Pig outlook: Lean hog futures bulls keeping price uptrend alive

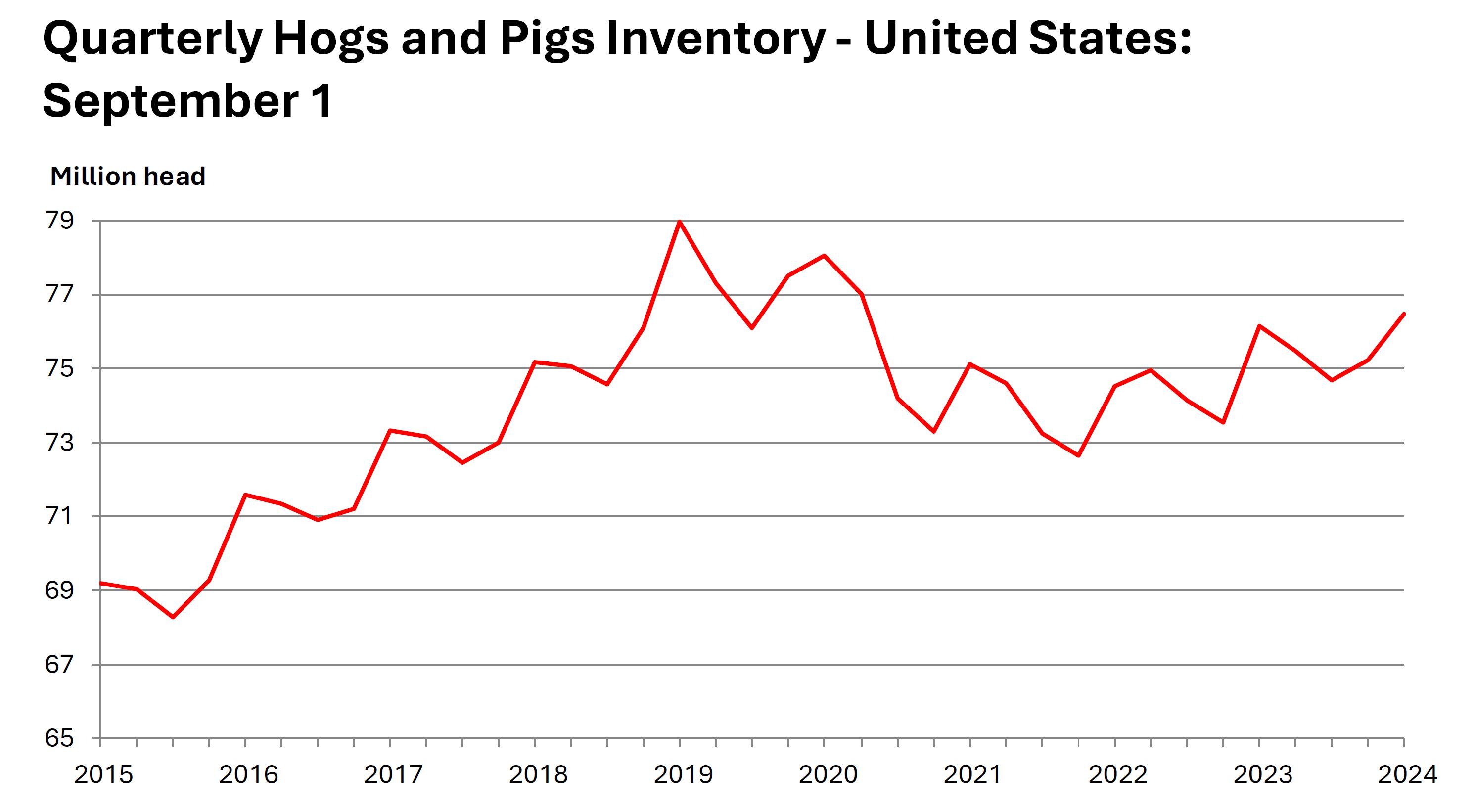

Livestock analyst Jim Wyckoff reports on pig news from around the globeDecember lean hog futures this week hit a nearly three-month high. Bulls have the firm near-term technical advantage as the price trend is their friend. However, cash hog market fundamentals have weakened a bit. The latest CME lean hog index is down another 16 cents to $84.05 as of Sept. 24. While pressure on the cash index hasn’t been strong, the slide in the index is likely to limit buying in futures. Seasonal weakness has stalled in pork cutout over the past week. Grocers have been slow to increase pork prices, which has been beneficial for demand. Some specials for National Pork Month in October are likely to further increase pork consumption. Traders are awaiting Thursday afternoon’s USDA’ Hogs & Pigs Report. Analysts expect the report to show the US hog herd grew 0.2% from year-ago to 76.285 million head as of Sept. 1. Market hog inventories are expected to be up 0.4%, while the breeding herd is anticipated to be down 2.1%.

