Jim Long pork commentary: US feed prices continue to decline

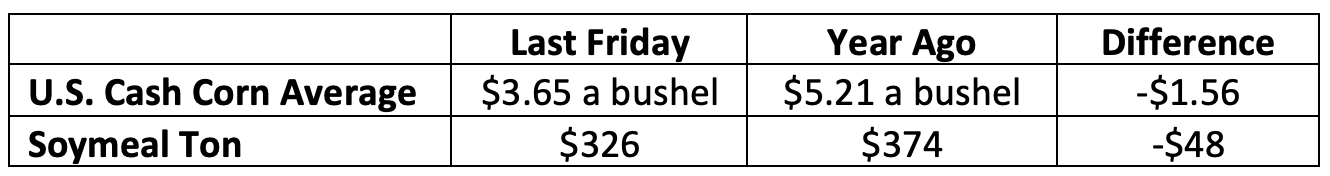

Not so long ago the idea that U.S. Cash Corn could average $3.65 a bushel would have been considered lunacy. Lunatics take a bow. U.S. Cash Corn averaged $3.65 a bushel last Friday with some corn trading below $3.00 a bushel.

The change in Corn and Soymeal price is about a $20 per head decrease in cost of production farrow to finish now compared to a year ago.

Thank goodness feed costs have declined. Iowa State University calculates the cost of production in July was 86.73¢ lb. lean with an average selling price of 91.10¢ lb. leading to a $8.86 per head profit. Last years feed prices would have had the industry in red ink.

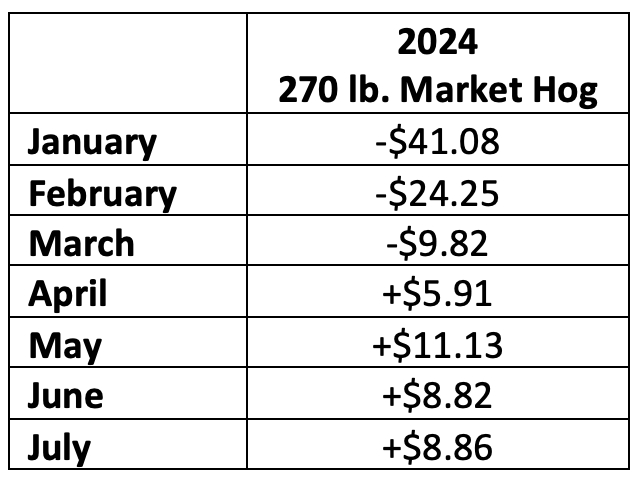

If you are not feeling flush with money maybe look at Iowa State’s farrow to finish returns year to date might show why.

You add up mostly losses $75.15, add up monthly profits $34.72, subtract the difference $40.43, divide by 7 months = average loss per head year to date -$5.77 per head. Not going to buy a condo in Arizona with these returns.

In 2023 and late 2022 losses were in the $31 per head range. We have as an industry a profitability problem.

Compounding the history of lack of profits is lean hog futures indicating an average price from October to May in the 75¢ lb. range – cost of production 87¢ lb. If lean hog futures reflect what the market could be, losses in the $25 per head range over the next several months.

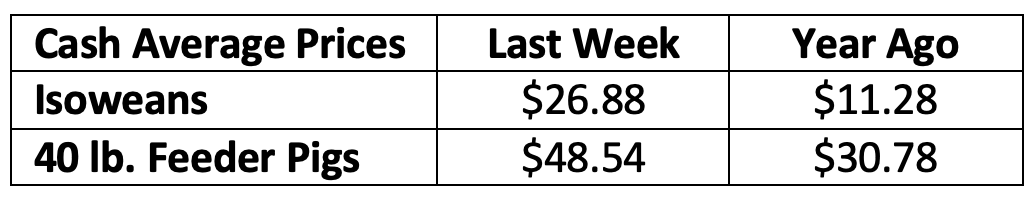

Small Pigs

The U.S. small pig price is stronger than a year ago.

Small pigs $15-18 stronger than a year ago, probably reflecting lower feed costs to finish a pig. We also understand that there appears to be good demand. Demand can be best illustrated in that the current purchase price of small pigs is about $10 per head over a calculated breakeven using lean hog futures.

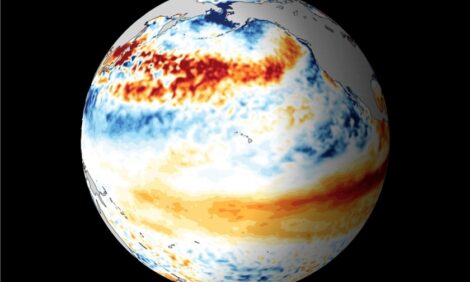

China

The current hog price in China is 20.66 RMB/kg or $1.33 U.S. liveweight a lb. Breakeven in China is about 15 RMB/kg. Farmer Arithmetic has us saying China profit per head $90-100 USD.

The reason the price has jumped. Liquidation 3-4 million sows gone due to industry losses in the billions (7-10% of herd). Seems in China unlike the U.S. financial losses have led to lower production. There is give or take 12 million market hogs a week in China. If calculation correct industry plus $1 billion USD a week currently. That would backfill the equity hole.

China is by far the largest importer of pork in the world. The current price spread between China and major exporting entities is going to lead to increased China imports. Its simple Chinese business can buy imported pork at a price and then sell in China for a very good opportunity margin.

Tariffs $ on U.S. pork to China will limit U.S. involvement but as pork moves from Canada, Brazil, EU it means they have less pork for other markets which supports U.S. industry. We expect high tide will raise all boats.

We will soon be going to China to get further first-hand knowledge. Spencer and I will both be speaking at the Global Genetic Conference.