Producer & DVM perspective: Biggest challenges facing the pork industry

PRRS, labor, sow housing and foreign animal disease top the list for this veterinarian who is also a pork producerDr. Peter Schneider, veterinarian at Innovative Agriculture Solutions, spoke to attendees at the Annual Four Star Pork Industry Conference held in Muncie, Indiana in September 2024. His family also owns a 1,200-sow farrow-to-finish operation near Waterloo, Iowa. Their farm has been in his family for 150 years. So when he’s not doing veterinary work, he’s working on the family farm, giving him a unique opportunity to share his insights as both a veterinary and a producer. He focused on four key areas that he sees as the biggest challenges facing the pork industry.

“When I was asked to do this presentation, I started by creating a list of the challenges that I see in the industry – essentially, the things that kept me up at night,” he said. “It’s all the things that I spend a lot of time thinking about as I'm driving down the road. I decided to focus on four aspects that probably affect everyone fairly equally – foreign animal disease, labor, sow housing requirements and disease, more specifically, PRRS which is always the elephant in the room.”

In 2005, Dr. Eric Newman put the economic cost of PRRS at $560 million. Dr. Derald Holtkamp, professor at Iowa State University, updated that research recently and the cost of PRRS in the US alone is more than $1.2 billion.

“Given those stark figures, you can see that it’s a critical factor to our profitability as an industry. And I believe those numbers because from what I’ve seen in 12 years of practice, the severity of PRRS today seems to be ever increasing,” he said. “Until the 144-L1C variant that developed over the last few years, I don't remember farms going for four to six weeks after a first break without weaning any pigs. We're getting to the point where we're weaning pigs just because we need to get them off the farm because they're getting too old - not necessarily that we have enough pigs to even fill facilities sometimes.”

He said PRRS viruses persist longer now and take more time to eliminate on farms. In 2012, Dr. Daniel Linares, associate professor at Iowa State University, released a study looking at different methods of elimination of PRRS closures and the median time frame that he assigned to getting back to a negative production of PRRS pigs was about 27 weeks. Today, that timeframe is much closer to 40 weeks.

“In my experience, we're not even starting to look for negative pigs on farms until at least 20 weeks because we know we're going to have positive pigs being born, which might be the result of more sensitive testing methods,” he noted.

The higher losses create more frustration with our caretakers, both at the sow farm and on the wean-to-finish side.

“We're constantly dealing with biosecurity practices on the sow farms and our wean-to-finish caretakers are taking more effort and time to take care of those sick pigs,” he said. “PRRS can take a toll on everyone on the farm.”

Because of this, we are talking more about depopulations of farms after a PRRS outbreak.

“In the first 10 years of my practice time, I did one PRRS depopulation, but in the last two years, I've done three,” he said. “So depopulation is back on the table for a number of different reasons, and those reasons are different for every farm.”

Is PRRS depopulation right for your farm? Well, it depends.

- Can you keep the farm PRRS negative? If we've got a farm that's breaking every single year with PRRS, it's a different conversation than a farm that breaks every two to four years.

- What does sow farm productivity and downstream productivity look like with PRRS? It's good to talk to someone who has gone through this before on the farm. Everyone needs to understand how long the stages of the process will take and the significant disruptions to the operation including contracts, parities, production, workload, etc.

- What’s the cull sow price and gilt price? When we're starting to sell culls, if we can buy replacement gilts for the same value, it’s an easier conversation with less severe economic ramifications than when we're selling $20 cull sows and having to buy $300 replacement gilts.

- Contractual obligations? Some farms have contractual obligations which can impact their decision to move forward with a depopulation. It may be impossible to buy some of the niche production pigs in the open market to be able to fulfill their contractual obligations.

- What kind of sow farm feeding system is in use? Some electronic feeding systems take a little more work to train the sows to feed at the feeding station. A depopulation in this type of system may require extra work for farm staff to train the new breeding herd.

