Hog market languishes amid coronavirus outbreak worries

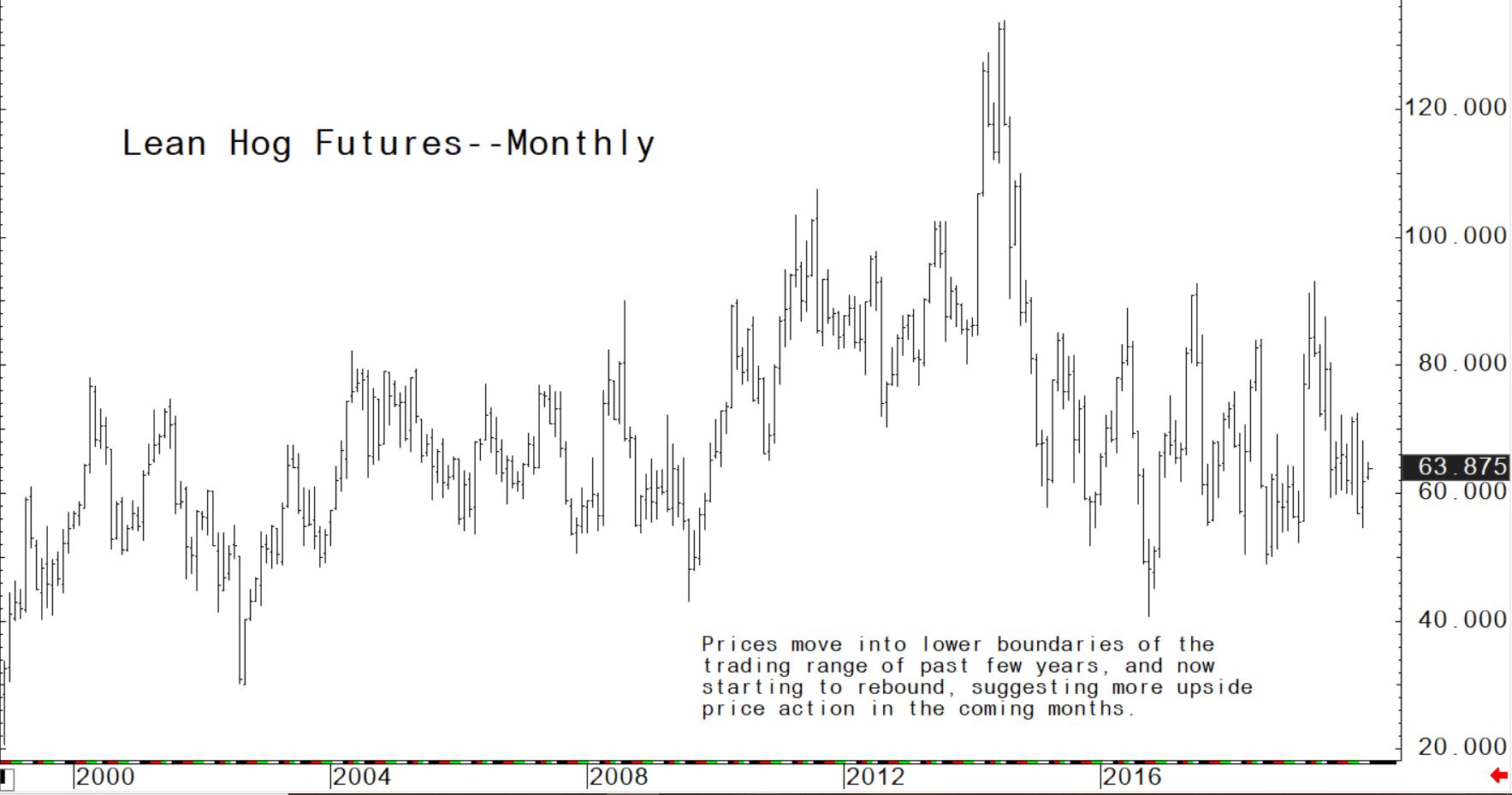

The pig traders’ perspective: The US hog futures market continues to trade choppy and sideways at lower levels, as the pork market bulls remain very timid amid the ongoing coronavirus scare that continues to upset the global marketplace.Do not look for this situation to stabilise anytime soon. Importantly, the benchmark US 10-year Treasury note yield earlier this week fell below 1.0 percent to a record low, and remains below that level. This has prompted keen concern among long-term market watchers that a US and /or global economic recession looms, including the prospect of debilitating consumer and commercial price deflation. This is bearish for stocks and most commodities, including cattle and pigs. An examination of a chart of the Goldman Sachs Commodity index paints a dour picture for the prospects for the raw commodity sector, including the agriculture markets.

The next week’s likely high-low price trading ranges:

