CME: Cancer Report Leads to Lean Hog Future Decline

US - Lean hog futures have lost almost 600 points in the last week, one of the biggest weekly declines this year.The hurried retreat can be attributed in part to recent negative media coverage and bombastic headlines declaring processed meats cause cancer, some even going as far as comparing processed meat consumption to tobacco smoking.

Stock photos of ham, bacon and hot dogs have been used copiously as the story percolates in the media cycle. We would argue that from an image perspective, pork has been impacted more than beef during this process. This is largely because key pork items, such as hams and bacon have been referenced specifically as Class I carcinogens.

It remains to be seen how consumers respond to this wave of negative publicity. Anecdotal evidence abounds but it tells us little. In the end this will decided by the silent decisions of millions of individual consumers that every day walk into a supermarket or restaurant and vote with their wallets.

For futures markets, until we gain some clarity about the demand impact, the tendency is to sell first and ask questions later. It does not help that seasonally this is the time of year when both the pork cutout and cash hog prices trend lower.

Hog slaughter this week is expected to be around 2.37 million head, almost 8% higher than a year ago and also slightly above 2012 levels.

We have been comparing current prices to 2012 for a while given estimates for similar slaughter levels. One thing to note, however, is that even as slaughter during Q4 of 2015 is expected to be close to 2012, much larger hog carcass weights will assure that pork supplies this year will be higher.

The data from the mandatory price reporting system shows that hog carcass weights have been gaining steadily recently, in line with their seasonal trend.

For the last five reported workdays, the average carcass weight of producer owned hogs was 211.8 pounds, about a pound higher than a week ago. Given the normal seasonal increase, we expect hog weights to peak around 213 pounds in the next couple of weeks. Current weights are about 1.2% lower than the same period last year but 4% higher than in 2012.

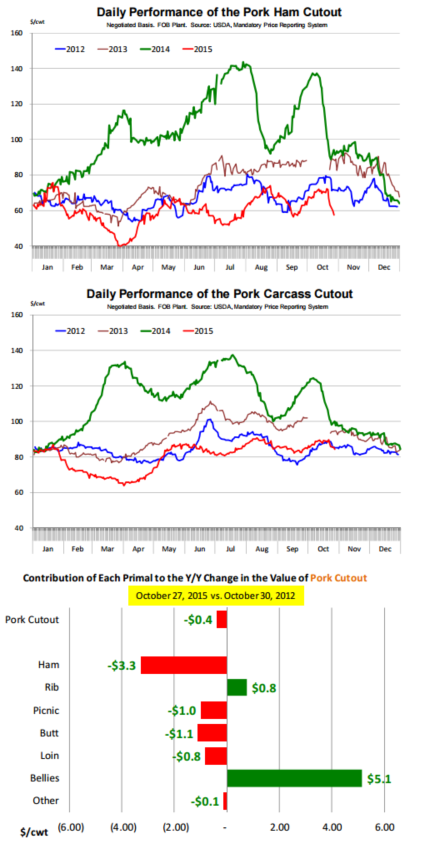

The three charts below illustrate why hog futures have become so unsettled in the last few days. The pork cutout is now holding at around 85 cents, which gives packers a pretty good margin and until last week helped propel futures higher.

One of the reasons why the cutout has held up so well is because of very strong bacon demand. The pork belly primal is now 60% higher than a year ago (despite a 6% increase in supply) and prices are also about 25% higher than the same time in 2012.

Will negative bacon stories kill bacon demand? For every $10 decline in the value of the belly primal, it will subtract $1.6 from the value of the cutout. Then there is the recent collapse in ham values.

As you can see from the top chart, it is not that unusual for ham prices to pull back in late October and early Novemmber, a function of higher supplies and also processors covering some of their holiday needs. But recent declines have been much more dramatic than seasonal trends would warrant.

The ham primal last night was quoted at $57.51/cwt, $15/cwt (-20%) compared to just a week ago. This has set alarm bell ringing as the holiday season approaches.