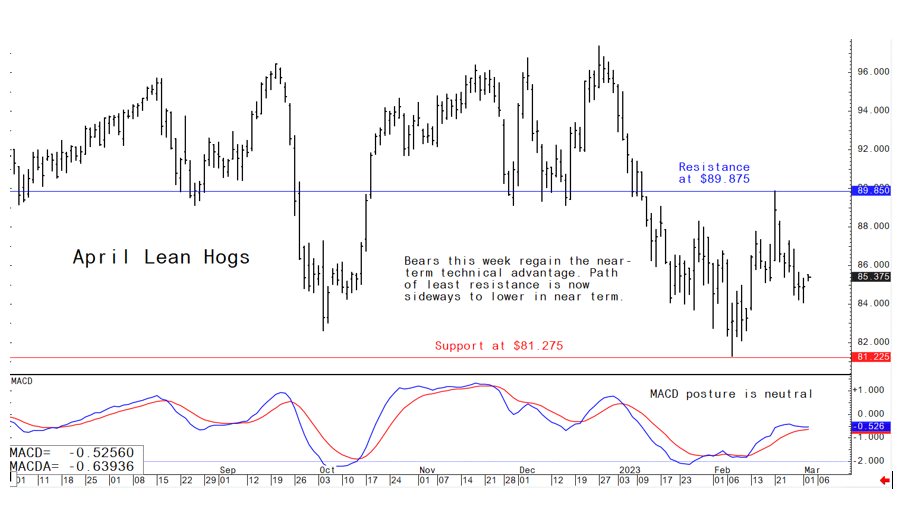

Lean hog futures bulls struggling again

Jim Wyckoff Pig outlook - Mar. 2After a late-February surge, April lean hog futures slumped again this week. Technicals presently favor the lean hog futures market bears. Fundamentally, hog futures’ premiums to cash continues to narrow, which is not bullish. The latest CME lean hog index is up 7 cents to $78.58 (as of Feb. 28). April lean hog futures finished $6.37 above that level Wednesday. Deferred lean hog futures contracts continue to underperform the nearbys. However, as the market anticipates rallies into the spring grilling season, hogs may over-perform as pork is underpriced compared to beef at the meat counter.

Latest USDA and other news regarding the global pork industry

USDA reports weekly US pork export sales

Pork US net sales of 31,000 MT for 2023 were down 40 percent from the previous week and 21 percent from the prior 4-week average. Increases primarily for Mexico (13,400 MT, including decreases of 100 MT), South Korea (4,500 MT, including decreases of 600 MT), Japan (4,300 MT, including decreases of 300 MT), Canada (2,300 MT, including decreases of 300 MT), and Australia (1,400 MT), were offset by reductions for Nicaragua (100 MT). Exports of 30,400 MT were up 4 percent from the previous week, but down 3 percent from the prior 4-week average. The destinations were primarily to Mexico (13,800 MT), China (4,100 MT), Japan (3,800 MT), South Korea (2,200 MT), and Canada (1,500 MT).

China’s sow herd contracts

China’s sow herd shrank 0.5% at the end of January compared with the prior month, according to ag ministry data. However, the herd at 43.67 million head was 1.8% bigger than January 2022.

Germany, Poland report ASF cases

Another case of African swine fever (ASF) was confirmed on a small domestic hog farm in the eastern state of Brandenburg, Germany. Poland discovered ASF in five wild boars in the northern part of the country.

USDA cold storage data supportive for beef

USDA’s Cold Storage Report showed beef stocks dropped contra-seasonally during January, while pork inventories climbed slightly more than average. Beef stocks at the end of January totaled 532.7 million lbs., down 11.2 million lbs. (2.6%) from December. The five-year average was a 7.7-million-lb. increase in beef stocks during the month. Pork stocks totaled 517.7 million lbs., up 61.3 million lbs. (13.4%) versus December, whereas the five-year average was a 54.6-million-lb. increase during the month.

The next week’s likely high-low price trading ranges:

April lean hog futures--$81.275 to $88.00 and with a sideways bias

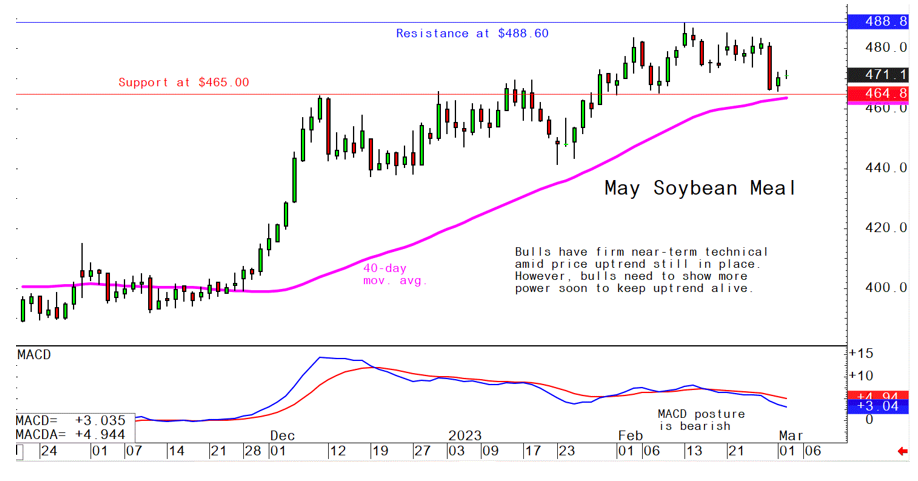

May soybean meal futures--$460.00 to $490.00, and with a sideways bias

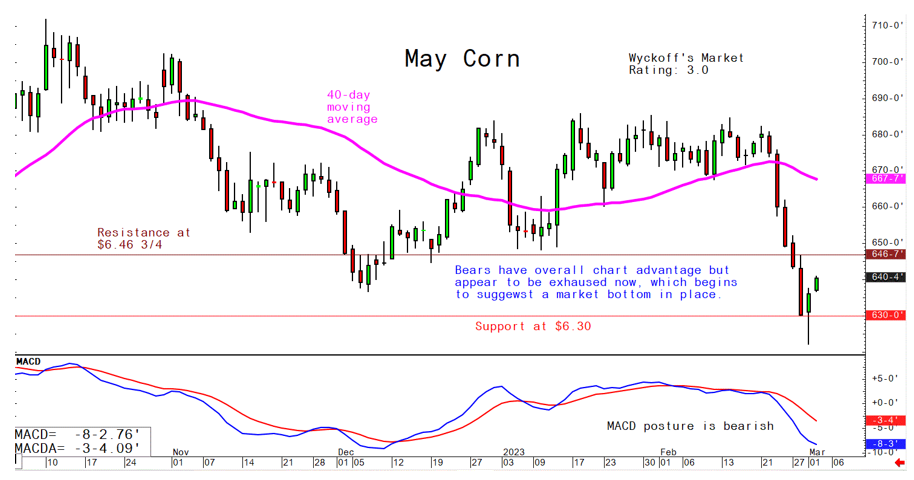

May corn futures--$6.22 1/4 to $6.60 and a sideways bias

Latest analytical daily charts lean hog, soybean meal and corn futures