Chinese Policies Attempt to Smooth the Cycle

Chinese officials use a variety of policy measures that are intended to reduce cyclical fluctuations in pork production, explain Fred Gale, Daniel Marti and Dinghuan Hu in a report entitled ‘China’s Volatile Pork Industry’ from the USDA Economic Research Service.Measures include subsidies, tax breaks, and market interventions in hog farming and pork processing. Government officials often play a coordinating role by recruiting farmers as suppliers, arranging access to land and bank loans, and brokering deals with investors or final customers.

In response to the steep increase in pork prices during 2007, the government announced a package of hog-sector subsidies just two months after rising pork prices became a subject of public concern (see Zhu, 2007). A series of additional grants, subsidies and tax breaks aimed at the pork industry followed later in 2007 and in succeeding years. A programme introduced in 2009 sought to stabilise pork prices by buying and selling pork for government reserves. The government renewed its emphasis on pork policies in mid–2011 when pork prices surged again.

Pork Industry Subsidies

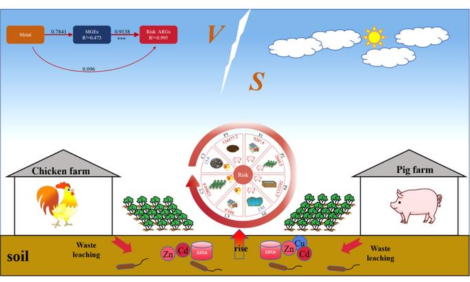

China’s pork policies are part of an ongoing effort to transform the traditional structure of ‘backyard’ farms, small butchers and pork vendors into a ‘modern’ livestock sector (see box, “Policy Priorities: Modernisation and Stability”). Since the 1980s, efforts to modernise the industry have included standardising hog breeds, feeds and veterinary medicines; regulating the use of feed additives; enforcing animal health regulations; and shifting toward modern slaughter, processing, and retail markets.

Efforts to modernise China’s pork industry were revisited in 2007, a period marked by soaring prices and widespread animal disease epidemics. Officials viewed the prevalence of small–scale backyard farmers as a source of instability because these operations are said to more readily slaughter sows during a market downturn and are more susceptible to animal disease epidemics than larger operations.8 Officials believe a modernized industry chain will bring stability to the market while also addressing food safety and disease issues.

China’s pork policies emphasise improvements in the breeding and farrowing stages of production, upgrading or refurbishing structures and equipment for farms raising slaughter hogs, and attracting investment to the sector.9 The main policy measures include the following (values converted to US$ at the official exchange rate in 2010):

- A subsidy payment for each breedable sow set at 50 yuan per head in 2007, raised to 100 yuan ($14.60) in 2008. The sow subsidy was withdrawn in many areas in 2009 but was restored in 2011.

- Subsidised insurance for sows against losses from disease and natural disasters. The premium (paid to a designated insurance company) is 60 yuan ($8.78) per head, of which 12 yuan is paid by farmers and 48 yuan is paid by central and local governments. Initially, the program only covered breedable sows, but it was extended to include gilts in 2011. Pilot programmes in some areas insure hogs raised for slaughter.

- Free mandatory immunisations against Porcine Reproductive and Respiratory Syndrome (PRRS, called ‘blue ear disease’ in China), foot-and-mouth disease and classical swine fever. Vaccines are procured from companies through a bidding process with costs split between central and local government. Vaccines are distributed to farms by veterinary officials.

A ‘fine breed’ subsidy for artificial insemination using semen from boars of approved breeds, such as Duroc, Landrace and Yorkshire. The subsidy is 10 yuan ($1.46) for each insemination, for up to four attempts per year for each sow.

- Financial awards (grants) of approximately $1 million each to local governments of 362 major pork–supplying counties for financing investments in hog housing, manure handling, immunisation and veterinary work.

- Financial awards to large farms holding at least 500 sows ($146,000) and to standardised farms and village ‘production zones’ where at least 500 hogs are slaughtered annually – from $30,000 to $117,000, according to farm size and province.

- Subsidies of $146,000 were given to each of 300 key breeding farms and provincial hog–breeding centres.

- A waiver of the 25 per cent corporate income tax for companies that engage in livestock and poultry production took effect in January 2008 (Petry and Zhang, 2009).

Spending on these programmes is only reported on a piecemeal basis by Chinese authorities. The total is difficult to ascertain since there are so many programmes, and many are financed jointly by central and local government funds. Central government funds for the ‘fine breed’ subsidy increased from $26 million in 2007 to $95 million in 2010. Pork surplus county awards totalled three billion yuan ($450 million) in 2010. Financial awards for large–scale farms totalled $367 million in 2010. Most subsidies are targeted to 362 important pork–producing counties that account for over 40 per cent of China’s hog production.10 The award funds are distributed by local authorities to farms, companies, and local officials for refurbishment of hog housing, acquisition of breeding hogs, vaccination programmes, manure management, subsidised loans and support of pork processing, breeding, feed companies and other segments of the industry supply chain.

Various measures are carried out at the local level as experimental pilot programmes. These include subsidies for village methane digesters to produce natural gas from hog waste, ‘ecological’ hog-farming projects, subsidised insurance for finishing hogs, funds to pay for disposal of carcasses of diseased hogs and small cash grants to encourage migrant workers to return to their home villages and set up hog farms.11 Some of these are extensions of an existing web of local subsidies, model farms, pork reserves, wholesale markets and supply chain linkages supported by the ‘vegetable basket responsibility system’ in which municipal leaders use various measures to ensure adequate supplies of meat and vegetables for their cities. Pork reserves (both frozen pork and hogs kept in reserve) are held at three levels: central, provincial and city. In 2011, China’s state council ordered large and medium cities in coastal provinces to hold pork reserves to meet 10 days of consumption; other cities were ordered to hold a seven–day reserve.

The implementation of hog sector support varies from year to year and place to place. Local government and bank officials make extra efforts to implement policies when orders are issued from national officials. In 2007, the China Bank Regulatory Commission issued a document ordering banks to make loans to expand pork production capacity. Commercial banks were instructed to lend to companies that raise or slaughter hogs; rural credit cooperatives were instructed to lend to individual hog farmers; and village banks and rural lending companies were instructed to offer production credit. An account by journalists described how local officials in a county of Sichuan Province organised a meeting in 2007 to urge farmers to raise hogs and offer them subsidies while bank officials went door to door to offer loans secured by personal property like ceiling fans and washing machines.

In coastal provinces, hog production is increasingly dominated by large–scale farms operated by companies. In some cities, hog production is banned due to environmental concerns. In western provinces, slaughter hogs are usually raised by individual small–scale farmers but officials encourage companies to invest in large breeding and farrowing farms that supply feeder pigs. In 2007 and subsequent years, Ministry of Agriculture officials accelerated implementation of a plan to subsidise construction of ‘livestock production zones’ (‘yang zhi xiao qu’) where individual farmers may concentrate their animals in facilities that simulate large–scale farms. In 2011, China’s State Council announced a plan to allocate 2.5 billion yuan ($385 million) annually over five years for construction of large–scale hog farms.

In 2007, the combination of policies and high prices attracted investment in new farms, slaughter and processing plants, and imported breeding animals. The build–up of production capacity stimulated by policies helped drive prices down during 2008–09 nearly as fast as they had risen during 2007. Meat sector analysts attributed falling prices to excess supply of pork, with some citing the influx of investment due to government policies as a chief cause (Yi Zhang, 2010, Feng, 2004; Xiao and Wang, 2009).

Policy Priorities: Modernisation and StabilityIn 2006, China’s vice minister of agriculture gave a speech at a ‘Modern Livestock Industry Summit’ that typifies the government’s approach to livestock industry policy. In his remarks, the vice minister stressed the importance of the hog sector’s transformation to a modern industry, citing special instructions issued by the country’s top leaders. According to the speech, President Hu Jintao had instructed officials to design policy measures to ensure the stable development of the industry, and Premier Wen Jiabao had called for policies that would stabilise hog prices and prevent large fluctuations in pork production. |

‘Price Alert’ Market Stabilisation

In 2009, Chinese policy–makers introduced a ‘hog price alert’ market intervention program aimed at reducing the cyclical variation in hog prices. The programme’s main function is to buy up pork for reserves to increase demand when prices are low and sell pork to augment supply when prices are high. The programme intends to stabilise hog inventories by preventing extended periods of low prices that might prompt large culls of sows.12

