EU pork production up in 2020

The European Commission recently released its Short-term Outlook for EU Agricultural Markets in 2020 report, indicating African swine fever (ASF) and uncertainties related to COVID-19 continue to pose a threat for pork and all meat sectors.

The short-term outlook is based on market intelligence available until mid-June 2020 and reflects the COVID-19 impact to the extent possible, with all the usual caveats and limitations due the rapidly evolving situation. Market forecasts are presented for EU-27 and assume a frictionless trade between the EU and the UK in 2020 and 2021.

The COVID-19 outbreak and the related economic impacts remain the overarching market driver. According to the report, the food chain proved particularly resilient in the EU. Producers and processors were able to deliver food, and supermarkets and food shops remained open during the entirety of the confinement period.

With confinement measures progressively lifted all over the EU and the start of the summer holiday period, demand specifically for foodservice is expected to return to normal levels.

Meat

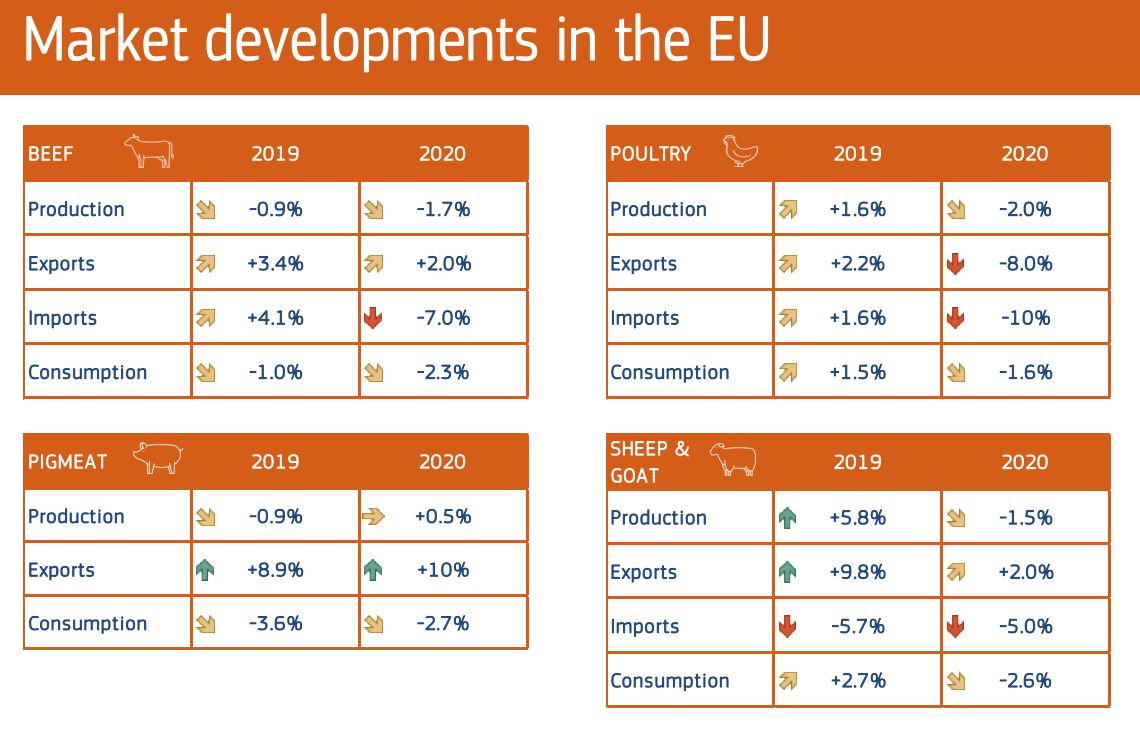

In 2020, EU meat production is expected to decrease for all meats but pigmeat (+0.5%) : beef -1.7%, poultry -2.0%, sheep and goat -1.5%. A fall in slaughtering in Q2 is forecast as foodservice closed, while production was constrained and logistics challenged. A broad recovery is expected in the second half of the year.

The ASF outbreak still poses a risk for pigmeat in addition to the uncertainties

related to Covid-19 for all meat sectors. After a decline driven by a fall in foodservice demand, prices for all meats have started to pick up when consumer demand (for certain cuts) recovered following the easing of Covid-19 lockdown measures.

Trade with the UK declined at the beginning of 2020 compared to the same period in 2019, generally more than with other partners. This decline strongly affects the figures on total EU trade.

EU meat exports are due to increase in 2020, with the exception of poultry. The increase will be particularly strong for pigmeat due to the accelerating import

demand from China which will remain the leading destination for EU pigmeat by far. EU meat imports are likely to fall, as animal and meat availabilities decrease.

Annual meat consumption could decline to 65.4 kg per capita in 2020 (-2.5%), due to a reduction in consumer demand during lockdowns, and subdued domestic availability not compensated by imports.

EU pigmeat production up in 2020

- EU pigmeat production was slightly down in Q1 (-0.5% year-on-year), driven by declines in PL (-8.2%) and IT (-20%). Growth in production, supported by high prices, was firm in other key EU producers with a rebound in DE (+1.1%) and DK (+2.7%), a continued sharp rise in NL and ES (both +4.4%, and benefitting from rebuilt herds) and a modest increase in FR (+0.6%). EU exporters benefited from strong demand from China (except PL due to the spread of ASF), which compensated the fall in demand from other main destinations (UK, Japan, South Korea, US, Philippines and Australia).

