2021 IPPE: Post-COVID Economic Outlook for US Meat and Poultry

COVID-19 severely impacted the US meat industry in 2020. What does 2021 look like?Part of Series:

During the 2021 IPPE, Dr. Paul Aho, economist and consultant at Poultry Perspective, gave a post-COVID economic outlook for the US meat industry.

The US industry was on an overall economic growth trend until the COVID-19 pandemic hit. The question for 2021 is: will that growth resume this year?

Aho expects that economic growth will resume, albeit in fits and starts. The most likely scenario is that we see less beef and pork per capita consumption and more chicken per capita.

For the first quarter, production will be lower than the rapid production rate we saw at the beginning of 2020. For the rest of the year, it is expected to be slightly higher than last year, leading to a 1% increase in production in 2021 compared to 2020.

Meat consumption to dip in 2021

Between 2018 and 2020, there was a large increase in total meat use in the US. Beef and pork accounted for 1.6 billion additional pounds, and poultry added another 1.6 billion pounds, for 3.2 billion pounds of total meat use.

Thus, it’s not surprising that, even without COVID-19, total meat use would begin to come down. However, with COVID-19, that total is decreasing more sharply.

Between 2020 and 2022, we can expect no increase in the US use and consumption of beef and pork. Poultry, on the other hand, will add an additional 800 million pounds, compared to 1.6 billion pounds in the previous two years. So, a slowdown is coming, but poultry expected to be higher than previous years.

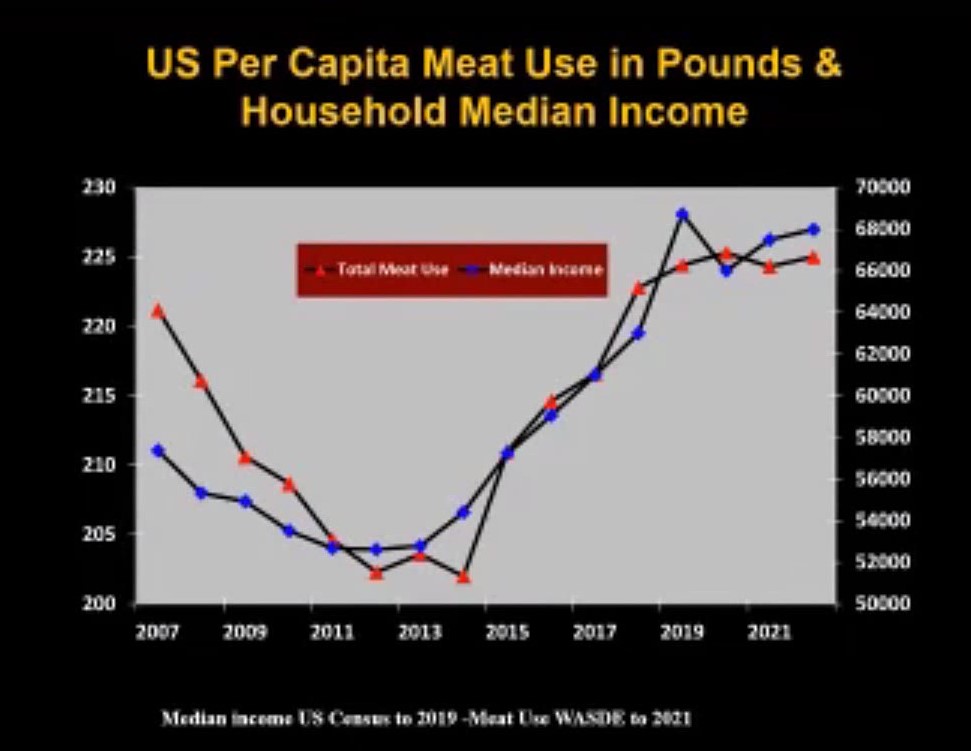

Aho also pointed out that meat consumption correlated very closely to the median household income in the US. He specifically looked at the median income, not the average income, to avoid any outliers like billionaires from influencing the results.

Aho followed median income and meat use from 2007 to 2022 and noticed a strong correlation between the two:

© Dr. Paul Aho, Poultry Perspective

Calmer prices for chicken meats

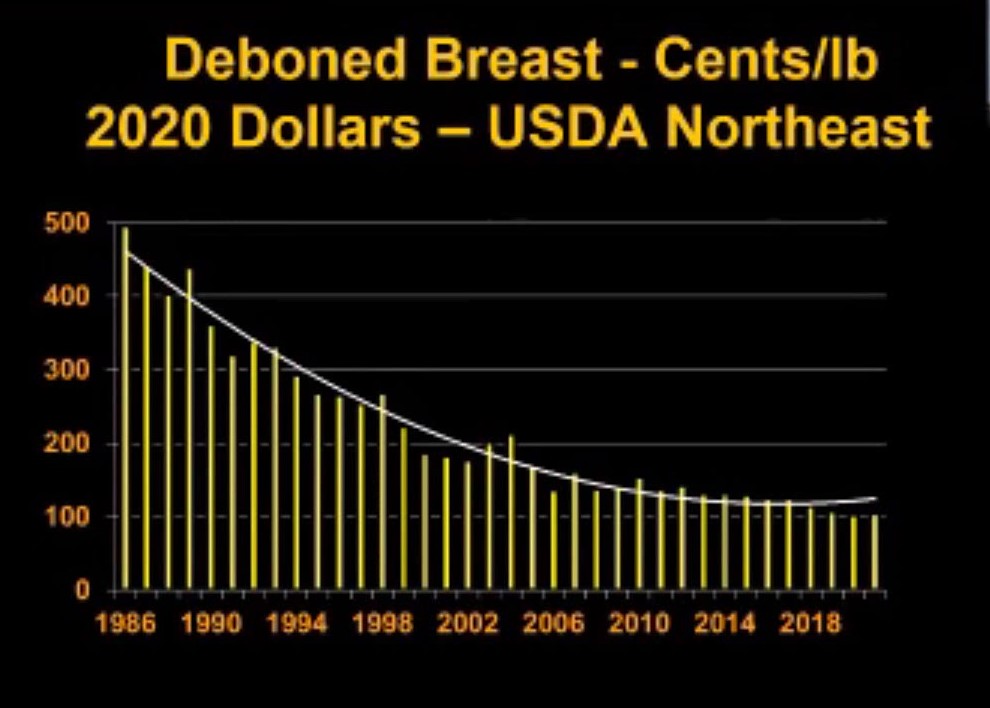

Deboned breast meat is a very important part of chicken production. Due to increased efficiency of production, deboned breasts have seen an 80% price drop since 1986, which was when the first dedicated processing plant for deboned breasts was opened.

As prices have gone down, consumption has gone up. Aho believes it’s to the point where the US could potentially start exporting deboned breasts.

© Dr. Paul Aho, Poultry Perspective