According to documents describing the programme, movements in the hog-corn price ratio and several other designated market indicators trigger purchases and sales of pork reserves. The programme specifies the ‘normal’ range for the ratio as 6:1 to 9:1 and authorities may take measures to prevent the hog–corn price ratio from falling below 5.5:1.13 When the ratio falls in various ranges below 6:1, authorities can order designated meat companies to purchase frozen pork to hold in reserve (table 1)14 When the ratio is 5.5:1 to 6:1, provincial documents specify that cities should maintain a 7-day reserve of pork (based on average consumption of 100 grams/person/day).15 When the ratio falls below 5.5:1, the central government can subsidise interest on loans to slaughter and processing companies to encourage them to increase inventories of pork and increase output of processed pork products.

Also, the government can authorise an increase in central meat reserves and local reserves in large cities. At ‘abnormally low’ levels below 5:1, the programme calls for large increases in reserves, and officials can authorise one–time subsidies per sow for farmers in major pork–producing counties to prevent slaughter of sows. The document also calls for limits on pork imports ‘to reduce market supply’ and increases in pork exports by raising food safety standards and providing technical, information and policy support.16 When the hog–grain price ratio exceeds 9:1, the government can sell frozen pork reserves to bring down prices, and it may issue subsidies to low–income consumers.

Since the programme’s inception, China’s NDRC has published weekly average prices and monthly hog inventory and slaughter on a web site. However, little information about purchases and sales of pork under the programme is revealed. News media reports reveal that purchases and sales have taken place but details on amounts or locations of the transactions are seldom announced.

| Table 1. China’s pork market intervention guidelines | ||

| Hog–grain price ratio1 | Color code | Government action |

|---|---|---|

| Over 9:1 | Sell frozen pork reserves into the market; issue subsidies to low–income consumers. | |

| 6:1 to 9:1 | Green (‘normal’) | Monitor markets and price fluctuations; issue information. Pork reserves mainly used for emergencies and disasters. |

| 5.5:1 to 6:1 | Blue | Add to central and local pork reserves when ratio is in this range for 4 consecutive weeks. |

| 5:1 to 5.5:1 | Yellow | Subsidise interest on loans to large meat processing companies to encourage them to add to commercial reserves and increase pork processing. |

| Under 5:1 | Red | Increase central reserves and require large and medium cities to increase local reserves of frozen pork when the ratio is in this range for 4 consecutive weeks. The number of live hogs kept in reserve may be increased. If the ratio is still in this range after reserve purchases, a temporary subsidy of 100 yuan per sow may be given to farms in main hog-producing counties when sow inventory is down 5 per cent year-on-year. Appropriately limit pork imports to reduce the market supply; ‘improve’ the food safety system to encourage pork exports. |

| 1Some provinces set a higher threshold for the hog-grain price ratio. Source: USDA, Economic Research Service using National Development and Reform Commission, Regulatory plan for controlling excessive hog price declines, Bulletin No. 1, January 9, 2009, and provincial guidelines for implementation. |

||

The first intervention under the stabilization programme occurred in May 2009, less than six months after its introduction (figure 9). The hog–grain price ratio fell below 6:1, and the government began purchasing pork for reserves in mid–June 2009. During April–June 2010, the government conducted five rounds of pork purchases before prices rebounded in July. Official reports said the hog–grain price ratio fell from 5.07 in mid-April to 4.81 by May 26, well into the ‘red’ region specified by the programme. It was still in the red region when the fifth round of purchases was carried out at the end of June 2010. NDRC reported that the hog–grain price ratio reached the 6:1 normal level in late July.

Later in 2010, the government ordered sales of pork reserves when pork prices began to rise rapidly. Hog prices rose more than 20 per cent during July–November 2010. A round of frozen pork sales was ordered to prevent excessive price increases ahead of the October 1 National Day holiday, and a second round was ordered in November. Some local authorities sold pork reserves in mid–2011 as pork prices reached record levels. These sales occurred when the hog–corn price was far below the 9:1 ratio specified for triggering such sales.

During 2011, as pork prices again became a national concern, there were scattered reports of pork reserve sales by some local authorities but no coordinated national campaign to sell pork reserves. Instead, the State Council issued a new directive ordering local authorities to increase their pork reserves. Large and medium cities and cities in coastal areas were directed to maintain a reserve equivalent to 10 days of pork consumption and other cities were directed to maintain a seven–day reserve.

