Jim Long commentary - Production data: myth versus reality

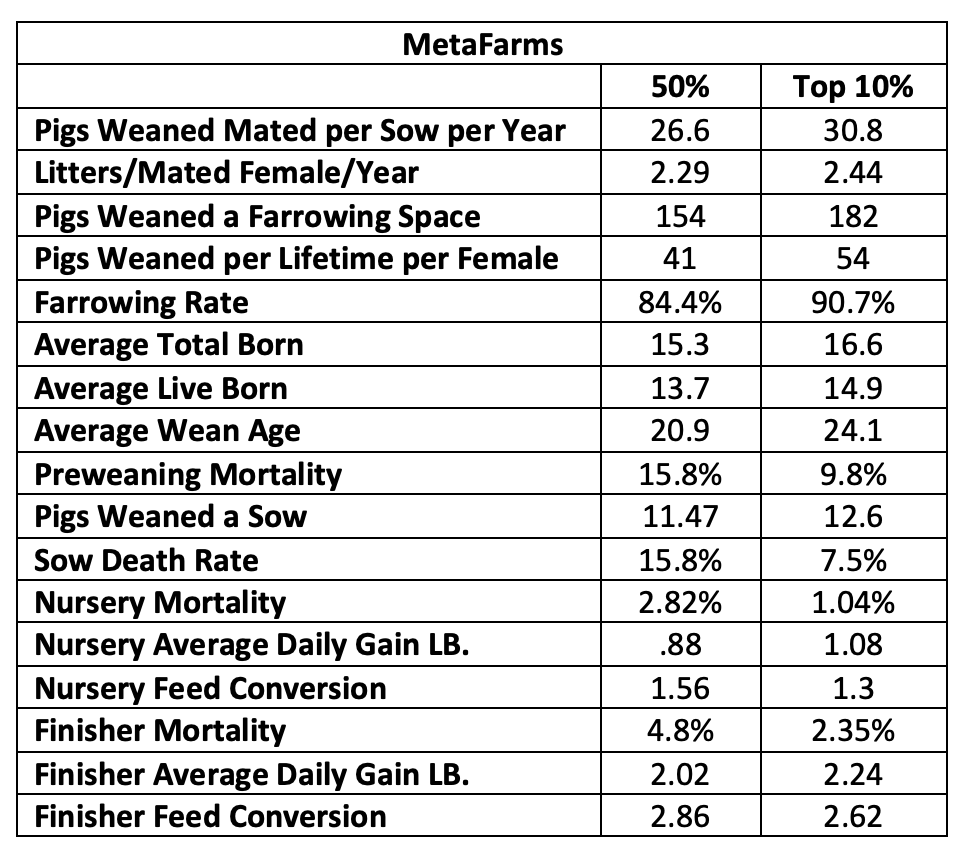

Pork commentary from Jim Long, Genesus CEOLast week was in a discussion with a producer. We had good dialogue on what productivity was currently. Made us wonder what reality is versus the myth of productivity claims. Consequently, we looked at latest available MetaFarms a database of 1.1 million sows in the U.S., Canada and Australia. 3,000 nursery close outs and 8 million pigs started grow finish. Big database reflects reality.

Nursery average weight 53.6 LBS. Average Finisher Hogs 286.6 LBS.

Let’s review. MetaFarms average pigs mated per sow 26.6. Average sow mortality 15.3%, Average nursery mortality 2.82%, Average finisher mortality 4.8% (7.6% total), average finisher feed conversion 2.86. Real Results from Big Database. The top 10% 30.8 weaned per sow, sow mortality 7.5%, nursery mortality 1.04%, finisher mortality 2.35% (3.4% total), feed conversion 2.62.

The MetaFarms data is a clear snapshot on production. We expect it is in general better than the whole industry average as its most likely producers that are striving and are participating in MetaFarms like databases. MetaFarms data continues to reflect the sow mortality issues we continue to have at 15.8% average. It's obvious as we go to more sows in pens there are genetics that can’t handle pen gestation. This is than magnified by the prolapse issues being propagated by certain genetic company.

Feed

If USDA is correct in these current estimates on the U.S. 2024 crop, we can expect relatively low feed costs in the next year. USDA projects record soybean crop and a corn crop over 15 billion bushels. Two years over 15 billion the first time ever. U.S. average Cash Corn is now under $3.60 a bushel while soybeans are $9.18 a bushel both a long way from $8.00 corn and $17.00 plus a bushel soybeans. We have seen cost of production of hogs farrow to finish now about 87¢ lb. lean down significantly from over $1.00 lb.

The lower U.S. grain – oilseeds costs have a rippling effect across the world lowering breakeven price points for all swine producers.

Its good feed prices have lowered for swine producers, we need it even with these lower feed costs the next several months of futures lean hog prices in the low 70’s, the losses per head will be in the $30 per head range (cost of production 87¢ lb.). We expect there are some dynamics that should support the hog prices i.e., exports Mexico – China, strong beef prices but our reality is consumers appear to not be prepared to pay a profitable price to us despite U.S. Beef cut outs $3.15 lb, Pork cut outs $1.00 lb.

The latest U.S. Pork Board data indicates consumers protein choice is driven by Taste, nutrition and convenience. Note Taste is first, as an industry we continue to produce pork that could use taste improvement. Not sure why we can’t embrace this reality, even with low feed costs the next six months plus look unprofitable. We are glad Pork Board is now addressing taste issue unfortunately if producers keep using genetics that produce pork that tastes like paper, our demand and profits will suffer.