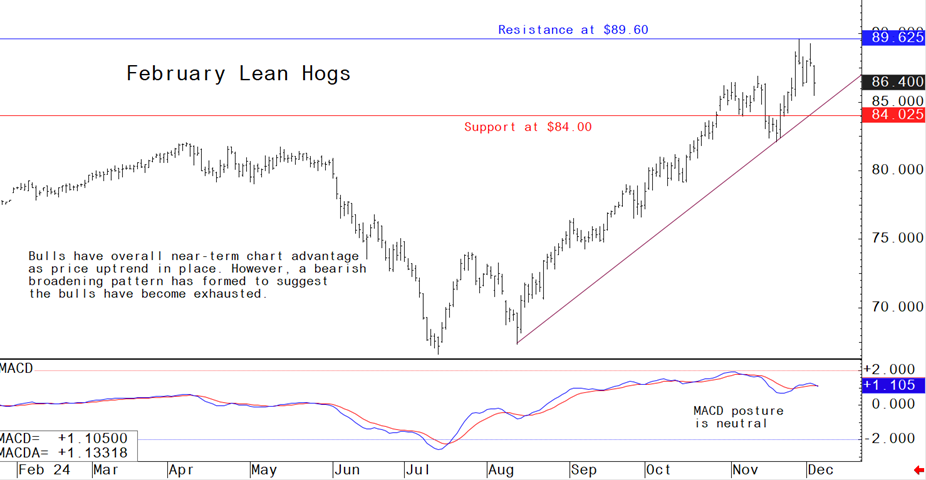

Pig outlook: Lean hog futures bulls may be out of gas

Livestock analyst Jim Wyckoff reports on global pig newsThis week’s price action in February lean hog futures suggests the bulls have become exhausted at higher levels. A bearish broadening pattern has formed on the daily bar chart. The latest CME lean hog index is up 1 cent to $84.01 as of Dec. 3, pausing the three-week price slide. Seasonally, the cash hog index and pork cutout could face more pressure, though hog slaughter numbers have been running well under levels implied by USDA’s September Hogs & Pigs Report, limiting normal fourth-quarter price weakness.

Latest USDA and other news regarding the global pork industry

Weekly USDA US pork export sales

Pork: Net sales of 35,200 MT for 2024 were up noticeably from the previous week and from the prior 4-week average. Increases primarily for Mexico (15,400 MT, including decreases of 200 MT), South Korea (9,100 MT, including decreases of 1,300 MT), China (3,400 MT), Australia (2,300 MT), and Japan (2,200 MT, including decreases of 600 MT), were offset by reductions for Malaysia (400 MT) and Hong Kong (400 MT). Net sales of 26,600 MT for 2025 were primarily for China (10,300 MT), Mexico (8,700 MT), South Korea (5,300 MT), Colombia (1,000 MT), and Japan (500 MT). Exports of 32,200 MT were up 14 percent from the previous week and 2 percent from the prior 4-week average. The destinations were primarily to Mexico (12,700 MT), Japan (3,700 MT), South Korea (3,600 MT), China (3,500 MT), and Canada (2,100 MT).

First Circuit weighs national impact of Massachusetts pork law

The First Circuit Court is evaluating the constitutionality of a Massachusetts law that mandates humane confinement standards for pigs whose pork is sold in the state. The law, which bans sales of pork from pigs confined in restrictive stalls, has drawn criticism from pork processors like Triumph Foods LLC. They argue it imposes undue burdens on out-of-state producers, potentially violating the Commerce Clause of the U.S. Constitution. Supporters of the law point to the Supreme Court’s 2023 decision upholding California’s humane-pork law, suggesting the Massachusetts regulation is not discriminatory. The case could have far-reaching consequences for the U.S. pork industry, with concerns over how varying state laws might reshape national production standards.

China’s sow herd, hog slaughter contract

China’s sow herd totaled 40.73 million head at the end of October, according to the ag ministry, down 3.2% from year-ago. Through the first 10 months of the year, China’s hog slaughter fell 2.6% from the same period last year to 264.21 million head.

China lifts final trade restrictions on Australian meat processors

China has lifted trade restrictions on two Australian meat processing facilities, allowing the full resumption of red meat exports to the country, the Australian government said. Beijing has now removed restrictions from all 10 Australian meat processors it banned between 2020 and 2022. China is the second largest market for Australian beef and veal after the United States.

FDA and USDA seek input on food date labeling practices to combat waste

FDA and USDA issued a joint Request for Information (RFI) to gather insights on food date labeling, such as "Sell By," "Use By," and "Best By," aiming to address consumer confusion and its contribution to food waste. The RFI seeks data on industry practices, consumer perceptions, and the economic and environmental impacts of date labeling.

Estimates suggest that confusion over labeling contributes to 20% of household food waste, costing the average family of four $1,500 annually. The RFI supports the National Strategy for Reducing Food Loss and Waste, which targets a 50% reduction by 2030. Stakeholders have 60 days to comment, helping shape future policies or educational campaigns. Further information on how to submit a comment can be found in the Federal Register.

Walmart CEO on food inflation, e-commerce, and future trends

Walmart CEO Doug McMillon projects continued food inflation into 2025, driven by pressures on eggs, dairy, cocoa and other inputs. Speaking at the 2024 Morgan Stanley Global Consumer and Retail Conference, McMillon expressed optimism about consumer resilience despite climbing prices. He noted that egg and milk prices might stabilize faster than processed foods, which could remain elevated next year.

Walmart’s pricing strategies and supply chain upgrades have bolstered its market position, with strong food unit volume growth and leadership in consumer-packaged goods (CPG) market share. The retailer’s e-commerce business, particularly Walmart Marketplace, continues to grow, achieving double-digit gains for six consecutive quarters.

Looking ahead, McMillon emphasized investments in automation, social commerce, and personalization as key drivers for Walmart’s evolving retail strategy.

WHO calls for stronger surveillance of H5N1 among animals

A World Health Organization (WHO) official on Thursday called for stronger surveillance in animals for evidence of infection with H5N1 to curb its spread. The official also urged stronger efforts to reduce the risk of transmission of the virus to new species of animals and to humans. The agency said it is in touch with partner agencies such as the World Organization for Animal Health and Food and Agriculture Organization to increase surveillance in animals.

The next week’s likely high-low price trading ranges:

February lean hog futures--$84.00 to 89.60 and with a sideways-lower bias

January soybean meal futures--$287.00 to $300.00, and with a sideways bias

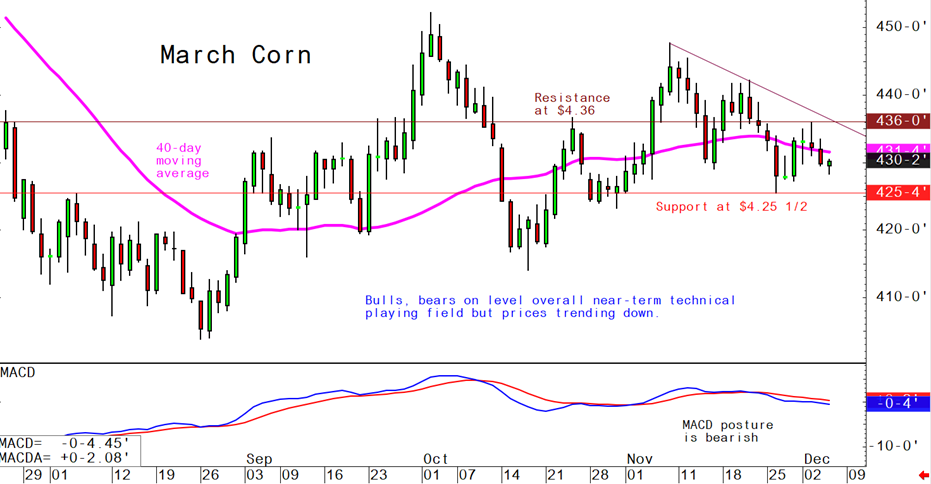

March corn futures--$4.25 1/2 to $4.36 and a sideways bias

Latest analytical daily charts lean hog, soybean meal and corn futures