USDA Reports Show the Good Times Lasting Longer for Pork Sector

US - Perhaps more important were year-on-year reductions in beef and chicken inventories of 26 per cent and 18 per cent. This is our smallest month-end inventory of frozen chicken since mid-2004 and the smallest amount of beef in freezers since early 2005. Pork inventories are at their lowest level since late-2011, writes Steve Meyer for National Hog Farmer.This situation may last a while – in fact “a while” longer than even I had anticipated. Such is my conclusion after last week’s reports from the United States Department of Agriculture.

It appears that – barring some unforeseen shock(s) – the good times we see now will be with us for longer than even I had anticipated. We all know it will not last forever, but ...

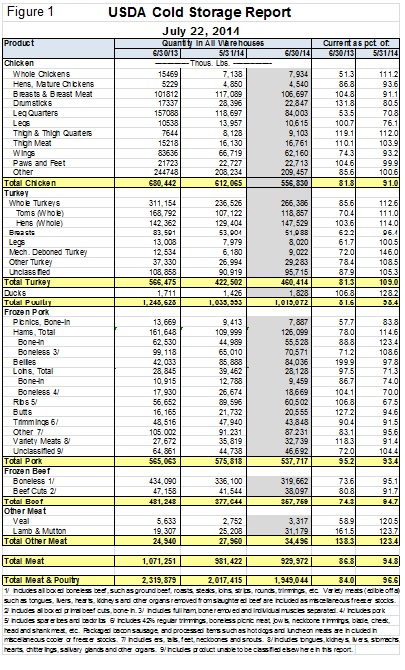

Last week’s Cold Storage report indicated further reductions of pork inventories. See Figure 1 for data for all species. Total pork in storage at the end of June totaled 537.7 million lb., 6.6 per cent fewer than at that the end of May, and 4.8 per cent less than one year earlier.

The reduction was comprised primarily of hams (down 22 per cent from 2013), other pork (down 17 per cent) and unclassified pork (down 28 per cent).

Bellies’ stocks were nearly double last year’s level but remember than they were unusually low, driving belly prices to then-record highs. Rib and butt stocks were 6.8 per cent and 27.2 per cent higher than one year ago but those percentage increases amounted to a total of only 8.24 million lb. The decline in ham stocks was 35.5 million lb.

This situation may last a while – in fact “a while” longer than even I had anticipated. Such is my conclusion after last week’s reports from the United States Department of Agriculture.

It appears that – barring some unforeseen shock(s) – the good times we see now will be with us for longer than even I had anticipated. We all know it will not last forever, but ...

Last week’s Cold Storage report indicated further reductions of pork inventories. See Figure 1 for data for all species. Total pork in storage at the end of June totaled 537.7 million lb., 6.6 per cent fewer than at that the end of May, and 4.8 per cent less than one year earlier.

The reduction was comprised primarily of hams (down 22 per cent from 2013), other pork (down 17 per cent) and unclassified pork (down 28 per cent). Bellies’ stocks were nearly double last year’s level but remember than they were unusually low, driving belly prices to then-record highs.

Rib and butt stocks were 6.8 per cent and 27.2 per cent higher than one year ago but those percentage increases amounted to a total of only 8.24 million lb. The decline in ham stocks was 35.5 million lb.

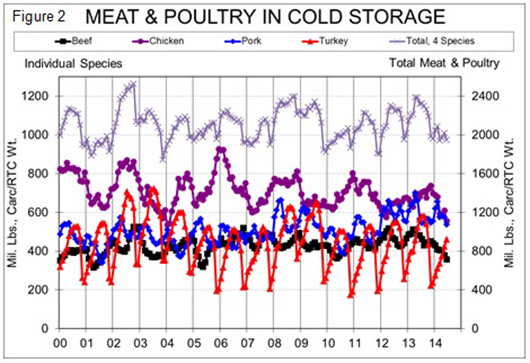

With all of those long-term lows, one would think total stocks would be lower as well but that is not the case because June is well into the annual build up of turkey inventories.

Still, the June 30 stock of all meat and poultry in freezers was 1.949 billion lb., an amount smaller than what was in freezers in December.That is an unusual circumstance and the supply situations for beef, pork and chicken do not suggest any significant increases in the next few months.

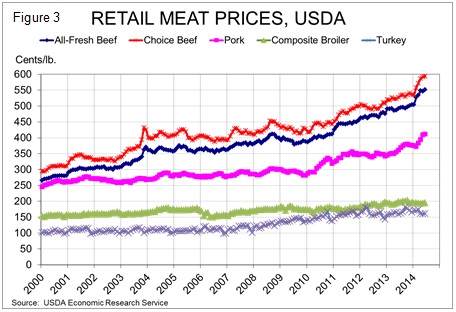

The first piece of the demand puzzle for June indicates that it is still going strong. Retail beef and pork prices were again record high while both broiler and turkey prices gained fractionally from May.

The average retail price of pork for June was $4.116/lb., up 13.8 per cent from one year ago. The Choice beef price hit $5.938/lb., up 12.6 per cent from June 2013 while prices for All-Fresh beef averaged $5.512/lb., 12.1 per cent more than one year ago.

The composite broiler price for June was $1.949/lb., up slightly from last month and 2.2 per cent lower than one year ago.

The June average turkey price was $1.606, also up slightly from last month but also 0.7 per cent higher than one year ago.

And finally, Friday’s cattle supply reports were both bullish. The Cattle on Feed report was marginally so with the main bullish factor being June feedlot placements (1.455 million head, down 6.2 per cent from last year) that were somewhat smaller than analysts had expected (the average pre-report estimate was down 3.8 per cent from 2013).

Those smaller placements left feedlot inventories short of year-ago levels once again and suggested tight cattle supplies once again in the coming winter.

Perhaps more bullish for the long term was the July Cattle (or Cattle Inventory) report that suggested a surprisingly small US beef cow herd and almost shockingly-low beef heifer retention given the current and expected profitability of the cow-calf sector.

No year-on-year comparisons were possible for these numbers since last July’s report was a victim of budget sequestration, but the comparisons to 2012 were nonetheless surprising.

The USDA pegged the beef cow herd on July 1 at 30.5 million head, 2.5 per cent smaller than two years ago. Further, the USDA found that only 4.2 million heifers were being retained as replacements.

That figure is 2.4 per cent smaller than two years ago. The lower female inventories fit with the USDA’s estimated 2014 calf crop of 33.6 million head, 2 per cent smaller than the July 2012 estimate of the 2012 crop.

The 33.6 million would also be 1 per cent smaller than the 2013 calf crop estimated in the January 2014 Cattle report. The USDA’s estimates imply that the supply of feeder cattle still outside of feedlots on 1 July was a record-low 34.569 million head, 3.1 per cent lower than two years ago.

A 33.6 million head calf crop will help that feeder supply number next year but will not likely get it anywhere near year-earlier levels, implying continued tight beef supplies through 2016 and into 2017.

With all of those long-term lows, one would think total stocks would be lower as well but that is not the case because June is well into the annual buildup of turkey inventories. Still, the 30 June stock of all meat and poultry in freezers was 1.949 billion lb., an amount smaller than what was in freezers in December.

That is an unusual circumstance and the supply situations for beef, pork and chicken do not suggest any significant increases in the next few months.

The first piece of the demand puzzle for June indicates that it is still going strong. Retail beef and pork prices were again record high while both broiler and turkey prices gained fractionally from May.

The average retail price of pork for June was $4.116/lb., up 13.8 per cent from one year ago. The Choice beef price hit $5.938/lb., up 12.6 per cent from June 2013 while prices for All-Fresh beef averaged $5.512/lb., 12.1 per cent more than one year ago.

The composite broiler price for June was $1.949/lb., up slightly from last month and 2.2 per cent lower than one year ago. The June average turkey price was $1.606, also up slightly from last month but also 0.7 per cent higher than one year ago.

And finally, Friday’s cattle supply reports were both bullish. The Cattle on Feed report was marginally so with the main bullish factor being June feedlot placements (1.455 million head, down 6.2 per cent from last year) that were somewhat smaller than analysts had expected (the average pre-report estimate was down 3.8 per cent from 2013).

Those smaller placements left feedlot inventories short of year-ago levels once again and suggested tight cattle supplies once again in the coming winter.

Perhaps more bullish for the long term was the July Cattle (or Cattle Inventory) report that suggested a surprisingly small US beef cow herd and almost shockingly-low beef heifer retention given the current and expected profitability of the cow-calf sector.

No year-on-year comparisons were possible for these numbers since last July’s report was a victim of budget sequestration, but the comparisons to 2012 were nonetheless surprising.

The USDA pegged the beef cow herd on July 1 at 30.5 million head, 2.5 per cent smaller than two years ago. Further, the USDA found that only 4.2 million heifers were being retained as replacements.

That figure is 2.4 per cent smaller than two years ago. The lower female inventories fit with the USDA’s estimated 2014 calf crop of 33.6 million head, 2 per cent smaller than the July 2012 estimate of the 2012 crop.

The 33.6 million would also be 1 per cent smaller than the 2013 calf crop estimated in the January 2014 Cattle report.

The USDA’s estimates imply that the supply of feeder cattle still outside of feedlots on July 1 was a record-low 34.569 million head, 3.1 per cent lower than two years ago.

A 33.6 million head calf crop will help that feeder supply number next year but will not likely get it anywhere near year-earlier levels, implying continued tight beef supplies through 2016 and into 2017.