Latest USDA and other news regarding the global pork industry

Weekly USDA US pork export sales

Pork: Net sales of 28,000 MT for 2024 were down 3 percent from the previous week and 8 percent from the prior 4-week average. Increases were primarily for Mexico (13,000 MT, including decreases of 300 MT), Canada (3,300 MT, including decreases of 700 MT), China (2,700 MT), South Korea (2,500 MT, including decreases of 500 MT), and Colombia (1,900 MT, including decreases of 100 MT). Exports of 27,900 MT were down 11 percent from the previous week and 3 percent from the prior 4-week average. The destinations were primarily to Mexico (11,800 MT), Japan (3,600 MT), China (3,000 MT), South Korea (2,000 MT), and Colombia (1,900 MT).

US Hogs & Pigs Report: Hog Inventory Up Slightly

- United States inventory of all hogs and pigs on September 1, 2024 was 76.5 million head. This was up slightly from September 1, 2023, and up 2 percent from June 1, 2024.

- Breeding inventory, at 6.04 million head, was down 2 percent from last year, but up 1 percent from the previous quarter.

- Market hog inventory, at 70.4 million head, was up 1 percent from last year, and up 2 percent from last quarter.

- The June-August 2024 pig crop, at 35.0 million head, was down 1 percent from 2023. Sows farrowing during this period totaled 2.99 million head, down 2 percent from 2023. The sows farrowed during this quarter represented 50 percent of the breeding herd. The average pigs saved per litter was 11.72 for the June-August period, compared to 11.61 last year.

United States hog producers intend to have 2.96 million sows farrow during the September-November 2024 quarter, down slightly from the actual farrowings during the same period one year earlier, and down 4 percent from the same period two years earlier. Intended farrowings for December 2024-February 2025, at 2.93 million sows, are up slightly from the same period one year earlier, but down 1 percent from the same period two years earlier.

The total number of hogs under contract owned by operations with over 5,000 head, but raised by contractees, accounted for 53 percent of the total United States hog inventory, up 1 percent from the previous year.

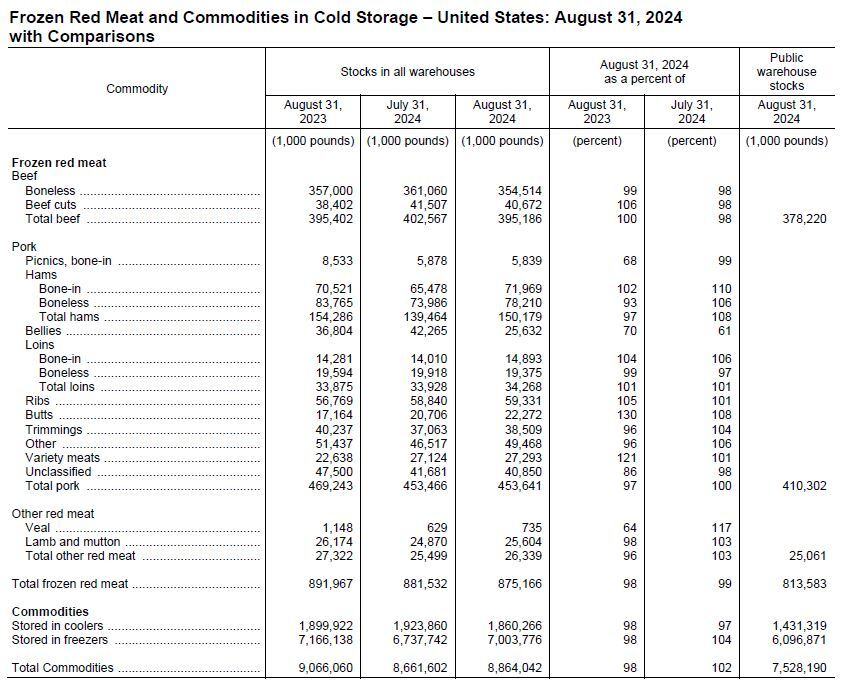

USDA Cold Storage Report shows pork and beef down from year-ago

Total red meat supplies in freezers were down 1 percent from the previous month and down 2 percent from last year.

Total pounds of beef in freezers were down 2 percent from the previous month and down slightly from last year.

Frozen pork supplies were up slightly from the previous month but down 3 percent from last year. Stocks of pork bellies were down 39 percent from last month and down 30 percent from last year.

The five-year average is a 5.1-million-lb. increase in beef stocks and a 5.3-million-lb. rise in pork stocks during the month.

Panel recommends USDA streamline meat plant inspections with new technology

The National Advisory Committee on Meat and Poultry Inspections (NACMPI) urged USDA to adopt new technologies to streamline inspections in meat and poultry plants. Recommendations include providing inspectors with government-issued phones and tablets to document findings, allowing video chat for communication, and using technology that converts voice or handwriting into digital text. These measures aim to reduce inspectors' workloads and speed up inspections. While some changes, such as remote inspections, may reduce delays and costs for companies, others, like video recording inside plants, could raise competitive concerns.

The next week’s likely high-low price trading ranges:

December lean hog futures--$72.50 to 77.00 and with a sideways-higher bias

December soybean meal futures--$315.70 to $335.00, and with a sideways bias

December corn futures--$4.00 to $4.23 3/4 and a sideways bias

Latest analytical daily charts lean hog, soybean meal and corn futures