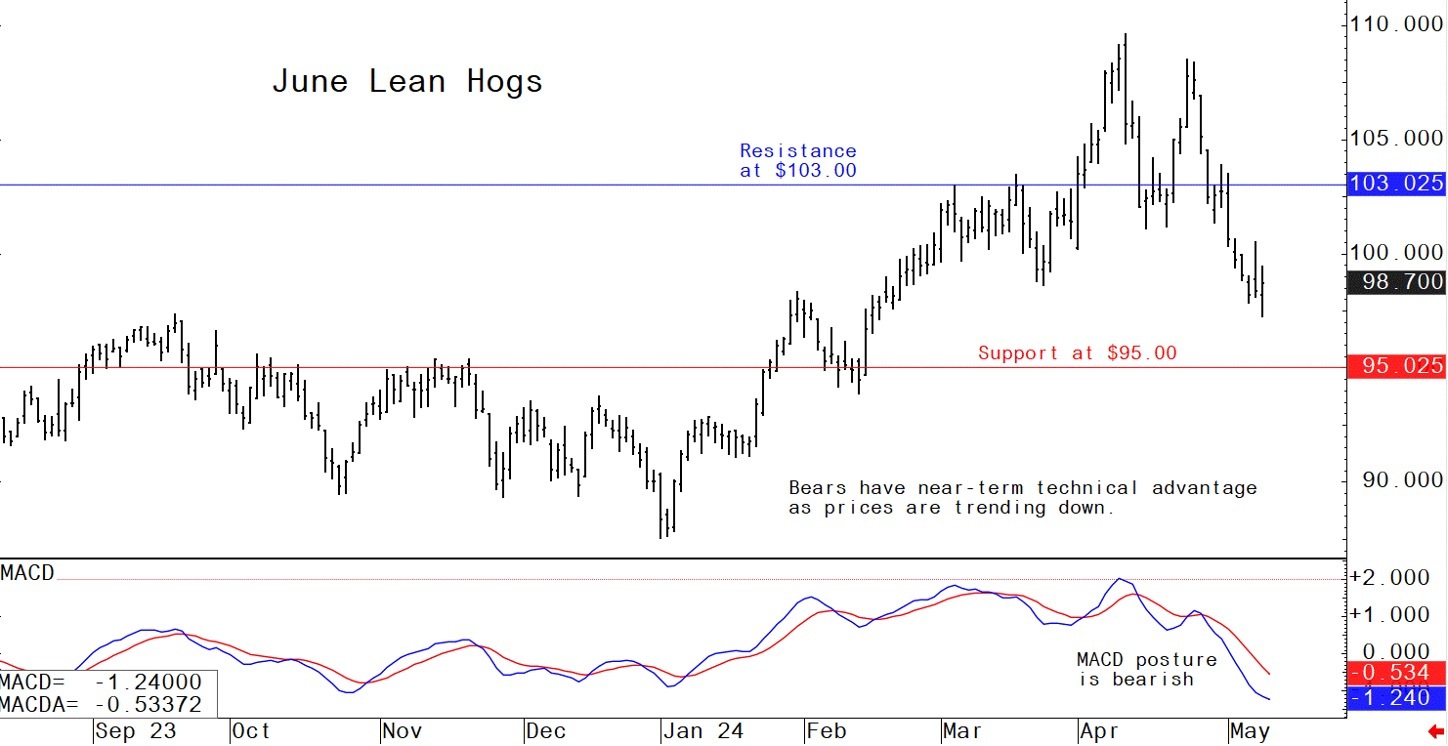

Pig outlook: Lean hog futures bears in firm control

Livestock analyst Jim Wyckoff reports on global pig newsJune lean hog futures prices are trending lower and this week hit a nearly three-month low. Bears have the firm near-term technical advantage to suggest more downside price pressure in the near term. The latest CME lean hog index was up 25 cents to $91.28 as of May 7. Although the summer lean hog futures contracts are trading at premiums to cash index, traders are pessimistic for the spring and early summer. They are actively removing futures premiums above the lean hog index. Lean hog futures bulls are hoping the Memorial Day weekend, when outdoor grilling demand is at its highest, will provide the lift in cash hog and futures prices that will at least stabilize the markets.

Latest USDA and other news regarding the global pork industry

Weekly USDA export sales of US pork

Net US pork sales of 24,400 MT for 2024 were down 27 percent from the previous week and 26 percent from the prior 4-week average. Increases were primarily for China (6,900 MT), Japan (3,900 MT, including decreases of 300 MT), Canada (3,700 MT, including decreases of 600 MT), Mexico (2,600 MT, including decreases of 200 MT), and Colombia (2,100 MT, including decreases of 100 MT). Exports of 35,000 MT were down 3 percent from the previous week and 9 percent from the prior 4-week average. The destinations were primarily to Mexico (12,900 MT), South Korea (5,400 MT), Japan (5,000 MT), China (3,300 MT), and Canada (1,800 MT).