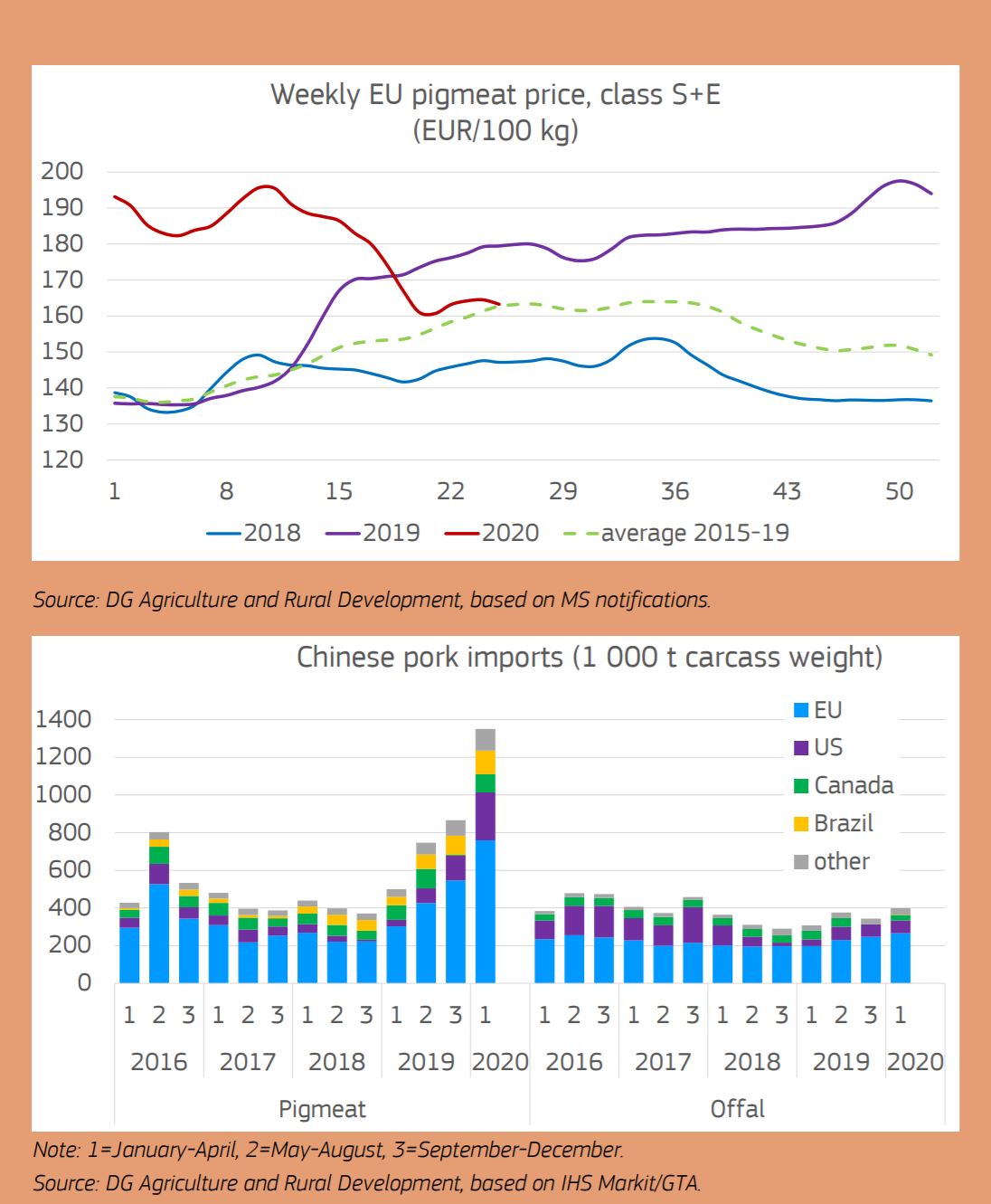

- Prices, which surged over 2019 when supply tightened and exports rose, started to recede towards the 5 year-average when foodservice demand plummeted. Prices have started to rise again in the last weeks, following the rebound of foodservice and world demand. They stabilized at EUR 163/100kg in week 25.

- Pigmeat production is expected to increase slightly in 2020 (+0.5%). It will be supported by favourable prices, return of consumer demand and solid export prospects (+10%/2019), mainly to China, and recent investments in the sector, assuming ASF does not spread further within the EU.

- Reduction in consumer demand during confinement and overall limited domestic availability will lead the apparent consumption of pigmeat to fall below 30 kg per capita in 2020.

Further surge in Chinese demand, and EU exports up

- With the persistence of ASF in China, experts anticipate a further herd reduction, an associated drop in pigmeat production of 15-25% in 2020, and a need for more imports. China’s imports of pigmeat grow massively until April (170% year-on-year), benefiting the EU (+150%) and other key suppliers (US, Brazil and Canada). The import shares in China increased for the latter countries (19%, 9% and 7% respectively) to the detriment of the EU (55%). Demand for offal also increased, but mainly to the benefit of the EU.

- The unprecedented magnitude of recent trade flows of pigmeat to China may soften in the second half of the year, urging consumption of other (imported) meats.

To view the entire Short-term Outlook for EU Agricultural Markets in 2020 report which includes details on livestock and crop sectors, click here.