Hog Slaughter Numbers Lowest Since July 2012; Weights Filling Gap

US - It is time once again for World Pork Expo! The annual “Hog-O-Rama,“ as one friend kindly calls it, runs Wednesday through Friday at the Iowa State Fairgrounds in Des Moines, writes Steve Meyer for the National Hog Farmer.All Weekly Preview readers are invited to visit the National Hog Farmer booth in the Varied Industries Building. In addition, plan to drop by the National Pork Board’s tent just north of the Varied Industry Building at lunchtime on either Wednesday or Thursday to grab a bite to eat and hear outlook presentations by Elwyn Taylor, Iowa State Climatologist, and yours truly. The food will be good and the presentations will be thought-provoking and, hopefully, accurate. Yes, we can always hope!

June 1 also means that USDA will be in the field with its survey for the June Hogs and Pigs Report. IT IS IMPERATIVE THAT PRODUCERS RESPOND AND RESPOND ACCURATELY TO THE SURVEY if we are to get a better handle on hog supplies. The March report still appears to have overcounted the pigs that are out there. The jury will not fully speak on that issue until later this summe, but we have another shot at accurately counting pigs. I appeal to producers to do their part in that effort.

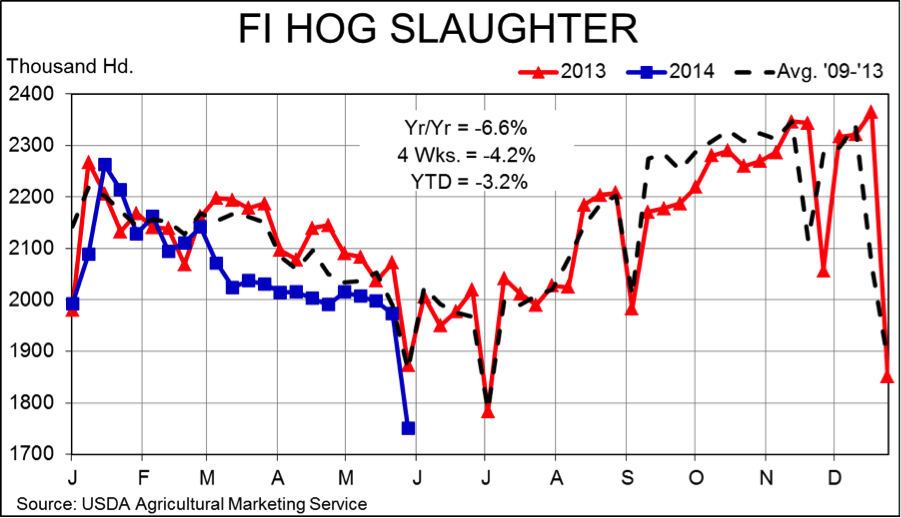

While last week’s slaughter and production numbers cannot be compared to week-earlier levels because of the Memorial Day holiday, year-on-year comparisons are still valid since the holiday fell in the same calendar week in 2013. Last week’s federally inspected slaughter run of 1.750 million head was 6.6% lower than last year and is the lowest weekly total since the week of July 4, 2012. The year-on-year decline is a little more shocking in unit terms: 114,500 head. FI slaughter has averaged, over the past 4 weeks, 4.2% lower then one year ago. My computations for May based on porcine epidemic diarrhea virus (PEDV) case accession data said May slaughter would be down 2.8%, so the decline for May has been even larger than I expected. That does not bode well for supplies later this summer when the accession data suggest that slaughter will decline by over 10% versus 2013.

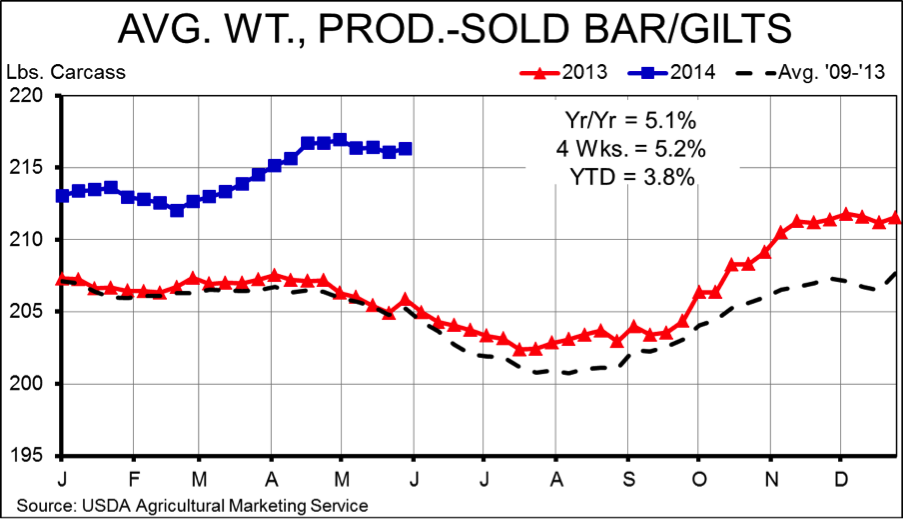

Weights are still filling much of the gap in supply, but their contribution is likely waning. Producer-sold market hog weights increased slightly (0.2 pounds) to 216.3 pounds last week. While weights did increase, the growth was about normal for Memorial Day week when pigs are, in essence, allowed to grow one more day than normal. The increase was half as large as the increase last year.

Weights will decline over the next two months. But that’s not news since weights virtually always fall when temperatures rise and feed consumption rates decrease. The question will be whether the decline is “normal” or exaggerated as packers chase the limited supply of pigs that I think are out there. If the 5% year-on-year increases can be maintained, the brunt of those summer slaughter reductions will be avoided. But I’m expecting the year-on-year growth to decline to at least 4% by July.

The balance between packer demand for pigs and the number of pigs available for slaughter will be very interesting to watch over the next few weeks. Lower wholesale prices – and a month to work through some of those panic-bought inventories – have likely rekindled buying interest in the wholesale pork market. The cutout was down last week, the victim of sizable reductions for both ribs and bellies – but talk in the trade is that buyers are coming back after backing off the record prices of March and April. In addition, packer margins have improved over the past two weeks and nothing gets packers interested in slaughtering pigs like money!

Those margins will almost certainly not get back to the $60 per head level (remember, this is a GROSS margin from which labor, plant, transportation, packaging, etc. must still be paid) but they could easily stay strong for the remainder of the summer. And,they will have to be strong given the fact that many companies will be operating at less-than-optimal plant utilization levels.