The influence of the price alert programme on pork prices is hard to discern, especially since the amount, timing and location of pork reserve purchases and sales are not announced. The programme’s ability to affect the market is limited because frozen pork purchases constitute a tiny portion of a huge, scattered market. Zhang and Nie (2010) reported that reserve purchases in 2009 totalled 110,000 metric tons, equivalent to just 0.26 per cent of China’s annual pork output. The Agricultural Development Bank of China reported that it financed meat-reserve purchases of 250,000 metric tons in 2010, about 0.5 per cent of annual pork production.17 Frozen pork itself constitutes a relatively small part of the market because Chinese consumers have a strong preference for freshly slaughtered meat.18

Officials credited the first round of purchases in 2009 for bringing about a recovery of pork prices that year but this seems unlikely since authorities were still recruiting companies to hold reserves and many provinces had not even released their implementation regulations at that time. Some market reports again credited reserve purchases for the rebound in hog prices in July 2010 but the rebound was more likely due to a 5.7 per cent decrease in hog slaughter that month.

The weakness of the hog price alert programme was revealed by the sharp increase in pork prices during 2010–11. During this period, rising food prices were a major policy concern in China and officials ordered sales of pork in the fall of 2010, yet hog prices rose 40 to 50 per cent and by June 2011, pork prices reached the record level set in early 2008. Market reports ascribed the surge in prices to short supplies of pork, which resulted from widespread animal disease, culls of sows and exits from the industry during the period of low prices and losses in 2010. The supply of feeder pigs in 2011 was limited by the cull of sows a year earlier, while rapid income growth created robust demand (Woolsey and Zhang, 2011). The wide swing in prices and hog inventories during 2010-11 was remarkably similar to that of 2006–07 – exactly the type of phenomenon that the price alert policy was intended to prevent.

Footnotes

8A Peoples Daily article blamed the ‘herd mentality’ and ‘synchronized behaviour’ of small farmers for market volatility and suggested that intervention cannot stabilise the market as long as small–scale farmers are predominant (Zhang, 2010a). The Ministry of Agriculture asserted that sow subsidies and improved market information prevented a large cull of sows during the period of low prices in 2010 (Sun, 2010).

9Only one policy was aimed at pork consumers: small cash subsidies for low-income families and students from poor families to compensate for the rising cost of purchasing pork during a brief period in 2007. Temporary subsidies for general food price increases were given in late 2010. During 2011, some local governments opened temporary shops selling discounted pork.

10These pork counties (zhu rou chu diao xian) are important suppliers of pork that produce more pork than they consume. They are chosen by ranking counties using an index based on the number of hogs sold outside the county, volume of hogs slaughtered and inventory of hogs. The number of counties receiving awards increased each year during 2007-10.

11Some of these local programs are financed by the financial awards and other subsidies included in the list above.

12A large cull of sows constrains the sector’s ability to expand production in later months. This phenomenon was blamed for the sharp increase in pork prices in 2007.

13Provincial guidelines specify that the ratio is to be calculated using the provincial average live hog price received by farmers and the wholesale price of corn. Secondary targets stated in the National Development and Reform Commission document are to prevent the ratio of feeder pig–to–hog carcass (bai tiao rou) prices from falling below 0.7:1, maintain hog inventories of at least 410 million head and maintain sow inventories of at least 41 million head.

14Provincial documents for implementing the programme set 6:1 as the break–even point for the hog–corn price ratio but officials may adjust the targets based on changes in industry structure and other factors. Henan Province’s document set the break–even point at 7:1 and Zhejiang Province set it at 6.5:1.

15Zhejiang Province specified a seven–day supply of reserve pork for its three largest cities and a three–day supply for other cities. As noted before, the national required reserve for large cities was raised to a 10–day supply in 2011.

16The means of limiting imports are not specified. The Shandong Province document explains that the provincial branch of the inspection and quarantine bureau will work with other departments to implement temporary policies to limit imports.

17This total may include modest amounts of other meats in addition to pork.

18Liu and Sun (2010) estimated that all sales of chilled, frozen and processed pork together account for less than 10 per cent of China’s pork market.

Further Reading

| - | You can view the full report by clicking here. |

| - | Go to our previous news item on this story by clicking here. |

March 2012