Australian Agricultural Commodities Report: Pig Meat

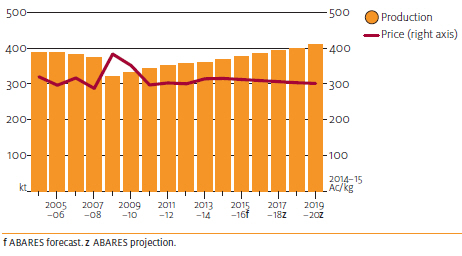

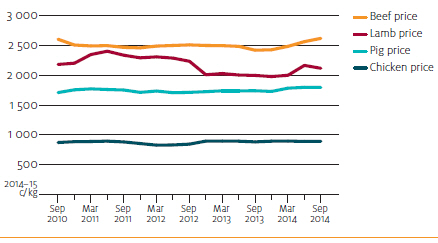

Pig meat production is projected to rise gradually over the short to medium term, reaching 410,000 tonnes in 2019-20, according to John Hogan in the 'Agricultural Commodities' report from the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) for the March quarter 2015.Pig prices are forecast to increase in 2015-16, reflecting higher domestic demand for fresh pork, relative to beef and lamb, and improved export demand following an assumed lower value of the Australian dollar.

Pig meat production is projected to rise gradually over the short to medium term, reaching 410,000 tonnes in 2019-20, compared with 360,000 tonnes in 2013-14.

The Australian weighted average over-the-hooks price of pigs is forecast to rise by three per cent in 2014-15 to 315 cents a kilogram (dressed weight). This mainly reflects increased demand for locally produced fresh pork as a result of forecast relatively higher beef and lamb retail prices.

The supply of pig meat in Australia in 2014-15 is expected to increase, as both imports of pig meat for processing and domestic production are forecast to rise.

In 2015-16 the weighted average over-the-hooks price of pigs is forecast to rise by a further two per cent to 320 cents a kilogram. Expected smaller increases in pig meat retail prices relative to other red meats are expected to continue to lead to a rise in domestic consumption of pig meat.

Over the medium term, over-the-hooks pig prices are projected to decline gradually in real terms, to 301 cents a kilogram in 2019-20 (in 2014–15 dollars). Downward pressure on pig prices over the medium term reflects continued competition from pig meat imports for processing and a slowing in average retail price increases of competing red meats as production of these meats rises. Imports from North America and the European Union are projected to remain competitively priced, despite the assumption of a lower Australian dollar over the medium term.

Production to Rise over Medium Term

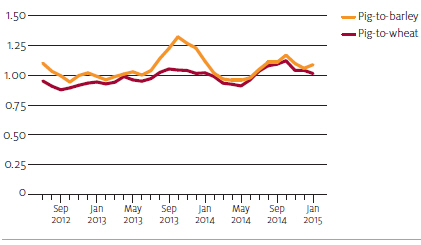

Australian pig meat production is forecast to rise by two per cent in 2014-15, by 8,000 tonnes to 368,000 tonnes. Higher returns to pig producers and relatively lower feed costs have supported production. Over the first seven months of 2014-15, the pig-to-wheat and pig-to-barley price ratios – indicators of returns from pig production – both averaged 12 per cent higher than the average in the first six months of 2014.

In 2015-16, production is forecast to increase by another 8,000 tonnes to 376,000 tonnes. Although competition from imports in the processed sector of the pig meat market is expected to continue, domestic feed grain prices are forecast to remain relatively stable. This should support domestic pig meat production for the fresh market. World grains prices are forecast to remain relatively low in US dollar terms in 2015-16, but the effect on Australian domestic grains prices is expected to be largely offset by an assumed depreciation of the Australian dollar.

Pig meat production is projected to rise gradually over the medium term, increasing to 410,000 tonnes in 2019-20. Over this period, domestic production is expected to be directed mainly to the fresh market. This is under the assumption that the fresh market will remain closed to imports because of biosecurity concerns, while the processed sector will remain open to competition from imports. Currently, all imported pig meat must be processed before sale, usually into bacon, ham or smallgoods.

Domestic Consumption to Recover over Medium Term

Australian per person pig meat consumption increased by nearly 25 per cent over the 10 years to 2012-13, to an average of 26.7 kilograms. Over the same period, pig meat imports as a share of domestic pig meat consumption grew from 23 per cent in 2002-03 to 49 per cent in 2012-13. In 2013-14 domestic pig meat consumption fell by six per cent to 25.1kg a person. This was mainly as a result of higher average retail pig meat prices following a significant reduction in imports and lower average beef and lamb retail prices. Over the next few years, per person consumption of pig meat is projected to recover gradually and reach 26.5kg in 2019-20.