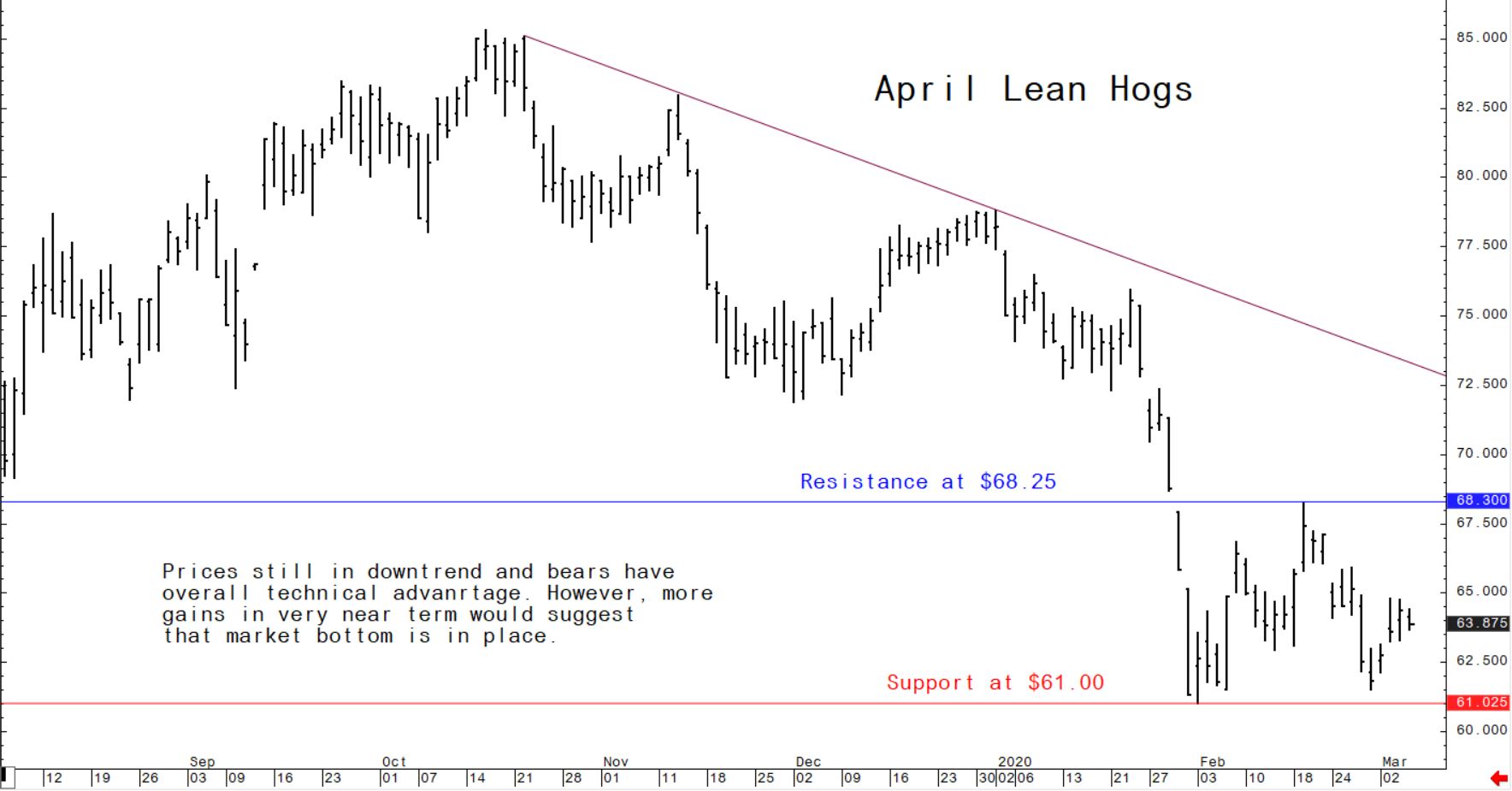

April lean hog futures: $61.00 to $68.25, and with a sideways, choppy bias

May soybean meal futures: $300.00 to $315.00, and with an upside bias

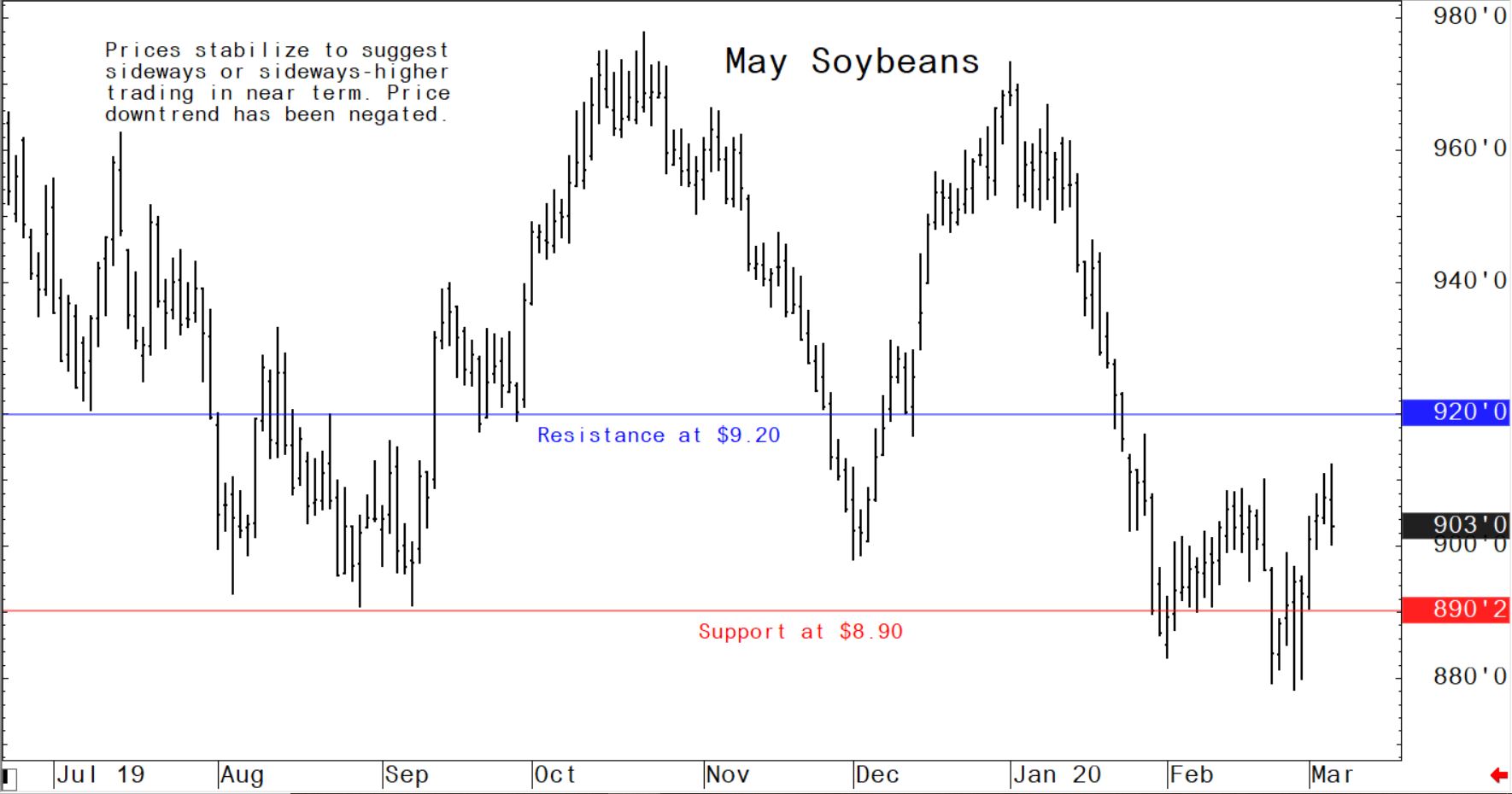

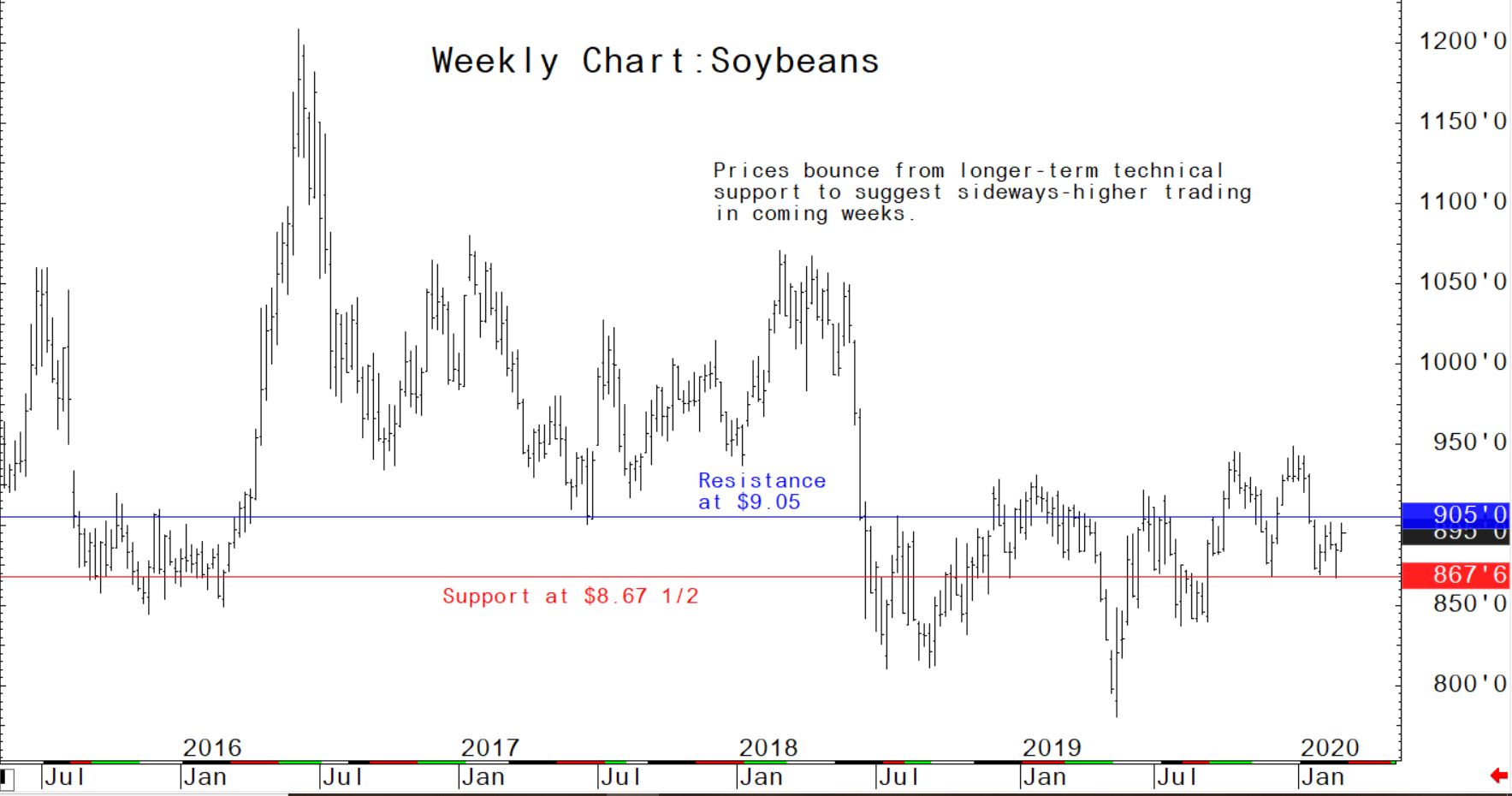

May soybean futures: $8.80 to $9.15 and with a slight upside bias

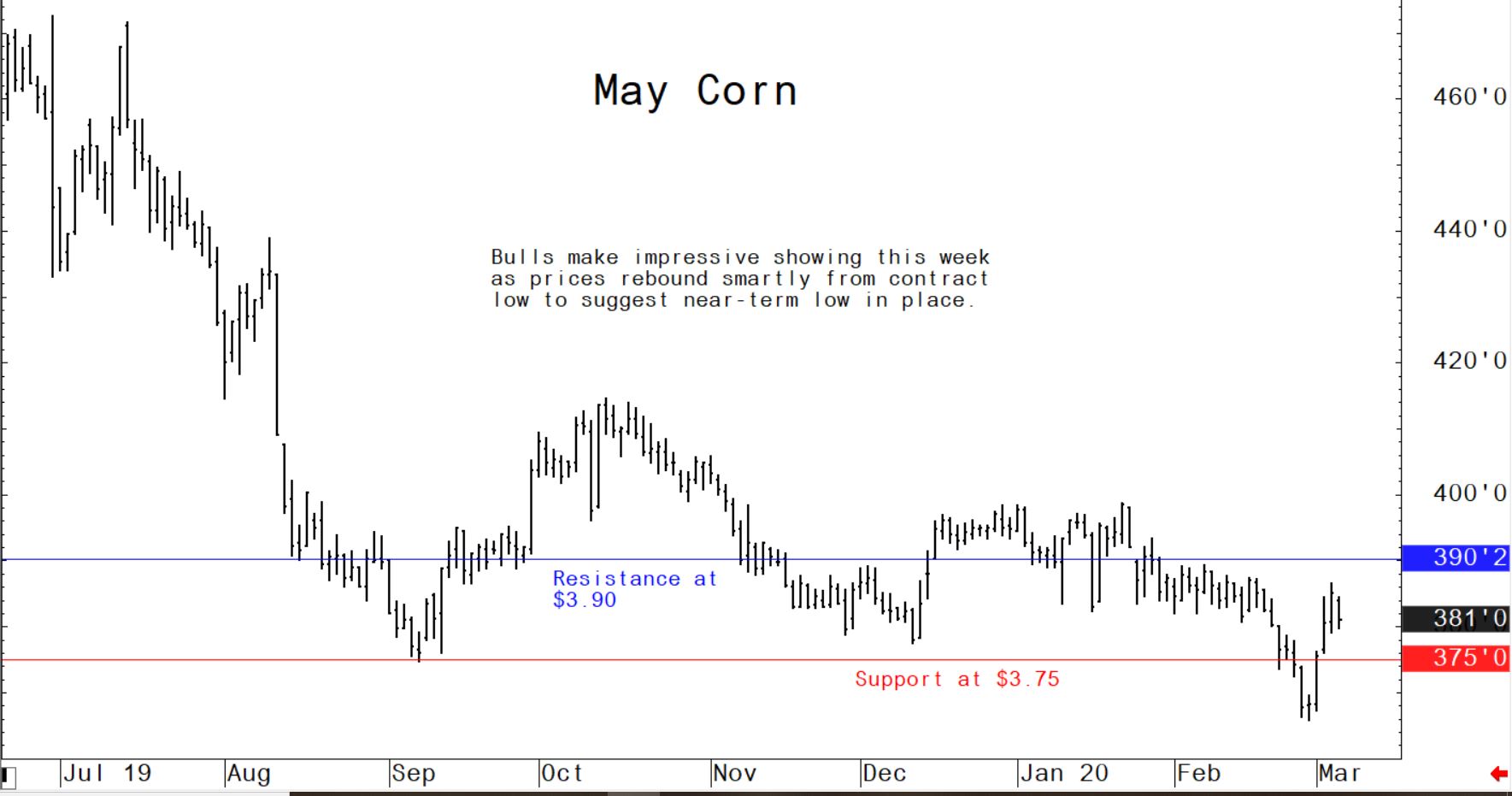

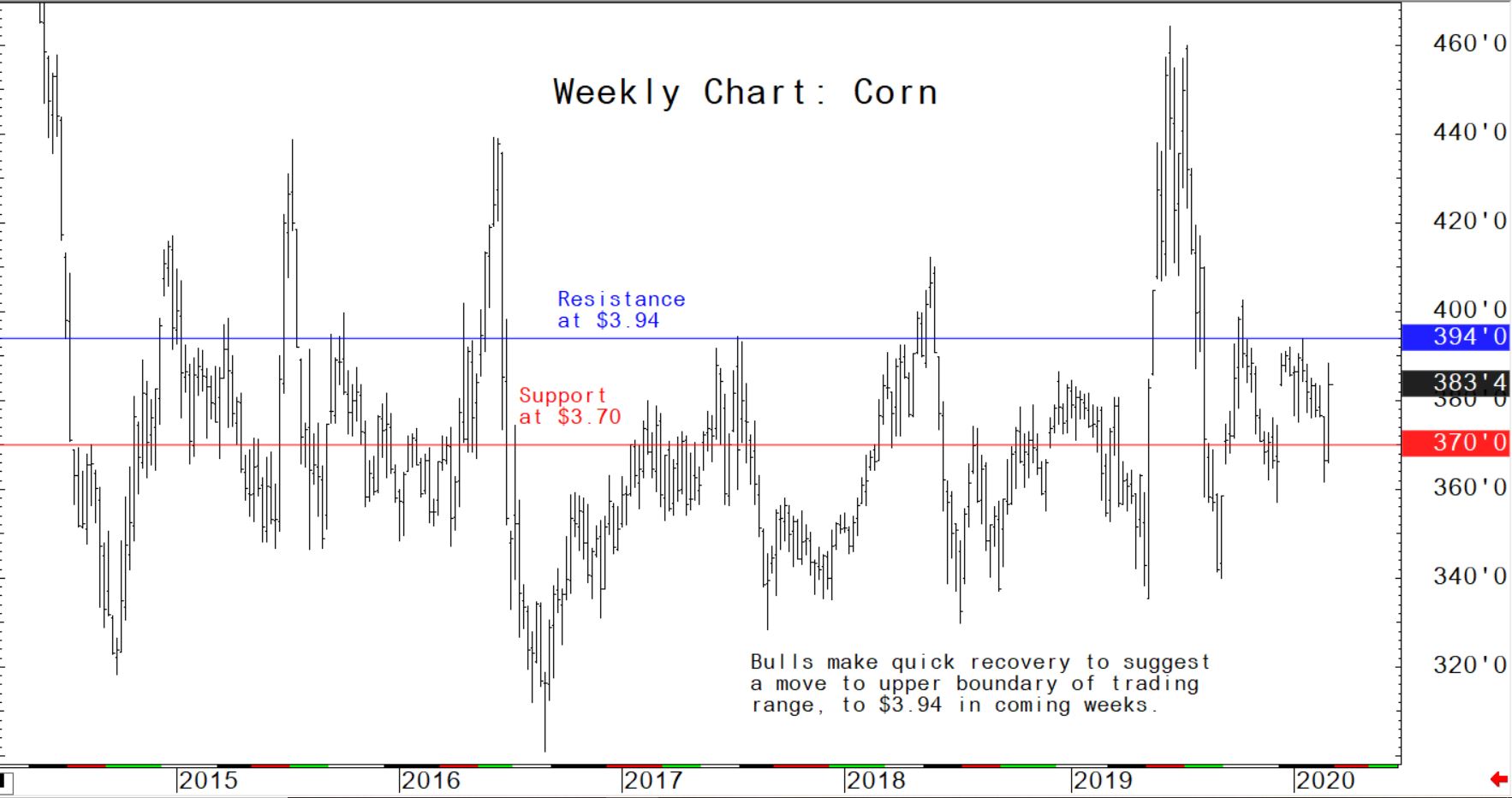

May corn futures: $3.75 to $3.88, and an upside bias

Pig traders see stepped-up China purchases of US pork