China’s meat imports drop in April

China imported 544,000 MT of meat in April, down 5.9% from the previous month and 8.5% less than last year. Through the first four months of this year, China imported 2.22 MMT of meat, down 12.6% from the same period last year.

Tyson Foods exceeded Wall Street's expectations for second-quarter profit

Tyson benefited from the closure of some chicken processing plants to cut costs. The company's shares rose by 3.5% in premarket trading, continuing a year-to-date increase of over 15%. Tyson has shut down six U.S. chicken plants since last year, alongside layoffs and plans to close a pork plant, aimed at cost reduction. This strategy led to adjusted earnings of 62 cents per share, surpassing analysts' average estimate of 39 cents. However, Tyson faces challenges such as slowing demand due to price-conscious consumers seeking more affordable options amidst high food prices and borrowing costs. Second-quarter net sales dipped by 0.5% to $13.07 billion, slightly below estimates. Chicken segment sales declined by 8.3% despite a 2.1% price drop, with volumes falling by 6.1%. Conversely, beef segment volumes rose by 2.8%, marking the first increase in five quarters, while the pork segment also saw a volume increase of 2.9%. Tyson anticipates flat total sales for fiscal 2024 compared to the previous year's $52.88 billion.

The next week’s likely high-low price trading ranges:

June lean hog futures--$95.00 to 103.00 and with a sideways-lower bias

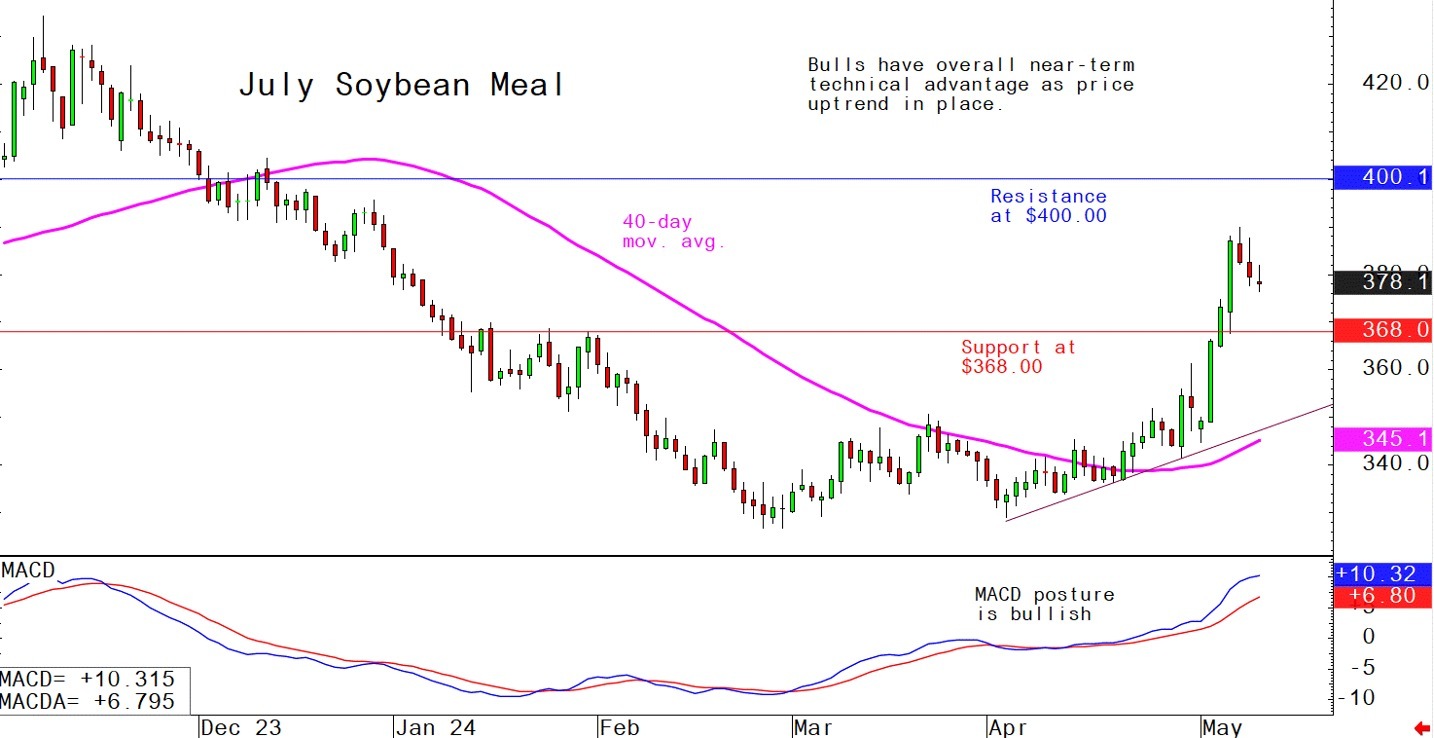

July soybean meal futures--$365.00 to $395.00, and with a sideways-higher bias

July corn futures--$4.50 to $4.72 and a sideways-higher bias

Latest analytical daily charts lean hog, soybean meal and corn futures