Pork-price recovery stalls in May, but likely to resume in June

The pig traders’ perspective

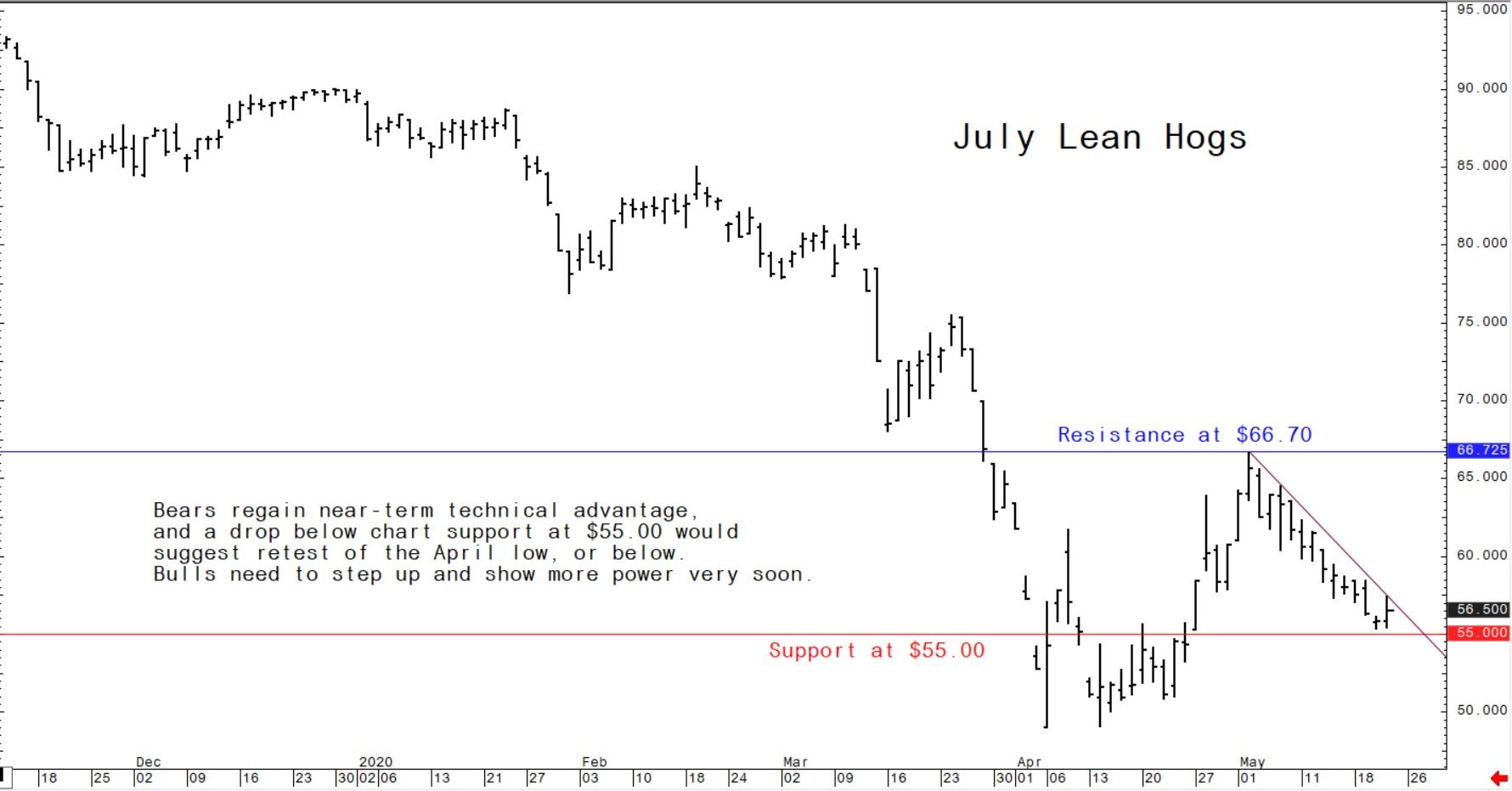

The US hog futures market has been struggling the past two weeks, after showing a strong rebound in late April into early May. Bearish elements still at work include reduced packing-plant slaughter capacity that has backed up animals, including putting extra weight on the animals. Still, pork processing continues to improve, with Wednesday’s US daily kill representing 85 percent of year-ago levels.

In Germany, rising cases of Covid-19 among workers prompted the government to tighten rules at slaughter facilities, including banning subcontracting of work through agencies. Under the new rules, meatpackers in in plants have to be employed by the company instead of using subcontracting agencies. Agriculture Minister Julia Kloeckner said companies must take responsibility for their workers. "There are conditions in the meat industry that are not acceptable," she said.

The other negative in the US pork industry is deteriorating US-China relations. China in recent years has been a major importer of US pork. US President Trump this week suggested Chinese leader, Xi Jinping, is behind a “disinformation and propaganda attack on the United States and Europe.” He said, “It all comes from the top.” Trump said China “could have easily stopped the plague, but they didn’t!” The White House also issued a broad critique of China’s economic and military policies. Meanwhile, the US Senate this week passed a bill that could bar some Chinese companies from listing on American exchanges.

Positives for the pork industry moving forward are that major global economies are reopening and consumer attitudes are improving. Global stock markets have been rallying and raw commodity sector leader crude oil has staged a strong and surprising rebound in prices—suggesting that many other raw commodity markets, including agricultural markets, have also seen their prices bottom out. Restaurants and bars are now reopening, or set to do so soon. There is now talk that schools and colleges could reopen in the fall, which would boost demand for pork used in school lunch programmes. Warmer summer weather and more sunshine in the coming weeks will see consumers attitudes continue to improve, including firing up their barbecues and grilling pork, which is much less expensive than beef.

The next week’s likely high-low price trading ranges

June lean hog futures--$55.75 to $62.00, and with an upside bias

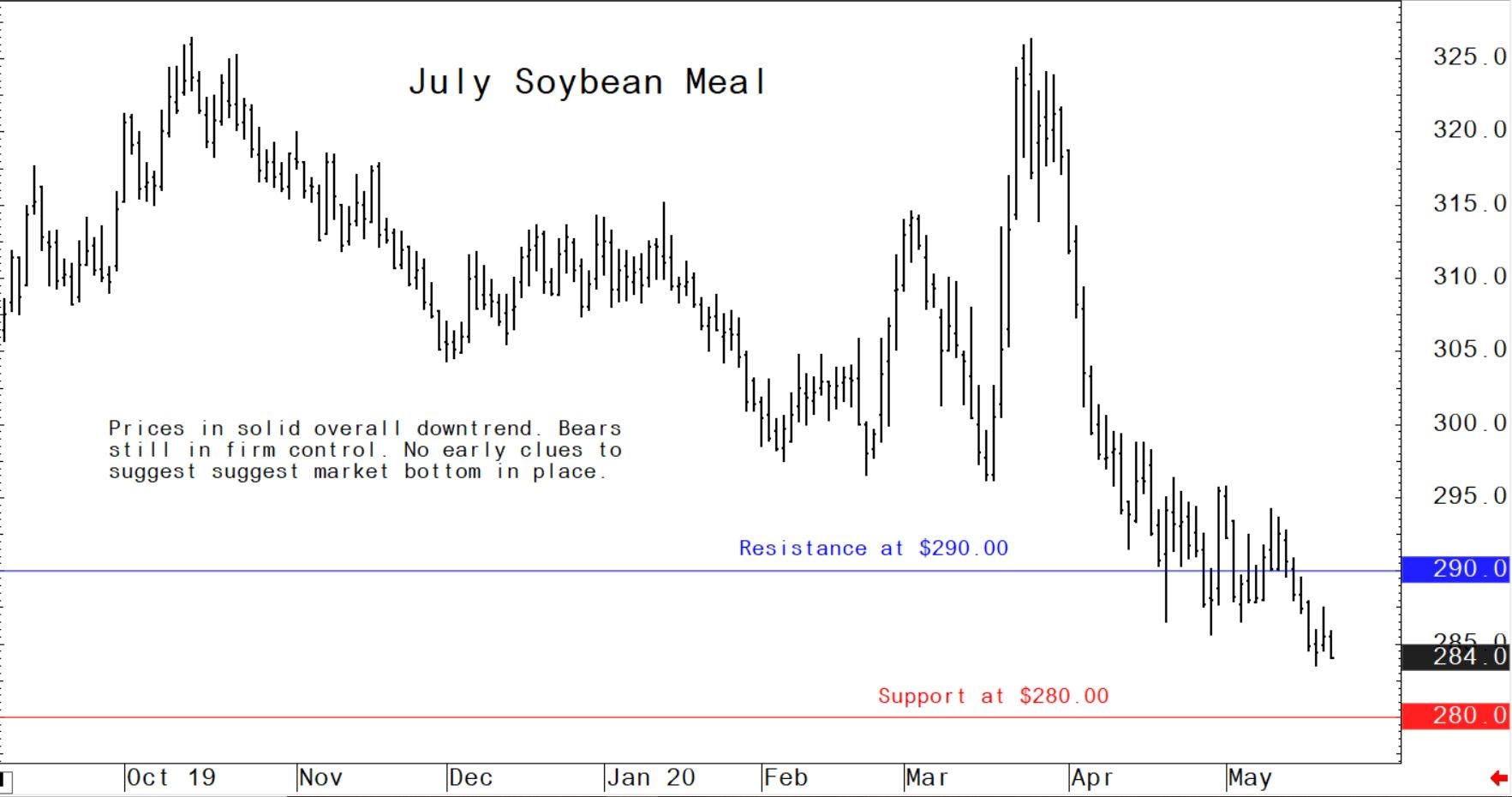

July soybean meal futures--$280.00 to $290.00, and with a sideways bias

July corn futures--$3.15 to $3.30, and a sideways-higher bias

Latest US Department of Agriculture (USDA) reports, and other news

USDA weekly export sales data a mixed bag for US pork

The latest USDA weekly export sales report on Thursday morning showed pork net sales reductions of 5,800 metric tonnes (MT) reported for 2020 resulting in increases for Japan (3,200 MT, including decreases of 600 MT), Canada (1,000 MT, including decreases of 500 MT), Nicaragua (800 MT), Mexico (700 MT, including decreases of 1,900 MT), and South Korea (400 MT, including decreases of 1,100 MT), were more than offset by reductions for China (12,600 MT) and Chile (700 MT). On a brighter not, US exports of 49,700 MT--a marketing-year high--were up noticeably from the previous week and up 36 percent from the prior 4-week average. The destinations were primarily to China (19,800 MT), Mexico (13,600 MT), Japan (6,100 MT), South Korea (4,100 MT), and Canada (2,000 MT).

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff