China: Hog Markets

CHINA - China: it is the pork powerhouse of the world with over 51 per cent of the world’s population of pigs raised within China, writes Ron Lane, Senior Consultant for Genesus China.Looking at the size of the breakdown of the inventory for March, 2013-breeding stock was around 50.93 million and total on farm inventory was around 434.36 million (as compared to February 2013-breeding stock was around 51.19 million (March is an decrease of 0.5 per cent from February) and total on farm inventory was around 438.30 million (March is down 0.9 per cent from February).

For January, 2013, the breakdown of the inventory for breeding stock was around 51.30 million (flat with December, 2012) and total on farm inventory was around 446.79 million (down 3.2 per cent from December, 2012). The 434.36 million head for March is down 1.7 per cent from last year while the March sow inventory of 50.93 million is up 3.00 per cent from last year (year over year).

Since October, 2012, there has been about a 7.9 per cent drop in total on farm inventory ( October 2012-total on farm inventory of 471.41 million head versus March, 2013 total on farm inventory of 434.36 million head), yet the sow inventory has remained flat ( 50.94 million sows in October, 2012 versus 50.93 million in March 2013).

October 2012 born pigs should be coming to market! The question becomes why is there such a large drop of 37.05 million head for on farm inventory with the same number of sows? Some answers may lie in calculation errors for actual inventory, but the large difference is more likely caused by actual situations such as a large effect of some diseases (FMD, PRRS, PED and/or PCV2) or the replacement of backyard farms with modern farms has not improved overall pig performance. (Estimated annual market pig slaughter for 2012 is at 714.27 million head divided by about 50 million sows and we get about 14.29 pigs marketed/sow/year). Other reasons and analyses may enlighten the readers of this report.

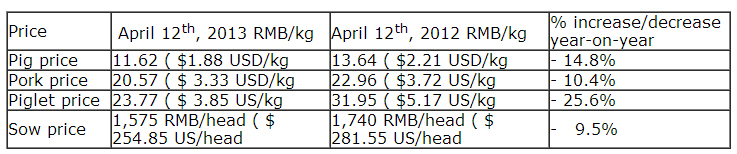

Profit margins are now showing larger negative returns. At the end of March, the estimated national losses were around 260 RMB/market pig ($ 42.07 USD/market pig) (as compared to the end of February when losses ranged from 15 RMB/head ($ 2.43 USD/head) to 37 RMB/head ($ 5.99 USD/head). As of January 9th, 2013, the profit margin was approaching 360 RMB/head-$58.25 USD/head marketed from a farrow to finish production unit. At the end of March, 2012 the profit margin was at 187 RMB/market pig-$30.26 USD. Average profit for 2012 was estimated at 177 RMB/ pig-$ 28.64 US.

What to watch for over the next few months!

This week, the pig to grain price ratio is 5.24:1 as compared to last Global Market Report (March 3rd with a 5.97:1) and as compared to (January 13th), when the ratio was at 7.52:1. (This is a further drop in 1 week of 2.78 per cent from April 3rd pig to grain ratio) For January, 2012, a 7.79:1 ratio was calculated. From mid-November to mid-January, there was reasonable profitable returns and the ratio increased by a factor of 1 (6.53:1 versus 7.52:1). Since mid-January to current date, the pig to grain ratio has dropped from 7.52:1 to 5.24:1 (a ratio of 6.00:1 is considered breakeven), about a factor of 2.3. Thus, the current losses that are being seen in the industry.

Last week, the average national corn price was 2.27 RMB/kg ($0.367 USD/kg), the average national soybean meal price was 3.29 RMB/kg ($0.532 USD/kg) and the average national wheat bran price was 1.96 RMB/kg ($0.317 USD/kg). The retail price to farmers for soybean meal would be 4.27 RMB/kg ($ .691 USD/kg). The national average feed price for a market pig was 3.29 RMB/kg ($ 0.532 USD/kg). This is an increase of 7.2 per cent from last year.

The Consumer Price Index (CPI) is quite interesting for the National Government. Rising food prices and especially increasing pork prices greatly affects the CPI. The CPI is made up of 30.49 per cent food found in the consumers’ basket. Pork is estimated to be about 1/3 of the food portion of the basket or in other words, about 8 to 10 per cent of CPI as a whole. Thus, with these calculations in mind, the price of pork in the entire CPI weighs between 2.5 per cent to 3 per cent . This level is much larger than the world's major pork producing and consuming countries, such as Japan (0.66 per cent factor), United States (0.34 per cent factor) and in Germany (0.71 per cent factor) on CPI. Currently, inflation was around 2.0 per cent for January, 3.2 per cent for February (a 10 month high) and estimated to be around 2.5 per cent for March, 2013. Food prices gradually rose during January (increased by 2.9 per cent ) as the Spring Festival holiday brought on high demand. In February, food prices rose by 6 per cent . This affected about 1.98 percentage points on the CPI. Pork was further down in price in February and this reflects nearly 0.04 percentage points drop in the CPI.

Recently, on April 7th , as the pig prices continued to stay low, the National Government announced that they would purchase and store pork to help decrease supply and to stabilize the price of pork. More than 20 provinces are buying pork to be frozen to assist farmers in reducing the cost of production losses. After the start of the purchasing and storage activities, in most parts of the country, the market pig and pork prices has increased by the range of 0.2 to 0.4 RMB/kg ($ .03 to $.06 USD/kg).

Grain production for 2013 is on pace to set a record. This will be the 10th consecutive year of growth as the Government enhances technology and infrastructure to maintain the growth. China’s grain output for 2012 rose 3.2 per cent to 589.5 million tons. This was 18.3 million tons more than 2011. The problem of grain waste in transportation, consumption and storage will also be targeted. It is estimated that 200 billion RMB (about $32 billion USD) of grain is thrown away each year.

In mid-March, a total of more than 16,000 dead pigs were “fished-out” of the Huangpu River, one of the main sources of drinking water for the city of Shanghai. Many people have speculated to the cause of the high death loss. Disease is probably the reason, but both local and national levels of government have not reported the chief causes or sources. Speculation includes a play on insurance claims; porcine circovirus was detected in some of the carcasses; and that normal channels for disposing of dead pigs were full and these places were refusing truckloads. Ear tags traced some of the animals to upstream farms in Zheijiang province.

The US Grains Council has recently conducted a series of village level Chinese pig producer meetings. In most reports, the producers claim that they will have losses during the 2013 calendar year. Current cost of production is estimated 12.39 RMB/kg ($ 2.01 USD/kg); while the market pig fetches about 13.48 RMB/kg ($ 2.18 USD/kg).

The Shuanghui Group (Shineway products is common product name), one of the larger processing groups in China, plans to spend about 6 billion RMB (about 970 million USD) to construct new projects mainly in the North-east provinces (Heilongjiang, Jilin and Liaoning) and in Guangxi and Yunnan in the south region. The Chairman, Wan Long indicated that the Henan based company could slaughter 15.5 million market pigs this year (for a value of 62.5 billion RMB-10.1 billion USD) as compared to 10.3 million hogs in 2012.

.jpg)