The weekly USDA export sales report issued Thursday morning showed the following, based on reports from exporters for the period February 21-27, 2020.

Pork: Net US sales of 33,700 MT reported for 2020 were down 13 percent from the previous week, but up 12 percent from the prior 4-week average. Increases were primarily for Mexico (17,500 MT), China (4,500 MT), Japan (3,800 MT), South Korea (3,300 MT), and Canada (1,400 MT). Exports of 43,500MT were up 2 percent from the previous week and from the prior 4-week average. The destinations were primarily to China (17,500 MT), Mexico (10,800 MT), Japan (4,700 MT), South Korea (3,300 MT), and Canada (2,600 MT).

March 5, 2020.

Beef: Net sales of 12,900 MT reported for 2020 were down 8 percent from the previous week and 26 percent from the prior 4-week average. Increases were primarily for Japan (5,100 MT, including decreases of 600 MT), South Korea (2,000 MT, including decreases of 500 MT), Taiwan (1,900 MT, including decreases of 100 MT), Mexico (1,200 MT), and Canada (900 MT, including decreases of 100 MT). Exports of 16,600 MT were down 6 percent from the previous week and 7 from the prior 4-week average. The destinations were primarily to Japan (6,100 MT), South Korea (4,300 MT), Mexico (1,900 MT), Canada (1,100 MT), and Taiwan (1,000 MT).

Corn: Net sales of 769,200 MT for 2019/2020 were down 11 percent from the previous week and 29 percent from the prior 4-week average. Increases primarily for Mexico (248,100 MT, including decreases of 24,600 MT), South Korea (136,000 MT), Colombia (88,000 MT, including 17,000 MT switched from unknown destinations and decreases of 33,000 MT), Vietnam (66,000 MT, including 65,000 MT switched from unknown destinations), and Saudi Arabia (65,700 MT, including 65,000 MT switched from unknown destinations), were offset by reductions for Haiti (800 MT). For 2020/2021, net sales of 100,000 MT were for Mexico (98,000 MT) and Guatemala (2,000 MT). Exports of 884,600 MT--a marketing-year high--were up 5 percent from the previous week and 18 percent from the prior 4-week average. The destinations were primarily to Japan (335,600 MT), Mexico (277,600 MT), Vietnam (66,000 MT), Saudi Arabia (65,700 MT), and Guatemala (31,900 MT). Optional Origin Sales: For 2019/2020, new optional origin sales of 188,000 MT were reported for South Korea. Options were exercised to export 58,900 MT to Egypt from other than the United States. The current outstanding balance of 779,000 MT is for South Korea (719,000 MT) and Israel (60,000 MT). Export Adjustments: Accumulated exports of corn to Mexico were adjusted down 331 MT for week ending February 13th. The exports were reported in error and included in this week’s report.

