AASV: Exports are key to the future of the US pork industry

Exports account for close to 30% of US pork and variety meat productionEditor's note: The following is from a presentation by Erin Borrer, US Meat Export Federation, during the 2024 annual conference of the American Association of Swine Veterinarians.

US veterinarians are essential to protecting the industry from foreign animal disease, preparing for the worst-case scenario and working every day to enhance productivity and sustainability.

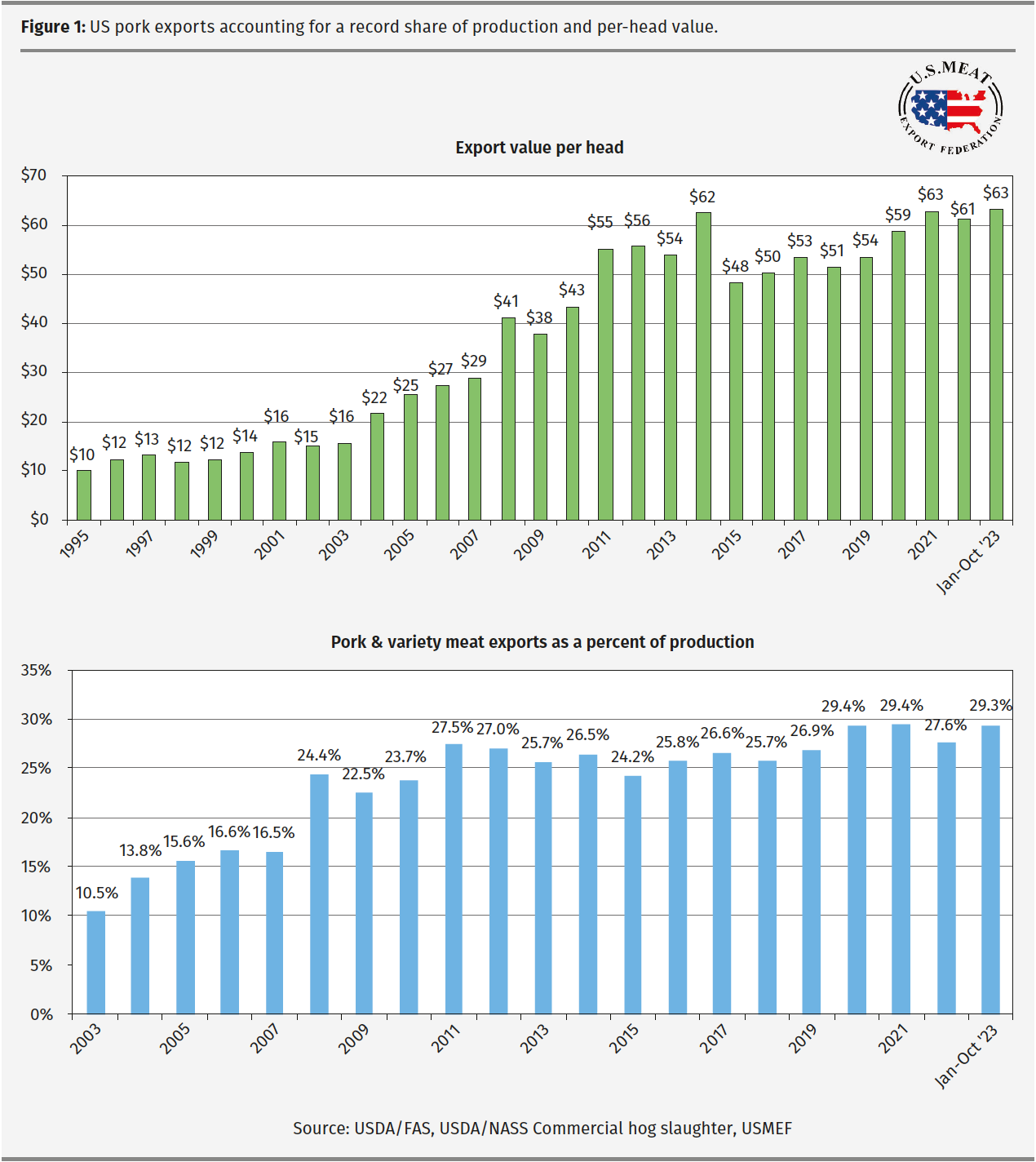

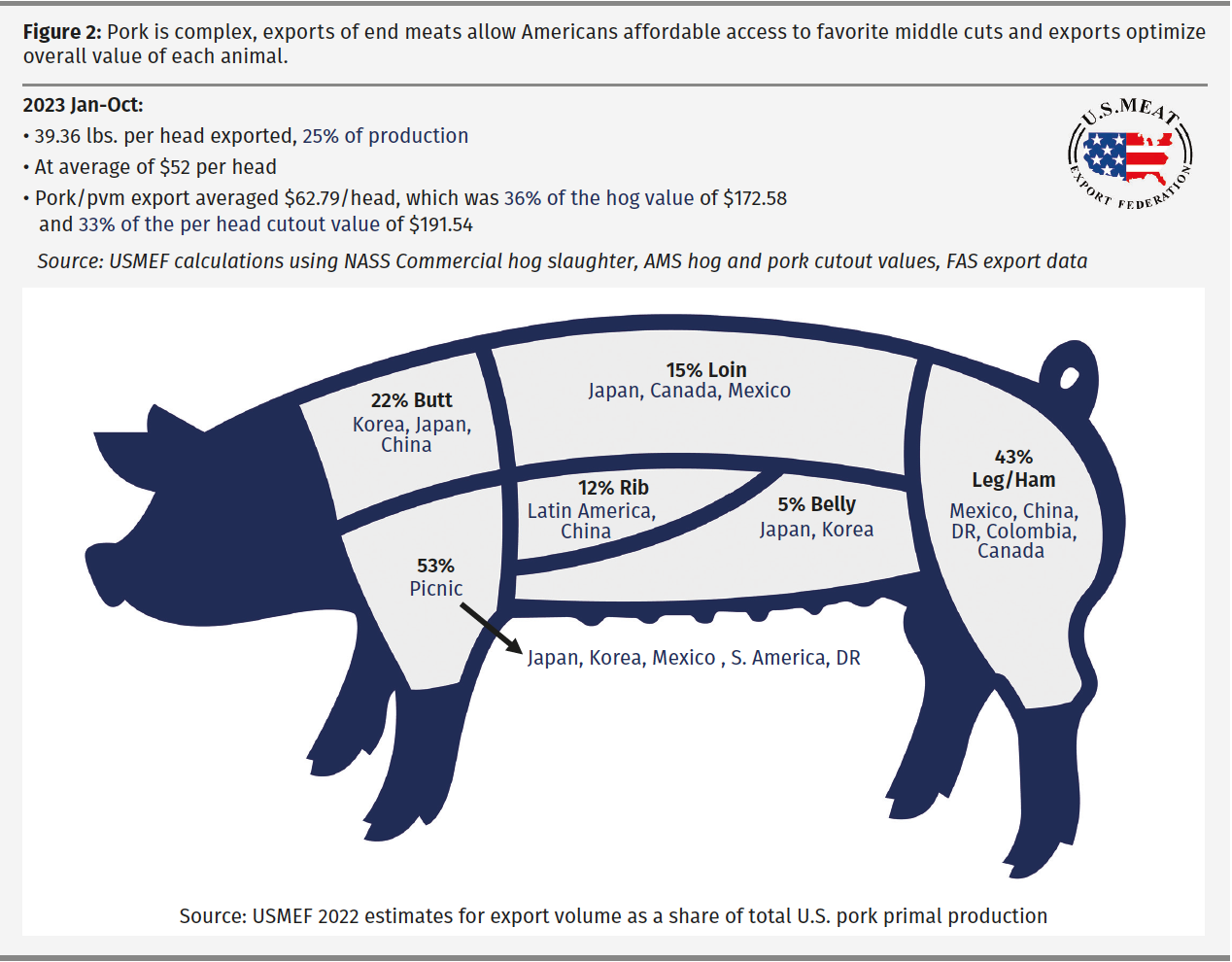

Pork and edible variety meat exports in 2023 averaged a record of $63 for every hog harvested (Figure 1). This equates to 33% of the hog value, using pork cutout as the basis. Exports account for close to 30% of US pork and variety meat production, but on a cut-specific basis, exports are even more important. Mexico takes close to half the US hams and if the Mexican market went away, only half of the US swine inventory would be needed.

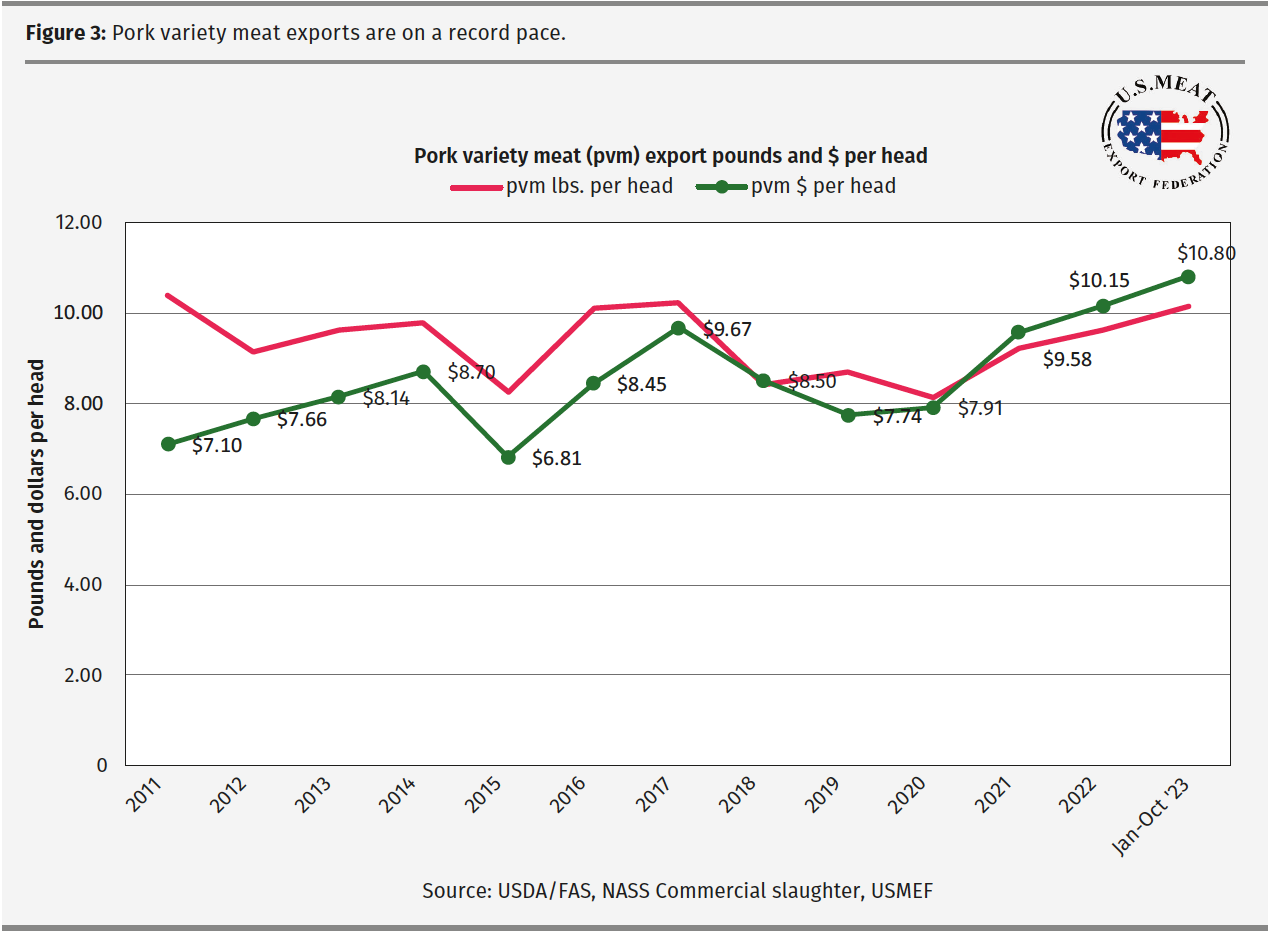

In addition to hams, picnics are also heavily exported, and butts are a key item for the top Asian markets as the US exports more end meats and a smaller share of the middle cuts that are popular in the domestic market (Figure 2). Variety meat exports are on a record pace and averaged nearly $11 per head in 2023, with China and Mexico as top customers (Figure 3). Top variety meat export items include feet and stomachs.

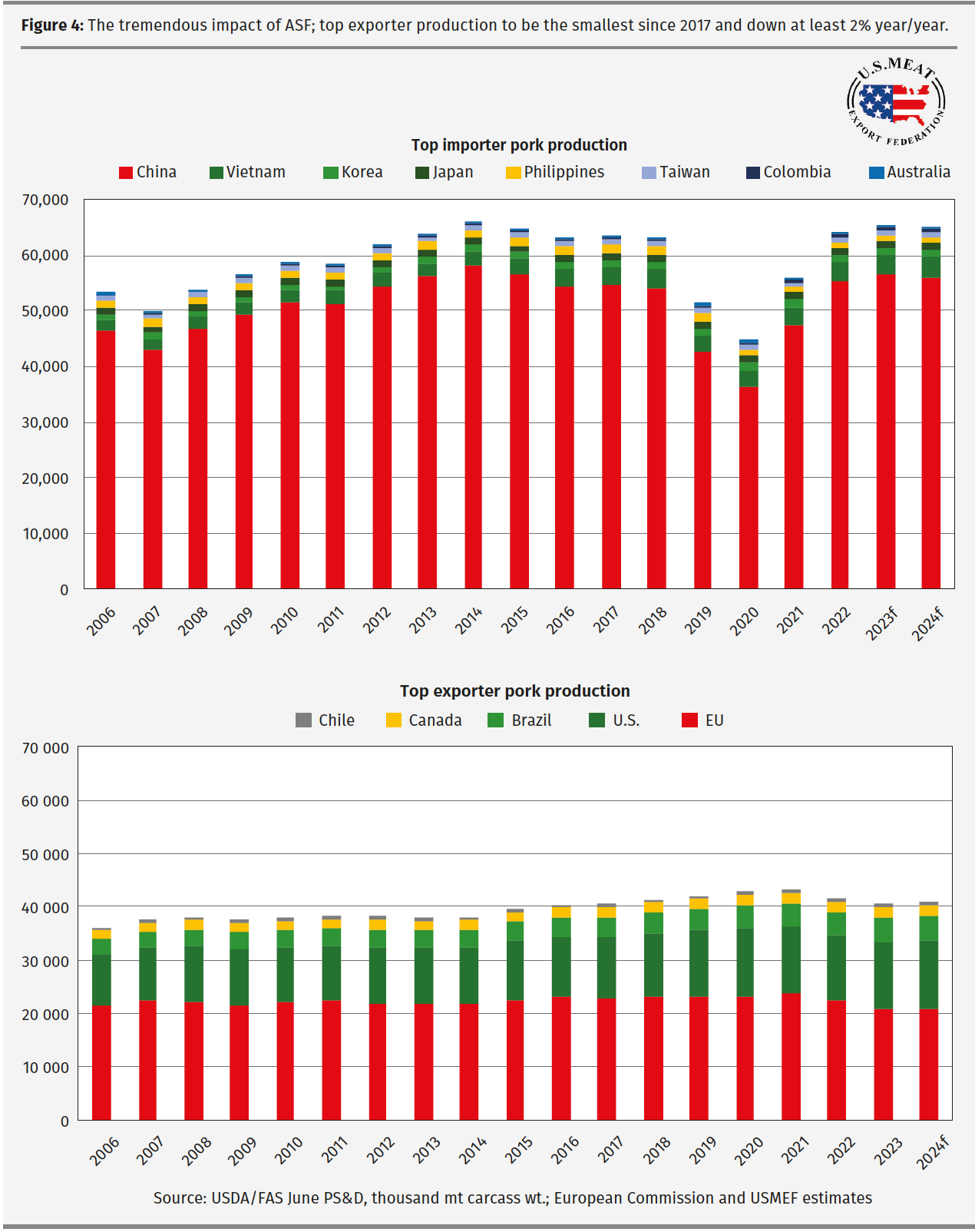

Countries like Brazil, South Africa and Australia restrict US pork due to PRRS. Germany, once the largest pork producer and exporter in Europe, has seen its production and exports plummet due in part to African swine fever (ASV) and subsequent market access restrictions. Brazil’s pork exports are limited due to their foot-and-mouth disease (FMD) status. China, the world’s largest producer, consumer and importer of pork, has had a massive impact on global markets due to its ASF-driven pork shortage followed by its rapid herd rebuild (Figure 4).

Animal health is foundational to market access and ASF and FMD must be kept out of the US. Veterinarians are also critical for herd health surveillance and for regionalization and emergency planning.

Long-term outlook

The European Union (EU) pork industry is undergoing structural change and production has fallen by about 2.8 million metric tons (mt), or 12%, from its 2021 peak, reaching an estimated 20.8 million mt in 2023. The European Commission expects a continued decline over the next 10 years.

This contrasts with the US pork industry where production growth resumed in 2023, reaching an estimated 12.36 million mt, and modest growth is expected in the coming years.

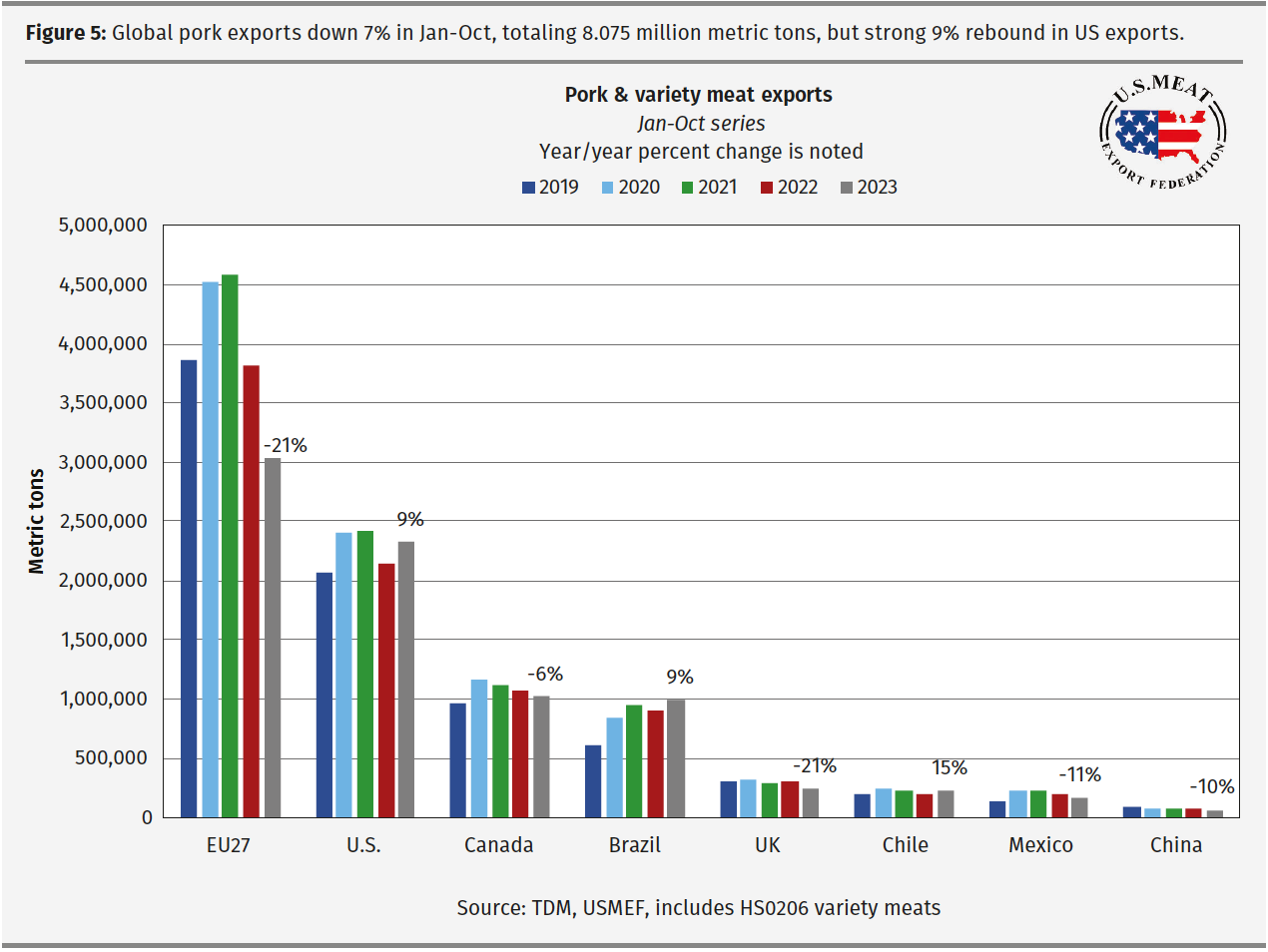

The combined EU-27 has been the largest pork exporter in the world, followed by the US, Canada and Brazil. The decline in EU output and increase in prices has helped the US move toward the top exporter position (Fig 5). But this position and further growth can only happen with herd health and productivity as the foundation.

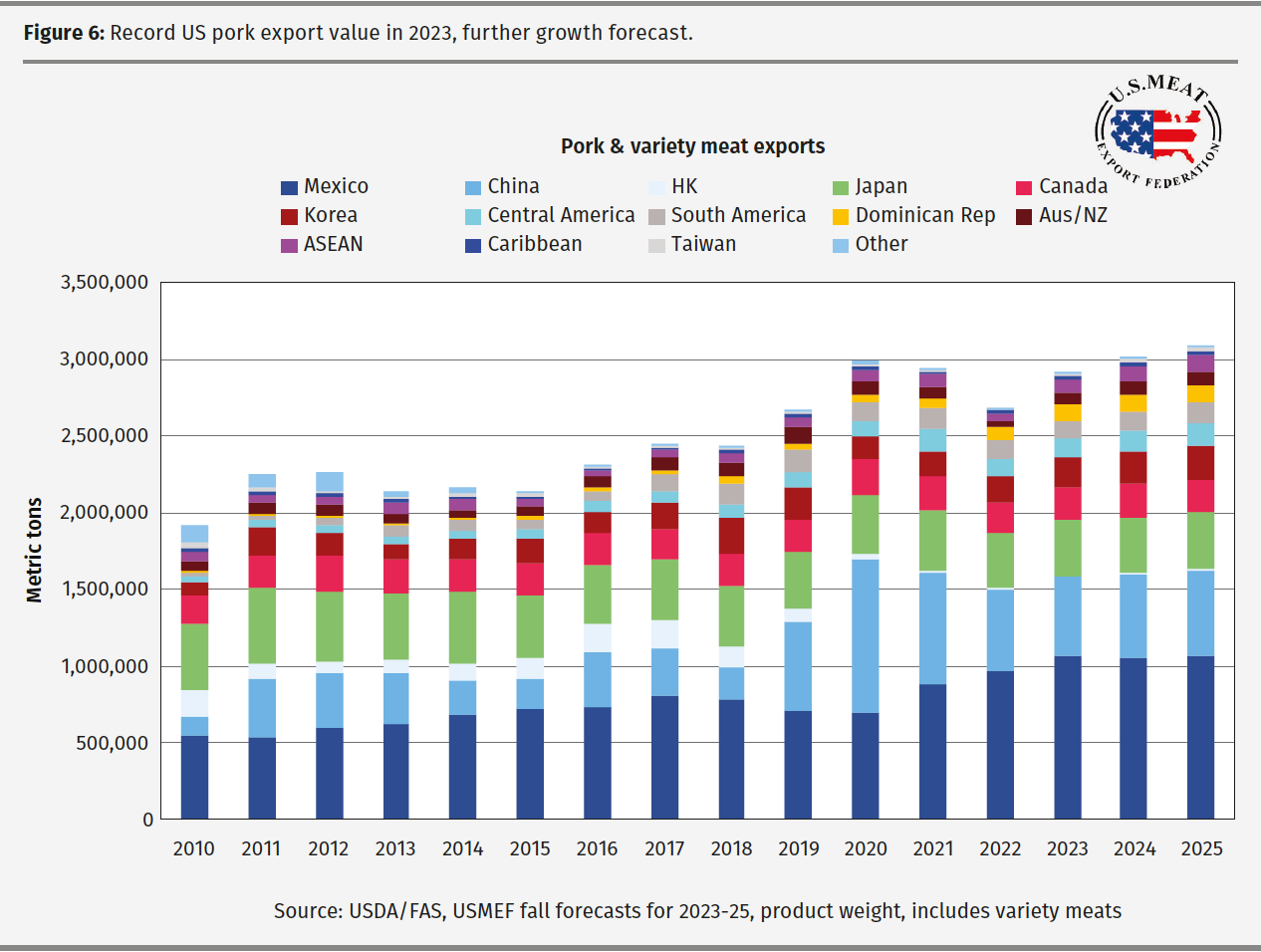

Veterinarians are at the core of the US pork industry and key to the industry’s continued success, including in the international markets which offer added value and growth opportunities (Figure 6).