Genesus Global Market Report: China

Genesus' Lyle Jones reports on the pig market in ChinaChina’s Top 20 Pig Enterprises lost 16.4 billion Yuan ($2,245 Billion USD) in the first half of 2023! What’s more shocking is the total debt of 450 billion Yuan ($61.6 billion USD)! The 20 marketed 77.23 million head in the first six months at an average loss of $30 per head.

Last week many Publicly listed pig companies released their semi-annual reports by the August 31 deadline. Obviously, this report is a harsh reflection of the pig production industry with low pig prices and high feed costs. Only two of the 20 listed pig companies Haida (Feed) and Jingji (Real estate) were profitable, but not from raising pigs.

Five companies reported losses of more than I billion yuan ($136 million USD) during the first six months of the year. Those five companies also happen to be the top five producers, indicating a harsh reality that has existed for the better part of the last two years. However, the 16.4 billion is a marked improvement from 19.8 billion these same publicly listed companies reported last year. In the first half of 2023 China National Bureau of Statistics reports 375 million hogs marketed. If the industry average is a $30 per head loss, the industry total loss $11.250 billion USD.

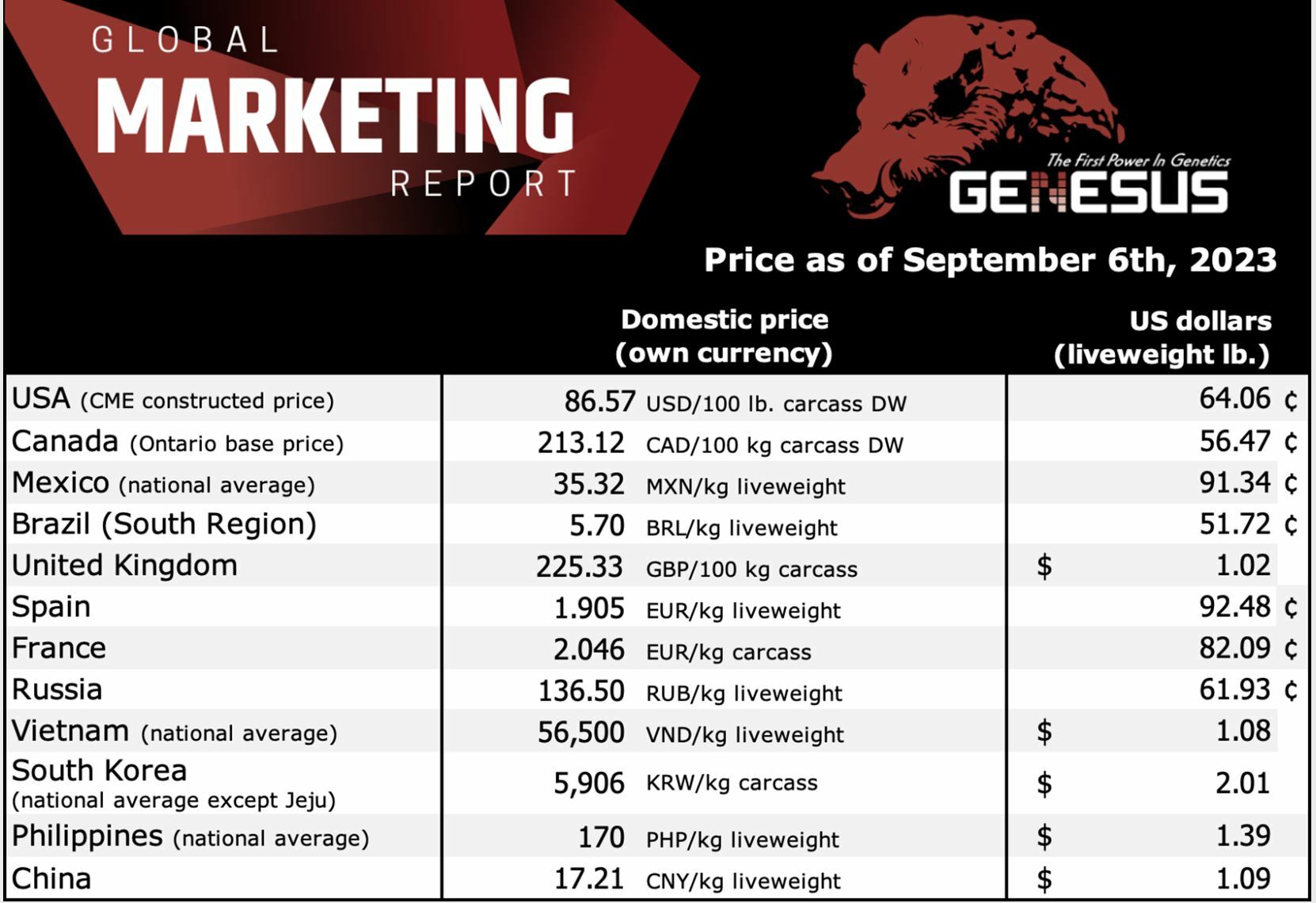

Markets: Looking at the Markets at the close of last week on Friday September 1st, slaughter pigs were 17.21 yuan/kg ( $1.09/lb.) up from 14.14 yuan/kg ($0.88/lb.) in early July. Profits are reported to be around 220 yuan currently, compared to losses of 120 yuan ($16.50) from January to July 2023. Weaned pig prices closed at 370 yuan ($50.96) each while feeder pigs 498 yuan ($68.60) each. Culled Sow prices were 11.19 yuan/kg ( $0.69/lb.).

Feed Costs: Increasing feed costs continue to eat away at margins. This morning it was reported 43% soybean meal was up 700 yuan ($95 USD) per ton from the beginning of August. As of August 31, the national spot price of soybean meal was 5013 yuan ($686 USD) per ton. As result since last Friday, several feed companies have joined in announcing feed price increases of 250 yuan ($34 USD).

ASF: Our contacts have been telling us ASF continues to circulate and has been very bad in certain provinces for the last two months. One unofficial report was that more than half the farms in his area may have been affected. Of course, no accurate accounting exists but no doubt there are many empty pig farms in China. We also hear more than half of the multi-story farms are sitting empty for one reason or another.

Small Producers: Many small producers have last confidence (or ability to compete) and exited with no plans of coming back. On the other hand, it seems small family farms are making money finishing recently and more willing to upgrade Genetics. We have seen more orders for breeding pigs earlier in the year than normal - primarily from the smaller farm producers.

Forecast: Hard to predict, but we hear so many stories of ASF outbreaks, forced marketing and empty farms. At the same time the quality of breeding herds is going backwards. Most farms populated with 3x, 4x, 5x cross commercial females. Can’t help but think China will need to import more pork.