Genesus Global Market Report: Russia November 2017

The current pig Price in Russia is 94 Roubles ($1.58) per kg, this is back a little from the highs of the summer, which is typical in Russia. However, with good producers having a cost of production between 60 and 70 Roubles (all costs) this still means profits of $50 to $70 per pig. Poorer producers with high costs will be making little or nothing at current pig price.Simon Grey, General Manager Russia, CIS and Europe

[email protected]

What can be done in a lower priced market to increase the sales of pork. For many years and in most markets, it was thought reducing fat in the carcass was the way. This was partly on the back of medical advice on reducing fat intake as it was thought to be the major cause in the rise in obesity.

We seemed to forget that our parents and grandparents grew up eating a lot more animal fats. I remember my grandmother always cooking with lard (pig fat) and having bread spread with dripping (beef fat) for Sunday tea after having roast beef for Sunday dinner!

Today’s medical advice is to avoid sugars (and carbohydrates) as it is these that are the major reason for obesity. If you look at our modern eating habits this seems a lot more logical!!

The beef industry has been very successful at differentiating products based upon real quality. Premium beef is darker coloured and has good marbling. People are more than happy to pay more for this than standard beef, even in Russia. Miratorg as an example have been very successful with Black Angus beef in Russia. It is seen as a premium product in many restaurants and supermarkets.

Russia, like most other countries is still using carcass standards for pork created in the last century. Most have been updated, but carcass quality is based upon lack of backfat.

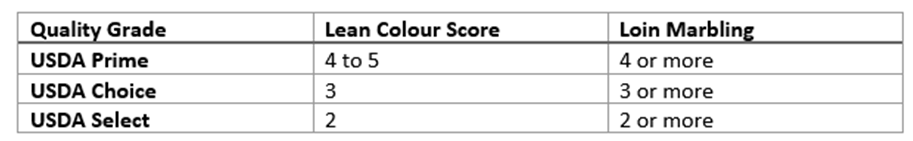

USDA Grading system

Last month the USDA announced the biggest potential shake up in the way pig’s carcasses are classified for years. The proposal is along the lines of the successful grading system for beef in the USA where prime beef receives a $0.15 premium over choice.

There are markets in the world where eating quality has always been recognised. Spain for instance where Iberic ham and pork is always sold at a premium and is in demand and not only in Spain!

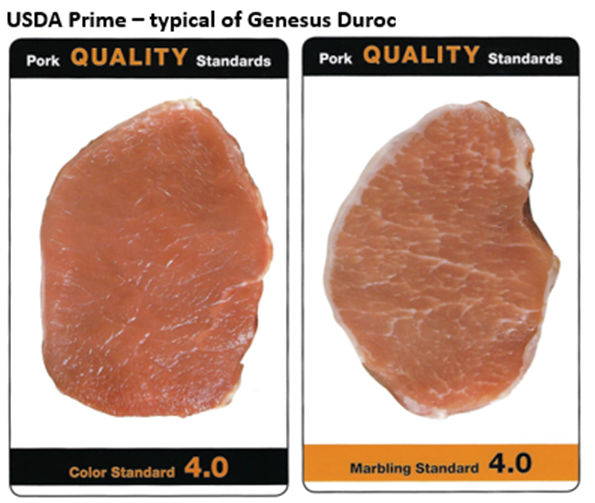

Genesus recognised in 1998 that to sell more pork and at a higher price required it to taste better! That is why Genesus at that time decided to scrap the multiple options it had at the time for sires and focus totally on the Duroc, a breed recognised globally as having superior meat-eating quality.

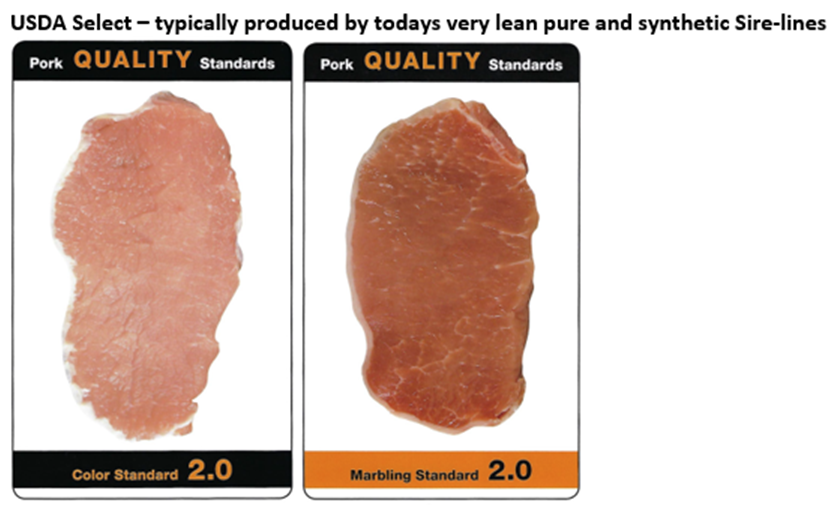

Many sire lines on the market today were bred for the existing market – very lean pigs. These sire lines will produce pigs with lighter coloured meat and lower levels of marbling. This meat lacks flavour and if over-cooked will become dry and tough, not a product that will encourage repeat purchase and certainly not a product people will pay more for.

The USDA is currently in consultation with the industry. It is difficult to see why anyone in the industry would be against a system that increases the sales price of better tasting pork. Anything that increases the sales of pork and the price is good for our industry.

The Americans are the first major producer and exporter to react to changing market requirements. With static pork consumption in North America and Europe at a time when meat consumption in general has increased means something was wrong.

The pig industry around the world has tried a lot of other things to increase sales. High welfare, ecological and antibiotic free (incidentally all pork is antibiotic free at sale, it’s a legal requirement)!!

Most consumers care little about these things, but all consumers care about the taste.

Let’s see who is next to follow….