This reflects projected higher rises in retail prices of beef and lamb. Both imports and domestic production of pig meat are expected to rise gradually over the medium term.

Imports

Deboned pig meat imports are allowed into Australia from approved countries,

subject to specific import conditions, and must be cooked before sale. Because of these

biosecurity restrictions, all fresh pig meat sold in Australia is domestically produced.

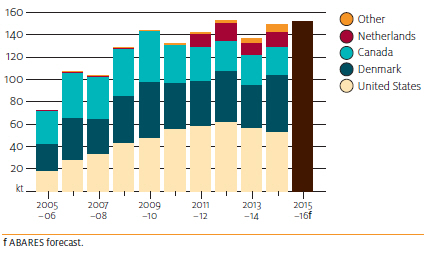

After falling by nearly 11 per cent to 136 000 tonnes (shipped weight) in 2013-14, Australian pig meat imports are forecast to rise by 10 per cent in 2014-15 to 149,000 tonnes (shipped weight). In 2013-14 pig meat imports from Denmark, the Netherlands, Canada and the United States were lower as a result of the strong Australian dollar against most overseas currencies. In addition, a porcine epidemic diarrhoea virus outbreak in North America, particularly in the United States, affected production through high piglet deaths. This reduced the supply of pig meat to Australia from that region compared with 2012-13.

In 2015–16 Australian pig meat imports are forecast to rise by a further two per cent to 152,000 tonnes. Although the Australian dollar is assumed to depreciate, access to relatively cheaper feed grains, notably corn and soybeans, allows importing countries to be highly price competitive. Over the medium term, Australian pig meat imports are projected to increase gradually, reaching 160 000 tonnes in 2019-20.

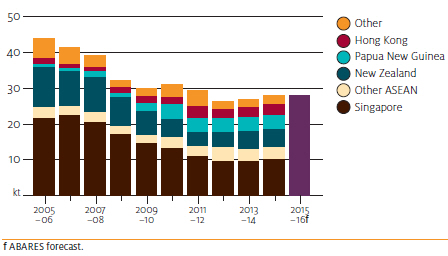

Exports to Rise Marginally to 2019-20

Australian pig meat exports are forecast to be around 28 000 tonnes (shipped weight) in 2015-16, with Singapore and New Zealand the largest markets. The assumed lower Australian dollar against the Singapore dollar and the rising strength of the New Zealand dollar against the Australian dollar are likely to make Australian pig meat more price competitive in those export markets. Over the medium term, Australian pig meat exports are projected to reach 30 000 tonnes in 2019-20.

| Table 1. Outlook for pig meat | ||||||||

| 2012-13 f | 2013-14 | 2014-15 f | 2015-16 f | 2016-17 z | 2017-18 z | 2018-19 z | 2019-20 z | |

|---|---|---|---|---|---|---|---|---|

| Over the hook price a | ||||||||

| - nominal, A¢/kg | 285 | 306 | 315 | 320 | 325 | 330 | 335 | 340 |

| - real b, A¢/kg | 300 | 314 | 315 | 312 | 309 | 306 | 303 | 3010 |

| Slaughterings, '000 | 4,745 | 4,778 | 4,866 | 4,970 | 5,050 | 5,140 | 5,230 | 5,500 |

| Production c, '000 tonnes | 356 | 360 | 368 | 376 | 384 | 393 | 400 | 410 |

| Consumption per person, kg | 26.7 | 25.1 | 26.1 | 26.2 | 26.2 | 26.3 | 26.4 | 26.5 |

| Import volume d, '000 tonnes | 152 | 136 | 149 | 152 | 154 | 156 | 158 | 160 |

| Export volume de, '000 tonnes | 26.2 | 26.8 | 27.8 | 28.4 | 28.8 | 29.0 | 29.4 | 29.7 |

| Export value | ||||||||

| - nominal A$ million | 81 | 85 | 101 | 105 | 107 | 109 | 111 | 113 |

| - real b, A$ million | 85 | 87 | 101 | 103 | 102 | 101 | 101 | 100 |

| a Dressed wt; b In 2014-15 A$; c Carcass wt; d Shipped wt; e Excludes preserved pig meat. f ABARES forecast; z ABARES projection Sources ABARES, Australian Bureau of Statistics |

||||||||

March 2015