Pig outlook: Lean hog futures bulls lose some steam

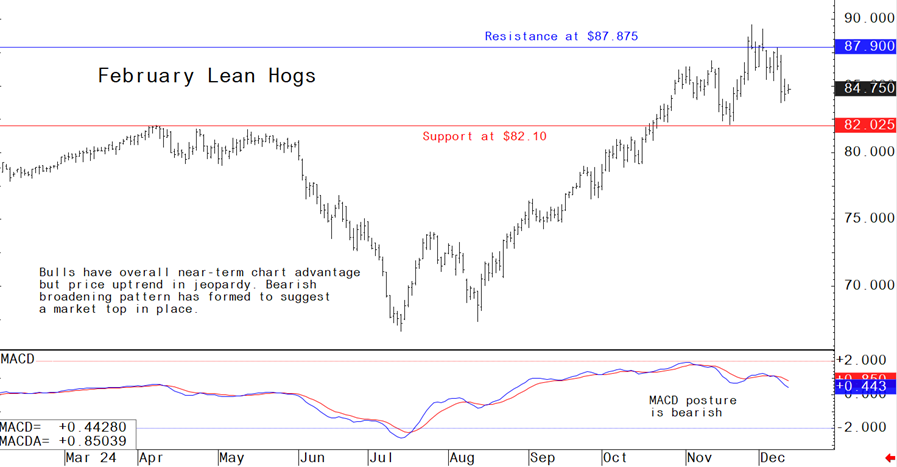

Livestock analyst Jim Wyckoff reports on global pig newsLean hog futures prices have backed down from the recent contract high and the bulls are fading just a bit, to begin to suggest a market top is in place. The latest CME lean hog index is up 29 cents to $83.61 as of Dec. 10. Traders will keep a close eye on the cash market to see if this is a short-term pause or a seasonal bottom. The last couple of years it has been common for seasonal weakness to persist into the new year, rather than making a low around Christmas.

Latest USDA and other news regarding the global pork industry

Weekly USDA US pork export sales

Pork: Net sales of 22,500 MT for 2024 were down 36 percent from the previous week and 1 percent from the prior 4-week average. Increases primarily for Mexico (9,100 MT, including decreases of 300 MT), Japan (4,500 MT, including decreases of 500 MT), China (2,700 MT, including decreases of 100 MT), Colombia (2,000 MT, including decreases of 100 MT), and South Korea (1,000 MT, including decreases of 600 MT), were offset by reductions for Australia (300 MT). Net sales of 4,600 MT for 2025 primarily for South Korea (2,400 MT), Japan (1,100 MT), Canada (500 MT), Mexico (300 MT), and Honduras (200 MT), were offset by reductions for China (500 MT). Exports of 33,800 MT were up 5 percent from the previous week and 10 percent from the prior 4-week average. The destinations were primarily to Mexico (14,700 MT), South Korea (3,900 MT), Japan (3,700 MT), China (3,100 MT), and Australia (2,000 MT).

China’s meat imports rise in November

China imported 581,000 MT of meat in November, up 46,000 MT (8.6%) from the previous month and 24,000 MT (4.3%) more than last year. Through the first 11 months of this year, China imported 6.06 MMT of meat, down 11.2% from the same period last year.

China resumes British pork imports

Major British pork produces can resume shipments to China, the UK ag ministry announced. China is the UK’s largest non-EU pork customer.

The next week’s likely high-low price trading ranges:

February lean hog futures--$82.10 to 87.875 and with a sideways-lower bias

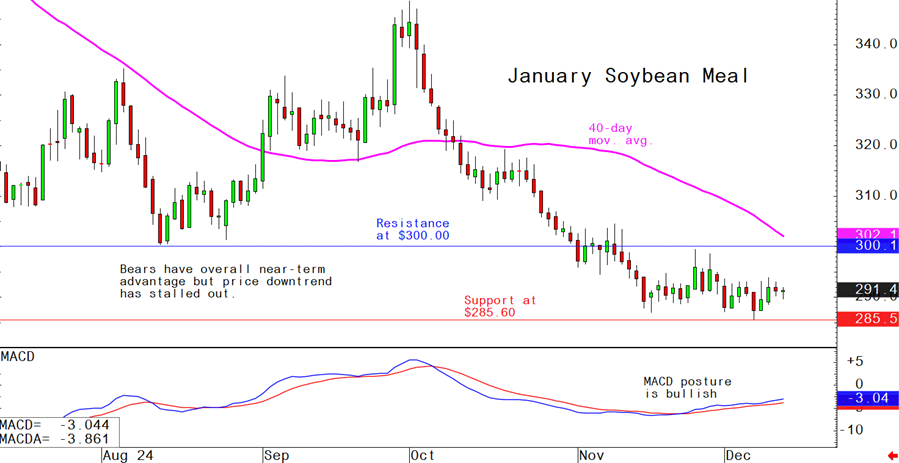

January soybean meal futures--$285.60 to $300.00, and with a sideways bias

March corn futures--$4.40 to $4.60 and a sideways-higher bias

Latest analytical daily charts lean hog, soybean meal and corn futures