Sorghum: Net sales of 71,600 MT for 2019/2020 were down 84 percent from the previous week and 46 percent from the prior 4-week average. Increases were for China (69,300 MT, including 66,000 MT switched from unknown destinations), Mexico (1,300 MT), and Japan (1,000 MT). Exports of 93,200 MT were up noticeably from the previous week and up 89 percent from the prior 4-week average. The destinations were primarily to China (69,300 MT), Mexico (12,700 MT), and Japan (11,000 MT).

Soybeans: Net sales of 345,000 MT for 2019/2020 were up 2 percent from the previous week, but down 35 percent from the prior 4-week average. Increases primarily for Mexico (164,000 MT, including decreases of 800 MT), Egypt (91,500 MT, including 90,000 MT switched from unknown destinations and decreases of 600 MT), the Netherlands (56,200 MT, including 60,000 MT switched from unknown destinations and decreases of 3,800 MT), Malaysia (50,300 MT, including 34,000 MT switched from unknown destinations), and Japan (42,300 MT, including decreases of 1,000 MT), were offset by reductions primarily for unknown destinations (135,200 MT). For 2020/2021, total net sales of 1,400 MT were for Japan. Exports of 695,600 MT were up 16 percent from the previous week, but down 22 percent from the prior 4-week average. The destinations were primarily to Egypt (171,500 MT), China (132,000 MT), Mexico (88,200 MT), the Netherlands (56,200 MT), and Bangladesh (52,800 MT). Exports for Own Account: For 2019/2020, the current exports for own account outstanding balance is 2,100 MT, all Canada.

Soybean Cake and Meal: Net sales of 316,700 MT for 2019/2020 were up noticeably from the previous week and up 64 percent from the prior 4-week average. Increases primarily for the Philippines (138,500 MT), unknown destinations (90,000 MT), Canada (54,100 MT, including decreases of 500 MT), Denmark (35,000 MT, including 30,900 MT switched from Germany), and the United Kingdom(24,100 MT, switched from Germany), were offset by reductions primarily for Germany (55,000 MT). For 2020/2021, total net sales of 4,900 MT were for Canada. Exports of 338,300MT--a marketing-year high--were up 22 percent from the previous week and 42 percent from the prior 4-week average. The destinations were primarily to the Philippines (66,200 MT), Bangladesh (51,000 MT), Denmark (35,000 MT), the United Kingdom (24,100 MT), and Canada (23,200 MT).

Highlights of US Agriculture Secretary Sonny Perdue’s testimony to the US Congress Wednesday

USDA Secretary Perdue said China likely will fulfill Phase 1 purchase commitments, even with concerns about the impact coronavirus may have on China meeting those obligations. “None of us obviously know what the impact is going to be,” he said of coronavirus, but added that market fundamentals remain strong thanks to robust consumer demand and the new trade agreement. Despite uncertainty over the virus’ impact, the signals from China are that they “want to fulfill” their purchase commitments under the Phase 1 deal, Perdue said. He predicted China would begin to increase purchases from the US in late spring and summer, as the market shifts from South American producers. .

One congressman asked Perdue if USDA is taking any action regarding the buildup of meat in cold storage due to shipping problems related to coronavirus. “We try to be aware with our eyes on the ground there, we see some easing of that, more people are getting back to work in the ports” in China, Perdue responded. Shipping backlogs appear to be easing as more products continue to be unloaded and “hopefully we're over the worst of that and can move forward,” he said.

Regarding possible US trade deals with the EU and UK, Perdue said the EU’s position on issues like biotechnology and issues like perceptions around chlorine-washed chicken, which “we really don’t do at all,” continue to be a sticking point. On the UK, Perdue was more hopeful. “I think the future is better for the UK We're looking forward to having reciprocal trade with the UK once they're out of the EU,” he said, adding that he thinks reaching a deal with the UK may help facilitate better relationships with the EU in trade negotiations.

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff