CME: Is the Worst of the Short Hog Supply Situation Behind Us?

US - Is the worst of the short hog supply situation behind us, asks Steve Meyer and Len Steiner.A reminder: The deadline for public comments on CME Group’s proposed changes to the Lean Hogs contract is this Friday, 8 August.

The proposed changes are 1) lengthening the averaging period for the CME Lean Hog Index from 2 to 10 business days; 2) moving the expiration date of all Lean Hogs contracts to the last business day of the contract month and 3) adding futures and options contracts for March, September, November and January.

CME Group needs to hear your opinions on these issues! Addresses for responses appear at the bottom of the CME Group announcement. Is the worst of the short hog supply situation behind us?

The answer to that question is more than likely “Yes,” at least after this week. But an affirmative response in no way means that hog supplies will be back to “normal” any time soon. As with most things these days, there are conflicting data on the supply situation that will not be reconciled for a few weeks at least. Let’s consider some recent developments:

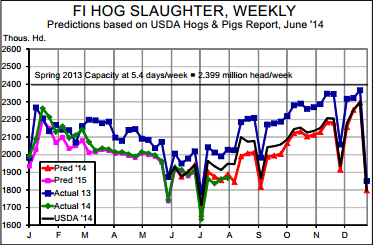

Last week marked the sixth week (of the past seven) in which FI (federally-inspected) hog slaughter was below 1.9 million head. One of those was the week of 4 July which normally sees such low slaughter levels but the one that was above the threshold was just barely so at 1.909 million head. Our forecasts suggest that this week will be the lowest non-holiday week of the year before slaughter numbers begin to grow.

Monday’s estimated FI slaughter was a shocking 337,000 head and that comes on top of an equally shocking 263,000 head total for Friday. It is true that some plants are scheduling normal summer maintenance “holidays” but those slaughter totals are very small.

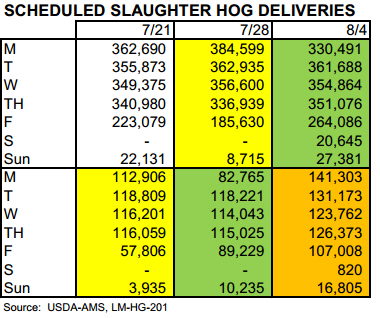

Still, the scheduled hog deliveries reported to USDA under the mandatory price reporting system and published each day in the LM-HG-201 report (Prior Day Slaughtered Swine) indicate that numbers are growing. The table at right shows the scheduled delivers for the following two weeks for 4 August and the past two Mondays.

Note that the colours denote data for the same weeks (the yellow under 21 July corresponds to the yellow under 28 July and same for the green blocks). It is clear that the delivery commitments for late this week are larger than last week and that those for next week (the orange block) are larger than corresponding scheduled deliveries the past two weeks.

BUT — we are not going back to anywhere near year-ago levels of hog supply any time soon! The peak for PEDv case accessions was in late February. That corresponds to late August marketings and slaughter.

Hog numbers usually increase rapidly during August and, at least after next week, we think they will this year but the absolute number of hogs coming to plants will remain far lower than “normal”.

Last week’s slaughter was 7.9 per cent lower than one year ago.That figure follows three weeks of 8 per cent -plus declines and one week of –6.4 per cent . Our forecast for this week (and through the end of September!) is –9 per cent from 2014 levels. That would put weekly totals near 2 million head.

Weights are still running over 5 per cent higher than last year and, it appears, will continue to do so.

But where that growth was once almost completely offsetting the reduction in slaughter, it is now making up only a bit more then half of the decline. Pork production was down 3.3 per cent , year on year, last week. Year on year declines in hog numbers will keep that number at –3 to –5 per cent , we believe, through the end of September.