Pig outlook: Lean hog futures remain bullish

Livestock analyst Jim Wyckoff reports on the US futures market and global pig newsOctober lean hog futures Wednesday hit a three-month high and prices are trending up. Bulls have the firm near-term technical advantage, to suggest more price upside in the near term. The latest CME lean hog index is up 12 cents to $86.27 as of Sept. 3, halting an extended string of seasonal price pressure. October lean hog futures finished Wednesday $4.695 below the cash quote, suggesting traders are still leaning bearish this fall. Pork cutout has seen volatility following the end of purchases for Labor Day specials. If some strength returns to pork cutout value, which is possible given grocers are likely to begin purchases for features during US national pork month in October, it could support cash hog prices and help continue the price advance.

Latest USDA and other news regarding the global pork industry

Boar's Head plant in Virginia linked to deadly listeria outbreak amid serious sanitation violations

The Boar's Head deli meat plant in Jarratt, Virginia, is embroiled in a major food safety scandal following a deadly Listeria outbreak linked to repeated violations of federal regulations. USDA documented 69 noncompliance instances over the past year, including severe sanitation issues like mold, insects and meat residues on equipment. The outbreak, which has caused nine deaths and hospitalized 50 people across 18 states, has been traced back to Boar's Head liverwurst. Despite the plant's serious sanitation failures, no enforcement actions were taken by USDA. In response, Boar's Head has recalled over 7 million pounds of products and suspended operations at the plant while addressing the issues.

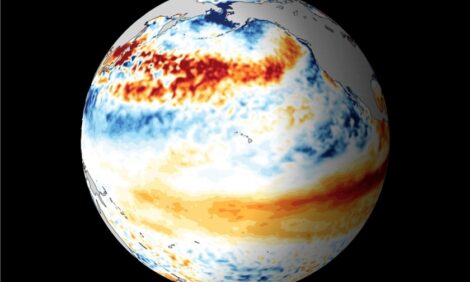

Pork and beef producers in developed markets face credit downgrade risks due to climate policies, Fitch warns

Fitch Ratings warns that pork and beef producers in developed markets are increasingly vulnerable to credit downgrades due to rising costs from stricter climate policies and the need for new technologies. Emerging markets, however, remain less affected due to stable demand and delayed climate policy implementation. The beef industry also faces challenges from shrinking demand driven by population decline, health concerns, and climate targets. Fitch estimates that one in five corporate issuers could be at risk of downgrades by 2035 due to climate-related vulnerabilities.

USDA seeks feedback on tech-enhanced inspections and meat plant categorization changes

USDA is convening a virtual meeting of the National Advisory Committee on Meat and Poultry Inspection (NACMPI) on Sept. 16-17 to gather input on leveraging technology for inspections and potential changes in categorizing meat and poultry plants. USDA aims to assess whether changes in plant categorization by size could improve the evaluation of business operations and the impact of regulations. The committee will also explore ways to enhance inspections using technology. Subcommittees will discuss these topics and provide recommendations to USDA during the meeting.

USDA tightens guidelines for animal-raising and environmental claims on meat labels

USDA's Food Safety and Inspection Service (FSIS) has issued stricter guidelines for substantiating animal-raising and environmental claims on meat and poultry labels, such as "raised without antibiotics," "grass-fed," and "climate-friendly." The new guidelines encourage meat and poultry establishments to provide more documentation, including third-party certification or USDA audit-based programs, to back up their claims. FSIS also highlighted the need for relevant environmental data and warned of enforcement action against false or misleading antibiotic claims, following a study that found 20% of cattle labeled "raised without antibiotics" had detectable antibiotic residues. Further testing and potential rulemaking may follow.

The next week’s likely high-low price trading ranges:

October lean hog futures--$78.70 to 85.00 and with a sideways-higher bias

December soybean meal futures--$308.00 to $335.00, and with a sideways-higher bias

December corn futures--$4.00 to $4.25 and a sideways-higher bias

Latest analytical daily charts lean hog, soybean meal and corn futures