Spain and Portugal Hog Markets

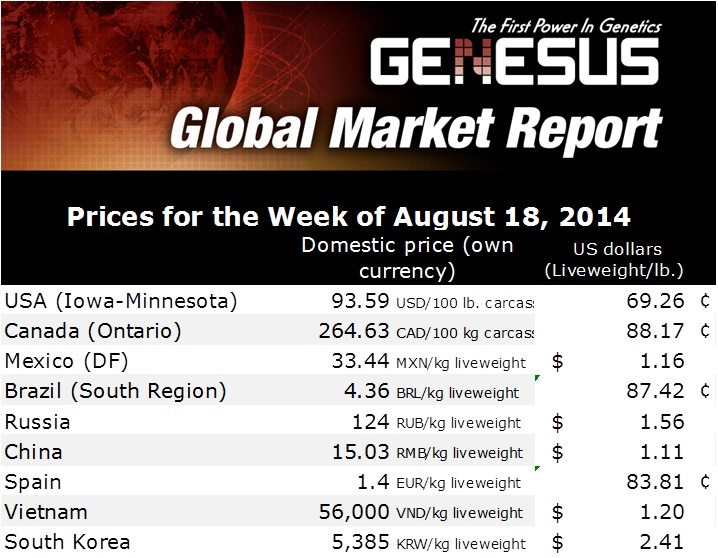

SPAIN and PORTUGAL - It has not been a surprise that hog prices went down in August, writes Mercedes Vega of Genesus, who covers Spain, Italy and Portugal. The good news is that this decline is still less than what would normally be expected at this time of year.Spain was leader in prices in July; it was higher than Germany by approximately seven Euro-cents. Spain ended the month at €1.438 liveweight, while Germany closed at €1.27.

Consequently, European producers have provided raw material to the Spanish meat industry in significant amounts causing a greater decline in prices. In August the Germany price (€1.27) is nine per cent below than the same period a year ago, while Spain (€1,433) is four per cent lower. This probably will cause a price balance and it could spur on some competition.

It should be also noticed that there are more pigs in the market because it has not been a very hot summer (the pigs are growing faster), and on the other hand, the farms are at their full capacity. Also as a consequence of the lower feed cost, the largest herd inventory after the animal welfare regulations enforcement and the genetic improvement in production. Spain is estimated to produce 60 per cent ??more than its domestic consumption.

It is of importance to highlight that in 2013 pork production was the first Spanish meat activity (3,420,000 tons. ANICE estimated value), representing nearly 83 per cent of red meat produced in the country. This level of production represents 3.4 per cent of world production, making Spain the fourth largest pork producer in the world, after China which produces 50 per cent, USA 10 per cent and Germany 5.3 per cent; Spain is also ahead of countries like Brazil with 3.1 per cent, Russia and Viet Nam with 2.0 per cent each, and Canada with 1.7 per cent.

For this reason the swings of border closures, diseases such as PED, etc., have a substantial affect on Spain’s swine industry because of the importance acquired in international markets as an export country in recent years.

European hogs have been banned from entry into the Russian market since last February, making this new scenario that Russia has created -with the embargo for a year to Europe, USA and Canada- with limited exports and forcing the EU since then to seek other markets.

However, this fact theoretically, it has not affected the Spanish hog industry because it has been suffering the embargo since May 2013. This is why, it has sought to diversify its markets in other areas, not affecting it in this case, with this new trade prohibition.

Spain has been able to export to third countries more than the rest of the EU because of the experience of prior years; but the price differential compared to the rest of Europe was not as great as it used to be now. On the other hand, you have to keep in mind that chicken and beef exports to Russia have not played a great roll in this mess, but it could make more noise now making the situation even worse in terms of a most important price war.

This is not the case in Portugal, which is directly affected by the EU dynamics and subsequently with the embargo imposed by the Russian authorities as well.

The Portuguese market is also in a difficult situation that inhibits their growth. Due to the associated feed situation, environment, animal welfare and food safety strict regulations, the reduction in consumption and low confidence in the economy. Consequently the hog population has declined in recent years; the herd is around 220,000 in May this year.