There are many other factors to consider, so it’s best to sit down with your team and your veterinarian to work through the options and the economics to determine if a depopulation is the right path for your operation.

The PRRS resistant pig

“I get asked a lot of questions about the development of PRRS resistant pigs, and I have really mixed feelings about this. As a producer and a veterinarian, I want what's best for the animals. We want to make sure that their well-being is cared for as best as we can when they go through PRRS,” he said. “A PRRS outbreak is hard on the pigs, it’s hard on the farm staff and care givers and economically, it’s hard on the livelihood of the operation. But I also understand as a producer that if we don't have PRRS, there's going to be a lot more pigs raised, and there's going to be some of us in the room that are going to have to leave the industry because we don't have enough demand to get rid of all the pork that we’ll be capable of raising.”

There are also a lot of questions to be answered about the technology that factor into its path forward, like which agencies will regulate it and how will they regulate it, and ultimately, whether the consumer will accept the product.

Labor sourcing is tough

Farm labor continues to be an industry challenge, but Dr. Schneider says technology can help.

“As we move forward, we've been able to automate a lot more processes, like electronic sow feeding and tracking your day one care and sow farm processes,” he said. “Automation is tool to help us have more control over our farms and eliminate some of the labor that goes into pig production, but we certainly cannot automate every process. Breeding and actual day one care will always require people.”

Based on farm data, there’s no question that a stable workforce and labor pool means more success on the farm. Production is always better on farms with well-trained staff that have been together for a long time and have great leadership.

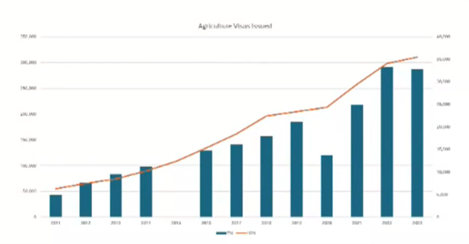

Part of the struggle is getting a local labor pool. The chart below shows the number of visas that have been issued since 2011. The blue lines are TN visas, and the orange line is for H-2A visas. There’s a steep increase in both of those categories as farms struggle to find labor

“In 2015 when I hired our first farm laborer through a visa program, it was a pretty simple process. I went to the immigration attorney and told them what we were looking for. In a few weeks, they had applicants that I was able to interview, and within four weeks I had somebody in the country that was working for me,” he said. “Today, that process takes about six months.”

Part of the longer timing may be due to more rejections as US Citizenship and Immigration Services (USCIS) is being more thorough in their investigations, looking at what degrees and education the workers have. There’s obviously higher demand as the chart above shows, so even getting interviews scheduled as part of the process can be challenging.

“You may want to consider other options like H2A and J1, however they have a shorter approved timeframe,” he said. “This sets us up for higher turnover in our staff and less continuity at the farm.”

Regardless of where the labor's coming from, it costs more. It’s not only the process to get workers to the US and their compensation, but farm owners need to offer housing or assistance securing housing and help workers get insurance and a low interest loan to buy a vehicle so they can get to work.

“Once we have a worker, we've got to make sure we keep them, by keeping them happy and part of that is good training. In my experience, when we do a good job training, we get employee satisfaction at a higher level. We have better productivity and more enjoyment in what they're doing on a daily basis. We need to make sure we're showing them respect because this helps create loyalty,” he explained.

Good leaders on the farm as department heads and managers can make all the difference in keeping employees motivated to stay and work at your farm.

“We need to continue to actively work to get more strong leaders on the farm to develop that next generation and make sure that we have people who are going to hold their team accountable,” he said.

Sow housing uncertainly

The issue of sow housing has been around for a long time. About 20 years ago, the industry started seeing the first sow housing regulations at the state level, defining how farms must confine sows.

“Proposition 12 in California is really the first issue that drove us to have a state regulating how we as an industry across the whole country housed sows. I don't think we're done with animal rights groups pushing to have more control over our industry,” said Dr. Schneider. “The data out of California, so far, shows a 10% to 15% decline in demand for pork in the state. Given the size of California and the amount of pork for our market, we're going to see about a 1% to 2% drop in domestic demand.”

He said it's estimated that about 50% of pork is sold on promotion, for example you’ll see $1 off pork loins or shoulders at the grocery store, which is designed to drive sales.

“If we don't have the ability to offer promotions because we simply don't have supply, that's going to be a result of the drop in demand coming from California,” he said. “Packers don’t look like they're willing to take on any more demand on Proposition 12 pork either at this time. In fact, some that I know have been cutting kills on the Proposition 12 product that they have.”

Pork consumption expected to decline

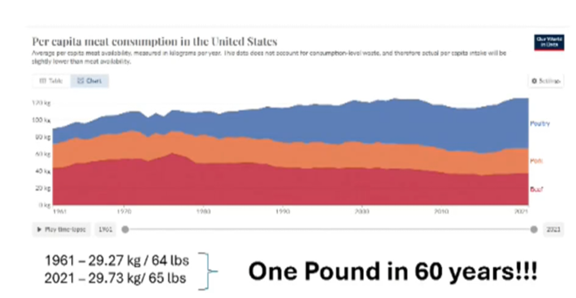

The graphic below shows US per capita meat consumption over the last 60 years.

The chart shows beef on the bottom which has gone down a little bit. Poultry consumption is the big winner, seeing growth. Pork has remained steady.

“I really wouldn't say that's a success story. I think there are underlying factors that we need to start considering – we need to figure out how to grow pork demand,” he said.

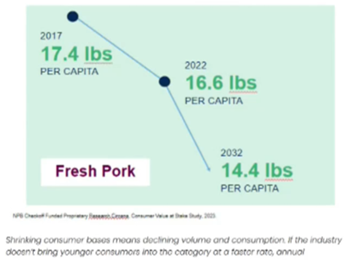

Last year, the National Pork Board commissioned research looking at the demand for pork among the next generations of consumers. The results show that per capita consumption of pork is expected to decline by about 3 lbs. 2017 to 2032.

Demand is driven by the fact that Millennials and Gen Zs aren’t as interested in eating meat as Gen Xs. So we're going to continue to see pork demand drop unless we take action as an industry.

Foreign animal disease

Even though producers may get tired of talking about foreign animal diseases like African swine fever (ASF), it still important to remain vigilant. The US has really upped their game plan since 2018 when the ASF outbreak started in China and the world saw first-hand the impact that it had on their country and global industry.

China’s outbreak shifted the risk level in the US and many other countries. Since then, the US has been working to prepare for an outbreak in North America.

“Over the last four years, I've been fortunate to be involved in the development of US Swine Health Improvement Plan (US SHIP),” he said. “Led by Dr. Roger Main, director of the Veterinary Diagnostic Laboratory at Iowa State University, the program is set up to create an opportunity for producers to continue to market their pork products in case we have a foreign animal disease entry into our country. This will ultimately be a producer-led organization that is geared towards creating that continuity of marketing pigs in the event of an outbreak on US soil.”.

The US currently exports about 30% of their pork and in the event of an outbreak, US export partners would no longer accept US pork.

“If we lose that 30% market share and we lose demand in our own country, we're going to have a ton of pork, and we're all going to have to sit here and eat it,” he said. “I've done this before. During 2009, pork was so cheap. I've eaten pork for 365 days, and a beef steak sounds good every now and then.”

US SHIP offers an opportunity for the US pork industry to create the continuity needed to continue to move pigs to market, by providing regionalization and departmentalization so exports can continue from unaffected regions of the country.

“Overall, this is good for the industry. If you aren't engaged yet, now is the time to reach out to your state pork or veterinary organizations. They can help get your farm enrolled or simply go online to US SHIP,” he said. “It takes a little bit of your time to enroll, but it’s a pretty straight forward process. Then, once you’ve enrolled, the maintenance is easy. So again, please take time to enroll and help protect our pig industry from foreign animal disease.”