Pig outlook: Lean hog futures remain in strong price uptrend

US cold snap roils the agriculture sector but potential consumer spending signals a rebound.The pig traders’ perspective

April lean hog futures this week hit a new contract high amid a strong price uptrend still in place on the daily bar chart—suggesting the path of least resistance for futures prices will remain sideways to higher in the near term. However, some analysts think the $8-plus premium the lead futures contract holds to the cash index mean futures are too far out in front.

While the CME Lean Hog Index is trending higher, the national direct cash hog bids dropped this week and the five-year average is $3.30 down in the cash index. If the cash hog market shows signs of softening, April hog futures would be a risk of greater losses. Seasonally, the cash index firms around $10 into mid-summer.

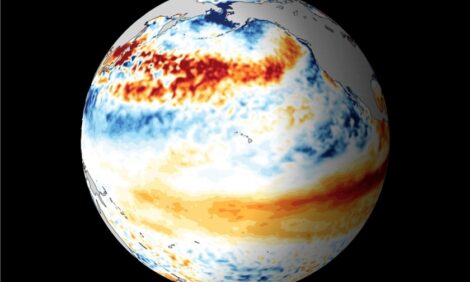

June and July hogs currently hold around $16 premiums to the cash index, while August hogs have more than a $14.50 premium. Part of that stronger-than-normal cash optimism is tied to expectations Chinese demand could be stronger than previously thought amid an uptick in African swine fever and other hog diseases during winter. Average hog weights in the Iowa/southern Minnesota market fell another 1.1 lbs to 287.2 lbs the week ending 13 February, which is 1.9 lbs above year-ago levels. Cold temperatures have limited animal weight gains and processing.

The next week’s likely high-low price trading ranges

April lean hog futures--$82.50 to $87.50, and with a higher bias

March soybean meal futures--$418.30 to $443.70, and with a sideways bias

March corn futures--$5.23 1/4 to $5.60, and a sideways bias

Latest US Department of Agriculture (USDA) reports, and other US news

US economic recovery is broadening, suggesting better pork demand

US consumers used stimulus checks to boost retail spending in January to its largest increase in seven months, a significant jump that comes as manufacturers continued to increase output and employers resumed hiring. Retail sales jumped a seasonally adjusted 5.3% in January from a month earlier, and manufacturing output neared pre-pandemic levels.

Consumer spending is the main driver of the US economy, accounting for more than two-thirds of economic output. Improvements continued to be seen compared with year-ago marks for building materials and garden equipment stores and food and beverage stores versus year-ago levels, while clothing retailers saw improved activity compared with December. Consumer demand for meat should continue to improve in the coming months, but food service and drinking places, while up from December, continue to struggle with COVID-19 impacts.

Meantime, the Federal Reserve Bank of Atlanta’s GDPNow model on Wednesday 17 February predicted the US economy will grow at a 9.5% seasonally adjusted annual rate in the first quarter, up sharply from a 4.5% estimate a week ago. Minutes from the Fed’s January policy meeting separately showed that policy makers expected the end-of-year federal stimulus package and progress toward widespread vaccinations to improve the outlook for the economy.

Brutal cold in central US impacting livestock marketing, health

US livestock processing demand will be reduced this week and possibly next week due to a number of meat plants in the central US having to reduce processing or close altogether due to the Arctic blast and related natural gas shortages. Also, livestock producers are seeing their animals stressed, including reduced weight gains, as well as having more difficulty transporting animals to market.

US food companies warn they may pass rising commodity prices on to consumers

Food companies Kraft Heinz Co and Conagro Brands warned they may need to raise food prices this year to account for commodity price inflation. “Where we are seeing [inflation] is in grains and everything related to grains ... It's across the board. Sugar has big inflation; mac & cheese because it has wheat; mayo because it has oil; salad dressing because it has oil; all sweet products like desserts,” Kraft Heinz Chief Executive Miguel Patricio told Reuters in an interview. Conagra CEO Sean Connoly commented that ingredient and packaging costs account for between 60% and 65% of the company’s total cost basket and so far, food companies have been forced to absorb higher costs.

On average, US consumers paid 3.7% more for food consumed at home in January than they did the year prior, according to the Bureau of Labour Statistics. Other major food companies like Lipton tea and Unilever (the maker of Hellman’s mayonnaise) also signalled higher prices are likely ahead.

Global pork industry news

German pork prices rising

German pig prices climbed this week, marking the first increase since November, according VEZG, an association of German animal farmers. Prices have been under pressure since November when African swine fever (ASF) was detected in the country, prompting widespread bans on German pork.

So far, Germany has kept the disease out of its domestic herd. Reduced processing due to COVID-19 has also kept a damper on prices, as it backed up marketings. “In the German slaughterhouse pig market the surplus and [animal] overweight continues to melt away,” the VEZG saod. “In some regions, marketing is again normal without problems.”

COVID-19 outbreak forces Alberta pork processing plant to close

A COVID-19 outbreak at an Olymel pork processing plant in the Alberta, Canada town of Red Deer forced the facility to close. The plant been dealing with cases of the virus since November, but cases began to spike on 20 January. Roughly two-thirds of those employed at the plant work a second job outside of the plant.

Chief Medical Officer Deena Hinshaw indicated the recent spike seems to be driven by a “confluence of events” outside the plant. Alberta Health reports 343 cases linked to the outbreak, with 200 of those cases being active and one worker death.

It’s unclear whether the facility’s 1,850 workers will be paid while the plant is closed.

Read Jim Wyckoff's latest updates on the poultry industry on The Poultry Site and see his analysis of the beef and dairy market on The Cattle Site.