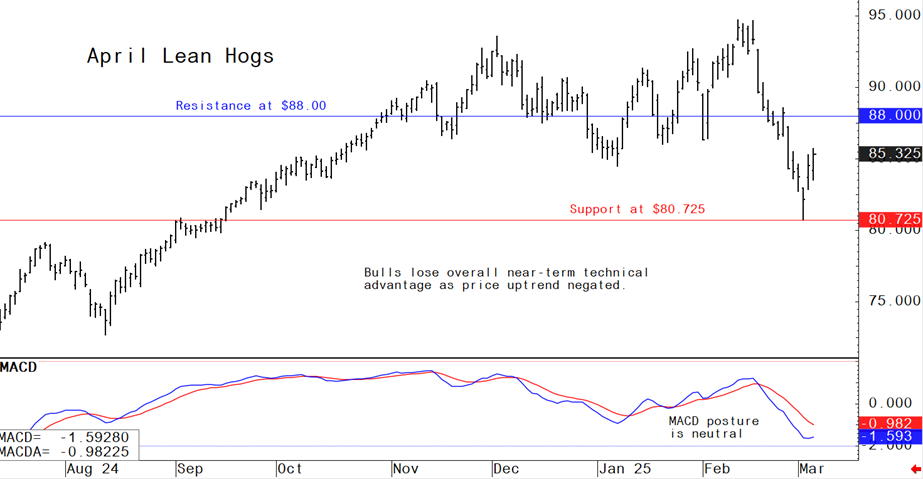

Pig outlook: Lean hog futures bulls work to stop the bleeding

Livestock analyst Jim Wyckoff reports on global pig newsApril lean hog futures this week hit a 5.5-month low amid a steep price downdraft that has knocked $10 off prices. Cash market fundamentals have eroded. The market will remain focused on the US tariff situation that remains fluid. If current plans hold in place, it could mean a significant reduction in US export demand, given three of the top five importers of U.S. pork are involved with recent trade tariffs. However, late-week reports the U.S. is dropping tariffs on autos from Mexico has traders thinking a broader deal could be close at hand. The latest CME lean hog index is down 2 cents to $90.20 as of March 4 after rising the previous three days.

Latest USDA and other news regarding the global pork industry

Weekly USDA export sales for US pork

Pork: Net US export sales of 42,400 MT for 2025 were up 32 percent from the previous week and 27 percent from the prior 4-week average. Increases primarily for Mexico (21,800 MT, including decreases of 400 MT), China (11,300 MT, including decreases of 100 MT), Japan (3,200 MT, including decreases of 300 MT), Colombia (1,900 MT, including decreases of 100 MT), and South Korea (1,300 MT, including decreases of 700 MT), were offset by reductions for Canada (100 MT). Exports of 32,200 MT were down 6 percent from the previous week and 3 percent from the prior 4-week average. The destinations were primarily to Mexico (13,500 MT), Japan (4,200 MT), South Korea (4,200 MT), China (3,000 MT), and Colombia (2,000 MT).

US beef and pork exports bolster corn, soybean markets

In 2024, U.S. pork and beef exports reached $19.1 billion, bolstering the corn and soybean industries despite a challenging year for producers. An independent study by the Juday Group, released by the U.S. Meat Export Federation (USMEF), highlighted that beef and pork exports contributed $2.24 billion to corn, $525 million to distiller’s dried grains with solubles (DDGS) and $1.12 billion to soybeans. The study emphasizes how red meat exports drive value back to producers, with beef and pork exports accounting for 525.1 million bu. of corn and 100.7 million bu. of soybeans used in 2024.

USDA reports on Mexico livestock industry

The pig crop is forecast to rise one percent in 2025 to 22.4 million head, driven by reduced production costs, improved hog prices, and favorable pork prices. Pork production is forecast to rise two percent in 2025 to 1.6 million metric tons MMT CWE. Population growth and increased disposable incomes are expected to drive moderate consumption growth and increased slaughter. Imports are forecast to remain stable in 2025 at 1.5 MMT CWE. Imports are expected to continue at current high volumes driven by demand from the Hotel, Restaurant, and Institution (HRI) sector.

