were 119,726MT, 11.6 per cent lower than a year ago.

The decline in exports would have been larger if not for about 5,400MT shipped to Russia prior to the ban on US products.

Exports to China/Hong Kong have declined sharply as buyers reacted to the spike in pork prices in July. Pork prices in Asia have declined and the expectation there is that US pork prices are due to be lower in Q4, hence exporters are willing to sit on the sidelines in the short term.

Seasonally pork exports are lower in the summer due to reduced supply availability and this year, the decline has been much more pronounced due to the PEDv-induced shortages.

Exports to Japan in August were 26,726MT, down 20 per cent from a year ago while exports to a number of smaller markets also declined 33 per cent.

But there were some positive signs in the August data as well. Despite the record high prices, Mexican and South American buyers continued to buy US pork.

Part of this may be due to a substitution effect, faced with a spike in beef and pork prices, they have opted to buy pork that has a lower price point. Pork exports to Mexico in August were 41,660MT, 14 per cent higher than a year ago. Exports to Colombia also rose 59 per cent compared to a year ago.

Pork exports are normally larger in the fall, as pork supplies expand but volumes this year will likely remain constrained on supply shortages for some products (hams for example) and the lack of Russian business.