McKean Swine Disease Conference: US pork market outlook

Lee Schulz, associate professor at Iowa State University, shares a US price outlook for the pork industry

Editor's note: The following is taken from the 2024 ISU McKean Swine Disease Conference Proceedings. The conference was held July 24-25, 2024, at the Iowa State University campus in Ames, Iowa, USA.

Returns on farrow to finish production averaged a loss of $32 per head in 2023 according to the Iowa State University Estimated Livestock Returns model. This was the worst year for profitability on record, even eclipsing the infamous situation in 1998. Average annual returns are forecasted close to break-even for 2024, based on mid-May estimates.

As recently as early January, an average annual loss of $18 per head was projected for 2024. While conditions have improved notably, challenges still remain. April was the first profitable month since July of last year and only the second profitable month since August 2022. Though seasonally stronger prices may help uphold profits through the summer, losses are currently expected for this fall and winter.

Despite deep losses in 2023, pork production forecast to grow

A decrease in pork production, all other things unchanged, would cause hog prices to rise. However, significant investment in the pork industry during the last decade has brought considerable asset fixity and asset specificity; both delay production cuts in response to losses. According to the Livestock Marketing Information Center, pork production is forecast to increase to 27.878 billion pounds in 2024. This would be a 2.1% increase from the 2023 level. The higher production is based on a projected 2.1% increase in commercial hog slaughter and no meaningful change in carcass weights.

Pork production in 2025 is projected at 28.238 billion pounds, up 1.3% from the current 2024 forecast. USDA is expecting even larger levels with 2024 pork production forecast to be 2.8% above 2023 production and for 2025 production to increase another 1.2%.

The March 1, 2024 U.S. swine breeding inventory was 6.016 million head according to data producers provided to USDA’s National Agricultural Statistics Service for the Quarterly Hogs and Pigs report. This was down 2.1% from March 1, 2023 and the smallest March 1 breeding inventory since 2016. The March 1 U.S. breeding herd peaked in 2020 at 6.475 million head. Even if there are further reductions in the breeding herd, this could be offset by improvements in productivity.

The last four quarterly US pigs saved per litter estimates were records for their respective quarters, and represented year-over-year gains the national numbers have not shown before, not including the post porcine epidemic diarrhea virus (PEDV) rebound. Expect a slowing rate of increase going forward. If nothing else, we will be comparing to a high base period a year prior. This, however, does not mean litter rates will decrease.

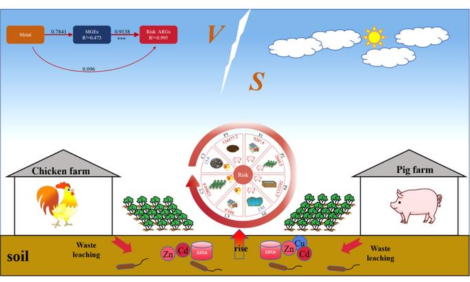

Domestic demand waning, exports strong

An increase in demand, all other things unchanged, would also cause prices to rise. However, the first quarter 2024 domestic retail pork demand index was down 5.2% from a year ago. From a historical perspective demand still remains relatively strong. That’s the good news. The not so good news is pork demand has waned the last seven quarters. With domestic per capita consumption projected flat to slightly higher this year and next year, U.S. consumers will need to be willing and able to pay higher real (i.e., inflation adjusted) prices for the industry to see an increase in demand.

Macroeconomic factors will challenge that. Strength in US pork exports in 2023 and 2024 has been a positive development and greater than expected growth going forward would inject optimism into the price outlook.

According to the Iowa State University model for farrow-to-finish production, costs increased 53% or $34 per carcass cwt in 2023 compared to 2020. This translates into an increase of over $70 per head in just three years. Costs are forecast to decrease 10% in 2024 compared to 2023. While feed costs are expected to be down 20%, pork producers use numerous other inputs and services and most all of those costs are up in 2024. Inflation and higher interest rates will limit declines in production costs.

Regardless of your agreement with this outlook for the pork industry, or someone else’s, I encourage everyone to stay informed of the economic situation and make use of available resources to help guide decision-making. A non-exhaustive list of Iowa State University resources includes:

1. Ag Decision Maker https://www.extension.iastate..... Monthly newsletter of market outlook, news, a “toolbox” of information files (factsheets), and decision tool spreadsheets.

2. Estimated Livestock Returns - Swine https://estimatedreturns.econ..... Monthly barometer of costs and returns.

3. Swine Crush Margins https://crushmargins.econ.iast.... Weekly indicator of profitability and price risk management opportunities