USDA reports on Brazil livestock industry

Swine

- Pig Crop: Post forecasts a one percent increase in 2025, due to lower production costs, strong domestic demand, and strong foreign demand.

- Slaughter: Post forecasts a 1.4 percent increase in 2025, reaching 46.67 million head.

- Pork Production: Post forecasts a two percent increase in 2025, reaching 4.7 million metric tons, as a result of increased slaughter, reduced feed costs, and investments made to increase production.

- Consumption: Post forecasts stable consumption in 2025 at 3.1 MMT CWE. Inflation on pork and pork products will likely impact consumption.

- Exports: Post forecasts a six percent increase in 2025, based on increased slaughter, firm external demand, increased purchases from new markets, export growth to existing consumers, and Brazil’s sanitary status versus its competitors who are facing challenges with animal disease, particularly Europe.

USDA Ag Outlook Forum assumptions for US protein

Hogs/Pork: Commercial production is forecast at 28.5 billion pounds, up 3% from 2024, with pork exports seen at 7.30 billion pounds, up 3% as “increased domestic production and continued strong international demand for pork is expected to support US exports.” Pork imports are seen at 1.17 billion pounds, up 2%. National base 51%-52% lean hog prices, live equivalent, are seen at $65 per cwt., a 3% rise from 2024. “Despite increased availability of hogs, prices will be supported by strong demand, both domestically and internationally, and higher beef prices.”

USDA’s Rollins also urged the rollback of California’s “overly restrictive” Prevention of Cruelty to Farm Animals Act

The 2018 ballot measure (Proposition 12) that established minimum space requirements for egg-laying hens, breeding pigs and calves. The law bans California businesses from selling eggs from chickens that don’t meet the requirements — thus forcing both California farmers and out-of-state suppliers to conform to the law. Although in 2021 the law was challenged by the North American Meat Institute — which argued that it violated the Commerce Clause of the U.S. Constitution — the lawsuit was rejected by U.S. Supreme Court.

The next week’s likely high-low price trading ranges:

April lean hog futures--$80.725 to $87.50 and with a sideways bias

May soybean meal futures--$291.00 to $310.00, and with a sideways-higher bias

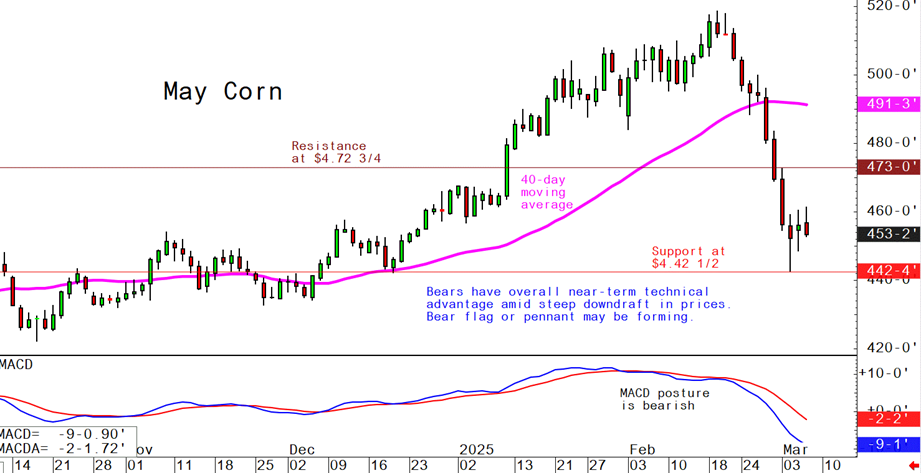

May corn futures--$4.42 1/2 to $4.75 and a sideways bias

Latest analytical daily charts lean hog, soybean meal and corn futures: